Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Europe is currently mixed with no standout winners or losers. Future here in the States point towards a gap down open for the cash market. This comes off an very strong day where everything was up on solid volume, and many breadth indicators were pushed into nosebleed territory. For example, of the 1500 stocks in the S&P 400, 500 & 600, 1295 are above their 10-day MA – 86% is a huge number.

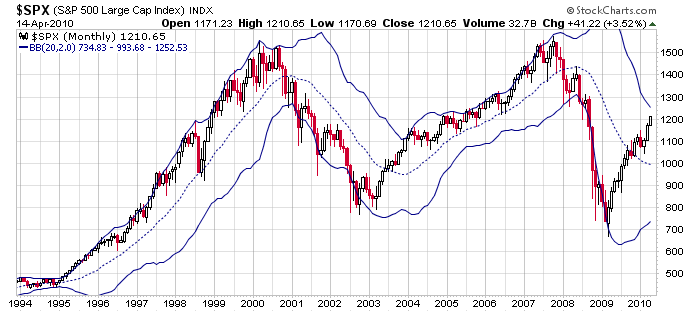

Short term anything goes. Longer term the trend is up until it’s not. If you constantly try picking tops, you’ll constantly be frustrated and you’ll miss lots of upside. If I had to pick a stopping point for the S&P – a level that’s much more significant than 1200 – I’d pick 1250. It’s the top Bollinger Band on the monthly chart.

In the back of my mind I’m wondering if we’ll get some selling pressure after options expire this Friday. That’s been the tendency – to rally into OE day to expire most puts worthless and then give something back after. I’m also thinking about a possible ‘buy the rumor, sell the news scenario’ playing out once a few more earnings reports are released.

The trend is up, but as always let’s not get lazy. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 15)”

Leave a Reply

You must be logged in to post a comment.

Yesterday, Wednesday, the 15,30 & 60 minute stochastics were all in oversold territory.

So, needless to say I was getting ready to go out there and short the market like a bandit!

But what happened in the 10am to 11am time frame was the Dow was up around 45 points, then

the effects of the oversold stochastics situation started to kick in.

So the net effect was the Dow started to pull back around 25 to 30 points,

stayed there for a while, and then the market was off to the races.

I have seen situations recently where we go into the open with Dow futures

down 45 to 55 points on the downside, the market opens up ‘down’, and

then it quickly reverses and starts to go up. Go figyah…..! HW

Hi Jason,

Always enjoy your posts even downunder here in Australia. Do you have index options expiry on or general stock oppie expiry on Friday? We had index expiry here today with the usual pre expiry market manipulation.

Also do you place any store on the VIX having gone outside the BB’s which usually signals a reversal.

Earlier in the week you talked about the put/call ratios and stated that a flat trading week would cause most pain to both sides. Has anything changed in that regard. I cannot find access to this data. I was surprised to see such a jump in yesterday’s trading.

Finally – Martin Armstrong has a turn date for 16th April. Do you place any trust in that sort of prognostication?

I also see the jobless data has just come out – up of course with the usual figure fudging – i.e. maybe it had something to do with Easter? Yeah? like the fudging of the March NFP figures – up some 163,000 odd but no one thought to add that around 43K of that was for the census – and only part time. Then of course you have the adjustments for births and deaths etc etc etc and what you really end up with is jobs loss not jobs growth.

Sorry I’m waxing on – but I just wish we could have some “real” accounting for a change then everyone would be well aware of just how ugly it is out there.

Elsbeth…

I get my open-interest data from here…

http://www.schaeffersresearch.com/streetools/indicators/open_interest_configuration.aspx?ticker=

I don’t watch the VIX close while it’s bouncing around low levels because low levels can persists for a long time – sometimes years. In my opinion, the VIX is helpful identifying market bottoms, not market tops.

Yes, according to the put/call data, a flat week would cause the most options to expire worthless. If the market moved up, so be it. A few call buyers might make a couple bucks but many more additional put buyers would lose. Nothing has changed to change this, and as I type the market is down slightly for the week. Mission accomplished.

I don’t know how Martin Armstrong is or why Apr 16 may be a turn date, so I can’t comment on that.

As far as jobs data or any other numbers released by the government, I don’t trust any of them. That’s why I stick to the charts.

Yes things are bad out there, but there’s a huge disconnect between Wall St. and Main St.

Jason

where is current option pain for SPY today?thanks.

I don’t do any calculations…I look at put/call OI just to get a general idea. I would never trade off the belief the market had to do a certain thing just because calls and puts are lined up a certain way. It’s just something I keep in the back of my mind.

**Correction from my earlier post:

When I said ‘oversold territory’

I really meant to say that the

15, 30 & 60 minute stochastics

were in ‘overbought territory’

last night.

(sorry for the confusion; that’s

what happens when you wake up

every day at 5am)

***oddly enough, it looks like the

same setup is occuring tonight at

the bell where the stochastics

appear to be in ‘overbought’

territory.

It could be kind of a sloppy day

tommorow if indeed Google misses

their numbers after the bell. HW