Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Europe is currently down across the board. Futures here in the States point towards a moderate gap down open for the cash market.

This comes off a day where all the indexes made new highs…but volume was light.

The market keeps going and going. It won’t pullback – heck it can barely rest for a couple days. I understand the buying the the last two days (The market can deal with news (good or bad) as long as it knows what the news is. What the market doesn’t like is uncertainty, and this is exactly what was lifted with the House passing the health care bill.), but buying for seven straight weeks is a little much. It seems like my ‘melt up’ theory is playing out.

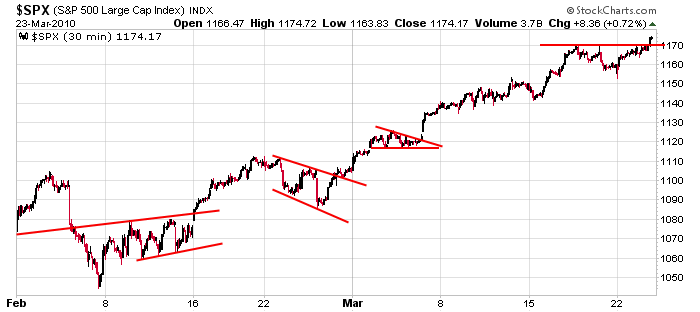

Here’s the 30-min SPX chart off the Feb low. 120 points in 7 weeks. You don’t have to understand why…just determine the what and trade in that direction. The extent of the move may not make sense – don’t let that stop you from making money.

The long side is the only side to be on. If the market suddenly reverses, so be it. I’ll go to cash and let the dust settle.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 24)”

Leave a Reply

You must be logged in to post a comment.

So when are you going to go cash Jason?

I agree with you that everything is going balistically up on no fundamentals only technicals – in that anyone can follow a line but when the music stops you had better be sitting down = out of the longs.

I find this market unbelievable. There is nothing fundamental driving it except the deep pocket PPT in overdrive.

I’m out of the game till the reality pill starts to take effect – one way or another.

Good luck to all longs and shorts from a technical sideliner.

E

Regardless of what I think, I’m going to continue trading in the direction of the trend…no reason to fight it.

I disagree that there is nothing fundamental driving the market. There has been a huge stimulus given to the economy and the economic indicators and reports have been improving. This may continue for a few more months… when the rate of economic recovery slows, then the stock market should, too.

I think there’s a huge disconnect between Wall St. and Main St….Wall St. is doing great, Main St. is still suffering. Wall St. can outsource to cheap labor markets overseas and they’ve benefited from a weak dollar, so their stocks are doing great. But the benefit is not being kept here in the States.

I trust nothing the gov’t says.

Having said that, the trend is up and I’m not going to fight it.

Oil weakness: Peter Worden had a video on XLE. The 50 and 200 are squeezing. From Peter’s charts it looks like oil is going down.

Question: what’s the consumption breakdown for oil?

Not by country but by industry.

iwm 50. vooooooop vooooooooooooooooooopppp. stay clear of the resources and currencies. euro is going back to 82 cents, if it still exists by then. get ready to buy a big chunk of the long bond. 3% yield on the way, meaning a 60% rally in the no-coupon 30y bond.