This is my forth report covering the technical aspects of the newspaper stocks.

Here’s a quick summary of my analysis from the last couple months. The longer term charts do not look great, but the intermediate and shorter terms are trending up and offer trading opportunities for traders with shorter time frames (i.e. if you’re looking to buy and hold for 20 years, don’t bother, but if your time frame covers the next couple months, there may be a trade set up here). But given the near term trend, newspaper stocks are not high-flyers. They’re not going to bust out and quickly rally 10-20% like some tech stocks or materials stocks may do. Because of this, they are better bought on dips rather than on breakouts to new highs.

Let’s review the charts.

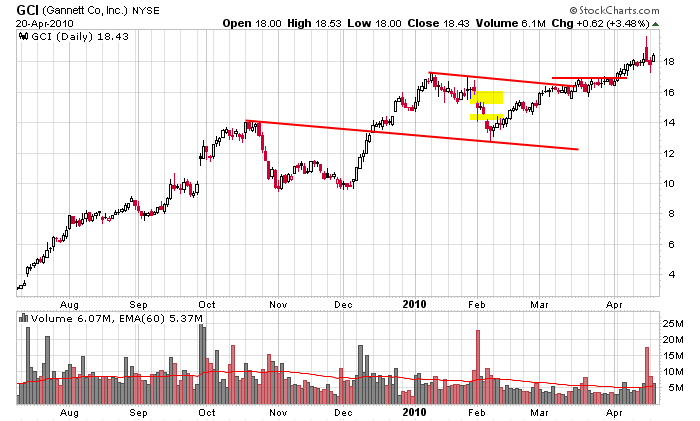

Gannett (GCI): The uptrend has continued. In my last report, I said long term investors could hold while shorter term traders should look to take profits at resistance and wait for a pullback to buy again. Long term investors are happy the stock has continued up; traders never got a pullback to re-enter at a lower price. That’s the way it goes. You must be consistent with your methods. If the stock would have pulled back, you’d be happy for the chance to get back in. As it is, the stock didn’t pull back, so you didn’t get another chance. So be it. Be consistent with your methods, and move on to the next trade.

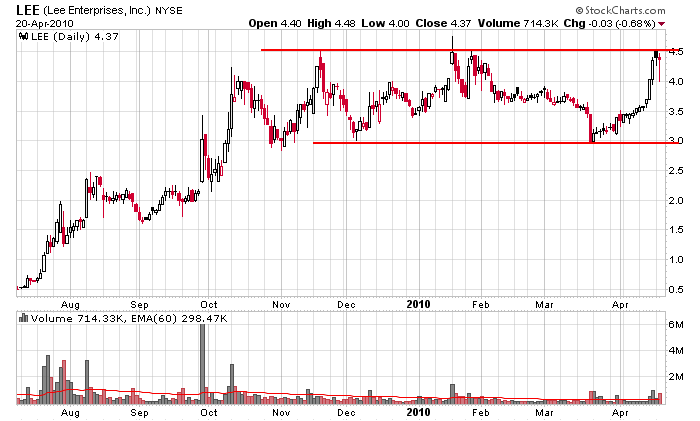

Lee (LEE): It’s been my stance LEE is not a good trading candidate because it can grind in place for days – and sometimes weeks – at a time. It’s made a nice move the last couple weeks (was a good buy at support), but I still think there are better trading candidates out there.

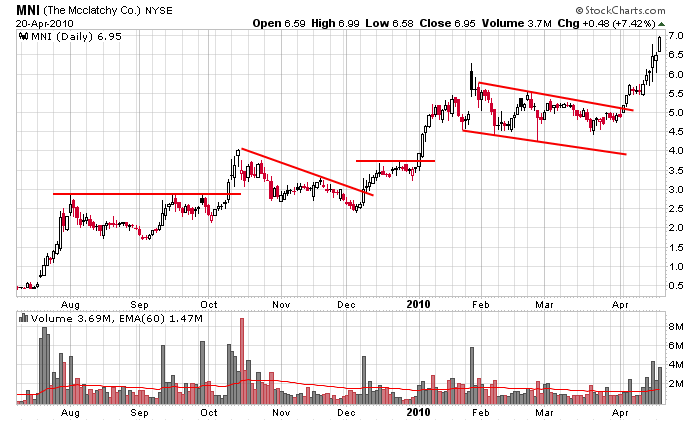

Mcclathy (MNI): It broke out from a falling rectangle pattern (this is a bullish pattern – when price falls against the overall trend, it acts to shake out the weak hands, and once enough weak hands have been replaced by newer and more patient shareholders, the stock is free to leg up again), and has run 40% in just the last couple weeks. There’s no reason a long term investor should do anything but hold because they are trying to ride the stock for everything it’s worth. Shorter term trades on the other hand should take partial profits because it’s the MO of a trader to get off the elevator before it reaches the top floor, not after it starts coming down.

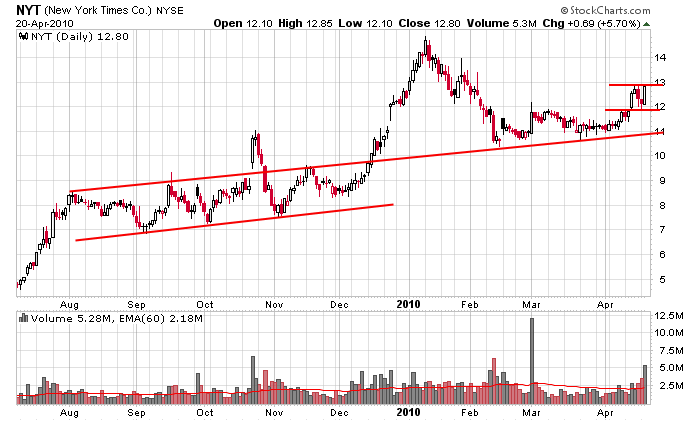

New York Times (NYT): It continued to respect the trendline I drew last time, and it’s overall trend remains up. It’s not a high beta stock, so it’s not something that should be bought when it makes a higher high, but it can definitely be bought on a dip as long as market conditions remain constructive.

The conclusion to my last report was that the market was strong, the trend was up, and the newspaper stocks were good buys on dips. Here we are six weeks later, and my sentiment remains the same. The market is still healthy and trending up, and as long as this remains the case, the newspaper stocks are still good buys on dips.