Good morning. Happy Friday. Happy options expiration day.

The Asian/Pacific markets closed down across the board – there were a couple 1% losers. Europe is currently mixed with no big winners or losers. Futures here in the States point towards a small gap down open for the cash market. This comes off a day the market traded quietly while it waited for Google’s earnings.

GOOG did well with earnings, but the stock is down about 5%. GOOG makes lots of money but there are questions about whether it can emerge from being a 1-trick pony and be a major player in other businesses.

We entered this week with the trend being up, a few warning signs showing and potential resistance front and center. The trend is still up (every day this week has closed up), there are a couple extra warnings signs, and indexes have cleared resistance (although not by much). The Dow is at 11,145, the S&P is at 1211; the Russell is at 724.

I still see no reason to guess a top, but I also can’t sit back, relax and assume the short trend will continue. With the average true ranges (ATR) dropping and the put/call volume dropping and various breadth indicators back near their highs, the upside might be limited (in the near term – I believe any dip will get bought).

Also the chance the market pulls back after options expire and that stocks drop after announcing earnings like GOOG will do today. Too many question marks. I’m being cautious.

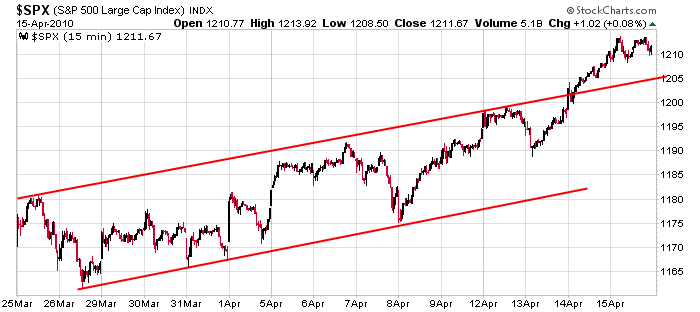

Here’s the 15-min S&P chart. 1205 may be support today.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 16)”

Leave a Reply

You must be logged in to post a comment.

**Regarding my post from yesterday (4/15):

“Yesterday, Wednesday, the 15, 30 & 60 minute stochastics

were all in ‘oversold’ territory….”

What I really meant to say was that they

were in ‘overbought’ territory.

The point of the excercise is this: If you are a day trader

(like I am), and you are looking for a quick trade, if the

15, 30 & 60 minute stochastics are all in ‘synch’

with each other you’ve got a pretty good shot

of gaining a little ground. The problem with this type

of trading it doesn’t really show you the interia or

the kind of leverage you’re up against when you do this.

That is to say the stochastics can go from top to bottom

with a mere 25 point swing in the Dow, or as much as a

100 to 150 point swing in the Dow, S&P, Nasdaq, etc. HW

How come you didn’t respond to any of my questions yesterday?

that’s a members only service. did you send your $50 check? you know, chicago style 🙂

You are a first class idiot.

easy now, let’s keep this sophisticated. LOL

Elsbeth I will respond to your post later today.

Hey thanks for the blog… can you explain what the low ATR means to you? I have never used that indicator.

Thanks!

I forgot all about my check for $50 dollars.

The bouncer at the door forgot to let me in. HW

Elsbeth:

http://www.schaefersresearch.com/streetools/indicators/open_interest_configuration.aspx?ticker=INTC

Here is the source to get Jeyson’s OI charts. There are many more tools there at SR that I use that are much more effective and predictive. Esp. Put/Call Open Interest Ratio and to some extent Volume Put/Call Ratio.

Don’t believe anything you hear about things being awful here in USA. It’s not great but it’s no worse than typical recession times either. It’s the good old USA, no more no less. What drives markets is very different than what drives the economy so I’d ignore all the economic news and numbers and such as well as the self-proclaimed “experts” like the one running this site (based on a few years of hanging out on his site and following his analyses, he does not appear to me to be an expert on anything). I’d focus on charts and more importantly sentiment.

Best of luck 🙂

I have dozens of posts from you predicting the end of the world last summer while I was going long. You said the S&P would gap down 50 points and sell off another 50 so fast, you would be able to exit longs or go short. What happened? The market kept going up. I was on the right side as I almost always am. You canceled your membership right after it was obvious you were dead wrong.

Everything is archived on the message board for anyone to see…and of course all the reports I write are archived also.

Don’t cross the line…you’ll find yourself the defendant in a defamation of character lawsuit.

first, i am not a self-proclaimed expert. i make predictions and trades and post them as they are. sometimes they work out, sometimes they don’t. based on my year-end p/l and capital gains taxes last 10 years, they work out mostly.

now as you say, my predictions are all on your message board. i was going long all the way to the top in 2008, then caught the whole move with big positions all the way down to March 2009 low (you were bullish with ridiculous targets back when spy was in the 140s), and startd going long right under spy 70 with big profits with otm calls (you were very bearish with a 400 spx target there).

i also caught couple of the oe week rallies last year (esp the august one) with big otm calls, so i did just fine, thank you. i am not even listing my tlt and ZB trades that made me more than stocks actually (because i had bigger positions in them mostly). sometimes i am dead wrong sometimes i am right, i don’t even think in those terms. i just look at the trades. if you want to reimburse me for my capital gains taxes, i’d be happy to send you my Schedules D and D-1 for this year. LOL

i still think you are no expert on anything (perhaps other than cashing member checks LMAO). my opinion is what it is about you. if that opinion calls for a defamation lawsuit, bring on the lawsuit, i am looking forward to it. LOL

peace old friend 🙂

trend is up but i am conservative, this is no time to take chances. if we go up, i told you trend was up. if we go down, i told you this was no time to take chances. now that is a good piece of analysis, very informative. hard to be on the wrong side of the trend when you have both sides covered. 😉

mr jeyson maybe you should start deleting my posts here again, like you used to. then this bugger would definitely go away. LOL i even offered you that in a private message, all you have to do is say “please don’t post here anymore, it’s my playground and i don’t want you to play here”. or stop taking things so personally and acept the fact that not everybody has to agree with you. you would find yourself more secure and peaceful that way. 🙂

Is this an example of trader sentiment?

Definition

Sentiment: the literary device which is used to induce an emotional response disproportionate to the situation, and thus to substitute heightened and generally unthinking feeling for normal ethical and intellectual judgment.

Yep, just apply it to the stock market.

Thanks, I never knew that. Sounds like a 700 Club anchor.

Dear Liar Liar:

Hey, I got a good idea. Why don’t you

start your own website? Then I’ll

be your very first customer! Regards, HW

http://WWW.BitMeTrading.com?

lol, thanks for the compliment (or irony) mr howard. i appreciate both. i think the value of my advice is exactly what you are paying for. not that i give advice really, i just announce my trades. you’d be overpaying me if i charged you a penny for it. LOL

“I’d rather you teach me to fish than give me fish.”