Good morning. Happy Monday. Hope you had a nice weekend. I’m a little behind responding to emails because I was on the road Saturday (traveled Denver to south Florida) and didn’t have good internet access Sunday. I’ll get caught up today.

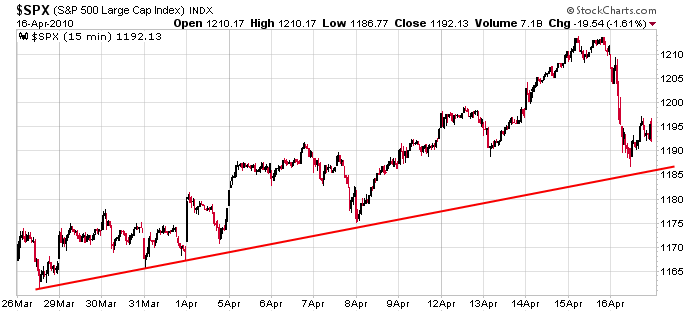

After making a new high Thursday, news that the SEC was charging Goldman Sachs with fraud hit the wires and sent the market down hard. When the dust settle, it was the biggest down day since early February and the biggest volume day since mid December. Traders definitely took the stance that it was better to sell first and ask questions second. Maybe it was an exaggerated knee-jerk reaction, maybe the selling pressure was deserved. From a trading standpoint, under no circumstance should we argue with the market. The trend was up (still is on a long and intermediate term basis), but there were enough warning signs headed into last week that I had turned conservative. That means smaller position sizes and/or much quicker exits if trades didn’t work out quickly. That stance served us well, but now we wipe the slate clean and move forward.

There isn’t a single market worldwide that is up. The Asian/Pacific markets suffered stiff losses; China fell almost 5%. Europe is currently down across the board; losses aren’t as bad as Asia. Futures here in the States point towards a moderate gap down for the cash market.

News trumps the charts, so it’s somewhat silly for me to post a chart and say “there’s support.” Wall St. does very well dealing with good and bad news. It doesn’t do well dealing with uncertainty, and that’s what we have right now surrounding Goldman Sachs. Is the situation the tip of the iceberg or is Goldman isolated? It’s unlikely traders/investors will enthusiastically buy until things are more clear.

Here’s a chart I would be eying absent the news. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers