Good morning. Happy Tuesday.

The Asian/Pacific markets rebounded from Monday’s stiff selling pressure. They closed mostly up with moderate gains. Europe is currently posting solid across-the-board gains, and futures here in the States point towards a gap up open for the cash market.

Yesterday the market took out Friday’s low and then rallied. Throw in today’s gap up open and half of Friday’s intense selling will be recovered. The jury is still out as to whether the Goldman news is a big deal. As I stated over the weekend, it could have a psychological effect – especially the uncertainty of it – but otherwise I didn’t think it was anything to be worried about. In the end the market gets to make the final decision, and I’ll follow the market’s lead. But if I was operating in a vacuum, I personally wouldn’t pay too much attention. My reason is very simple. Goldman is a publicly traded hedge fund. They make most of their money trading, not via investment banking. If they do well, it’s not because the economy is doing well, and if they do poorly, it’s not because the economy is contracting. Goldman is not a proxy for anything other than perhaps market volatility which makes it easier to make money.

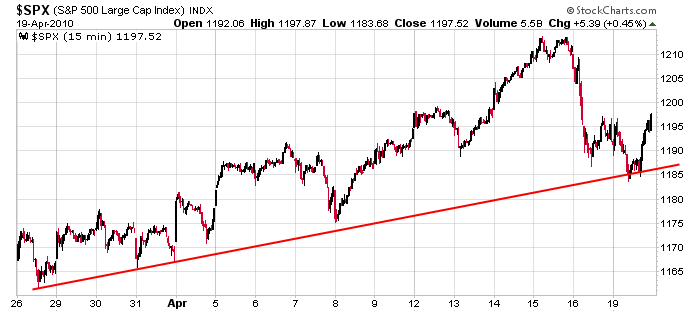

The conditions that existed over the weekend still exist. The personality of earnings season has yet to be determined…it’s unknown if there’ll be a little give back after options expiration…several breadth and sentiment indicators point towards a need for the market to correct before continuing up. Here’s an update of the chart I posted yesterday. For what it’s worth, support held. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 20)”

Leave a Reply

You must be logged in to post a comment.

I have not written any books on trading, but lately

I am a big believer in Elliott Wave Theory.

They suggest in not so many words we are sooner

to a re-testing of the March 2009 lows rather

than see the Dow poke it’s nose through 12,000. HW

Regarding Elliott Wave Theory, take a look at the 15 minute chart above. Would you call that a 5 wave decline followed by a corective 3 wave rally, or a 3 wave decline followed by an impulsive forming 5 wave advance? Depending on your conclusion, we have either seen some sort of top of some degree with more downside implied, or we’re headed for yet another high.

My point, having become familiar with EWT for over 25 years, is that you cannot use it in a vacuum. I could make the argument (as Prechter does in EWT) that the move down from the Oct’07 high was a 5 wave affair and we’re at the end of the wave 2 corrective rally. In that case, look out below! But, I could also make the argument that the move off the Oct’07 high down to the Mar’09 low was a 3 wave affair, implying that we’re in for years of flat, volatile, sideways “corrective” type action bounded by the Mar ’09 low and whatever turns out to be the high of this rally off the Mar’09 low.

Before you get too excited about EW, I would suggest you combine it with other forms of of technical analysis and look for confirmation. After 25 years, that’s my conclusion. By the way, I think very highly of Bob Prechter’s “Elliott Wave Theorist” and subscribe to it because he writes so well. But I wouldn’t use EW alone for entry and exit points. In short, the more I’ve learned about technical analysis over the years, the more I realize that it’s fruitless looking for the “holy grail” of technical indicators. I’ve survived only because I finally learned to cut my losses short and let my profits ride.

Attn: PJ43

I would like to discuss this with you.

Howard Weinstein

hweinstein7@nyc.rr.com

I’ll be traveling tomorrow….will email you Thursday.

Jason

i am not as old as mr pj43 in ewt, but i have been using it for 12 years overall and for 10 years very profitably. ancillary indicators for confirmation would definitely increase profitability and success rate, but ewt is an amazing tool on its own if used properly. it works very well in bonds and currencies (ec and ec/jy cross) as well as in corn and wheat. it does ok in stock indices but not great. i cannot find a signal at all times, but the ones i find turn out awesome. i could never get it to work in metals, oil or soy consistently. it definitely does not work in individual stocks. it is very hard work though, as one needs to know the count at all degrees (at least two upper and two lower). it is never 100%, as nothing is, but i find amazing trades with sky high r/r ratios with it. its down side is that it is partially subjective, so novice traders with underdeveloped money management skills should not use it.