Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed with across-the-board gains. Europe is currently mostly up. Futures here in the States point towards a flat open with perhaps a slight upward bias. This comes off a week where the net change was small, but there were a few sudden moves which made day trading a little frustrating (swing traders were already in a conservative mode).

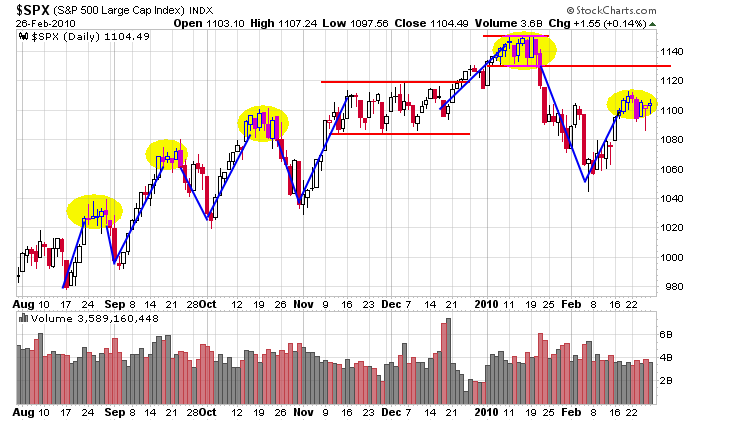

I don’t have much to add to my weekend report. The overall trend remains up, but over the last couple months things are more neutral. The S&P is currently consolidating a 50-point move, and per the breadth indicators, a little pullback or sideways trading would set a better stage for a rally attempt. The indicators are a little overbought.

But although the charts tell me there may be limited upside should the market decide to run right now, I’m aware of the market’s recent tendency to go on semi long winning streaks. It’s not uncommon to get 6 or 7 consecutive up days or 8 of 10 up days.

Here’s the S&P daily. It’s recaptured more than half its Jan pullback and is currently resting. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers