Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across the board. Europe is currently posting solid gains. Futures here in the States point towards a very good gap up for the cash market. It looks like we may get some movement – a welcome condition considering the intraday ranges have been contracting.

INTC had earnings after yesterday’s close. The Street likes what it saw and is rewarding the stock with a 1-point gap up (almost 5%). As of the open, the stock will have almost doubled since its low in early 2009.

I hate being the guy who said “but,” but you gotta watch out for a “buy the rumor, sell the news” scenario unfolding. If their earnings were fully anticipated, there may not be many buyers left; there may not be much more upside.

GOOG announces tomorrow after the close.

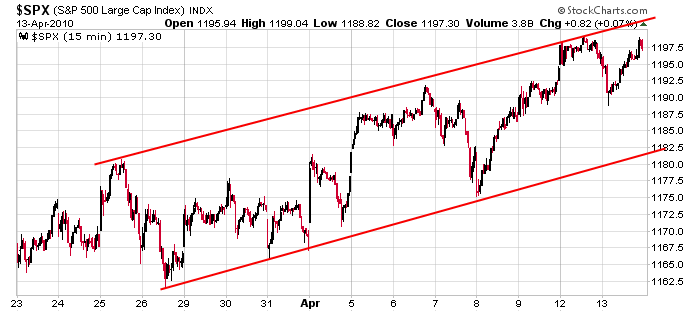

Here’s an update of the 15-min SPX chart. Today’s 5-point gap up will put the index just above the upper trendline. Day traders can guess a top with a tight stop. Swing traders shouldn’t guess tops because they end up missing big chunks of the trend.

How the market reacts to INTC’s and GOOG’s reports will offer hints as to how earnings season will play out. News trumps the charts, so stay in alert mode. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 14)”

Leave a Reply

You must be logged in to post a comment.

“Futures here in the States point towards a very good gap up for the cash market.”

How do you calculate this?

I don’t calculate it…I just look at the real time futures prices.

I’ve never understood how it works. Do you take the closing price of the SPX and compare it to the ESMini?

I compare the emini to itself while noting what it did between 4:00 and 4:15 the previous day (if anything noteworthy happened). Nothing complicated…just getting a quick glance of what the market will do at the opening bell.

Your are correct regarding an inflection point, but I think the street has the bit in its teeth and is off to the races.

Yes, it will regret it rush to recovery one day, but for now let the good times role.

Never mind the fact the JPM manipulated its loan loss reserves to sweeten its balance sheets, the secret meetings between the major wall street banks with Summers in the White House. You are not nervous yet, you are not listening. This game of charades has a ways to go, the question is just how much of it will the public swallow before selling.

finally got my year-end spy puts as well around 120.50 this morning. markets feel like they are going up furiously but they really are not. i have been waiting for spy to rally 1 point to buy these puts for two weeks now. also added iwm puts @71.25, short position average for me is 70.50 in iwm and 120.50 in spy now.

couldn’t get into bonds unfortunately, i was waiting for under 87 tlt. oh well, the plan is the same. begin buying under 87 and full position at 85. sometimes it falls through the cracks by pennies but it’s also important to stay steadfast to your setups and triggers.

i now have my basic short position in stocks, i’ll be adding if i get higher prices but i am in no rush to do anything. initial targets 50 iwm and 90 spy.

i am about to write a huge cap gains check to the irs for the nth straight year so i may take the rest of this week off from leveraged intraday trading 🙂 oh well, better to have to write the check than not having to write it.

best of luck to all friends and foes.

Dear Liar Liar,

Did you get stopped out of your short position yet?

Please advise,

Howard Weinstein

hweinstein7@nyc.rr.com

stop out? no way. i just got my positions in and i am targeting year-end. there is no stopping out for a while. i am looking to add to shorts if i get higher prices but i am in no hurry as i established a base position.

Cubs sock. Starting pitching is in shambles. Middle relief is non-existent. Closer is a walk machine and a head case. No pop in the lineup, bunch of aging has-beens. This will be a long, long year for the fans. No way Cubs are playing five-hundred ball this year. I am circling in 90 losses. Here we come 2011 🙂