Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down – there were a couple 1% losers. Europe is down across the board – most indexes are down at least 1%. Futures here in the States point towards a sizable gap down open for the cash market. This comes off a light-volume up day that put the market back in the middle of its 3-week consolidation period.

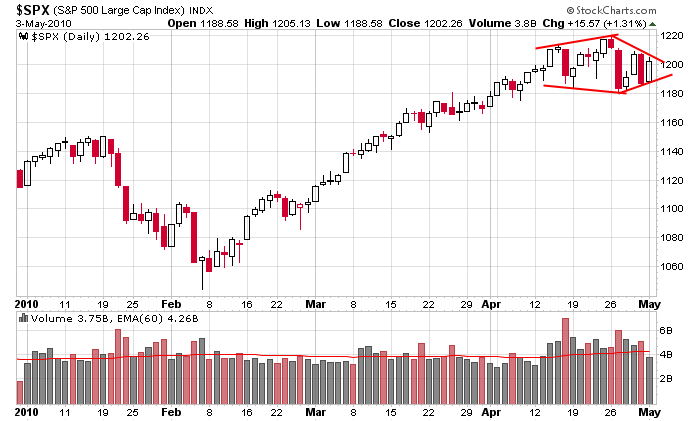

There have been several moves the last couple weeks which have excited both the bulls and bears, but in the end, the market unchanged. Indicators however suggest a top is being put in place rather than this being a simple pause within an uptrend. Volatility has expanded, the intraday ranges have grown, the put/call ratio is moving up and except for yesterday, volume has been above average.

I continue to trade lightly. I make money riding trends, not over-trading during consolidation periods. Perhaps the pattern will resolve soon. The price action is tightening up. Here’s the daily S&P. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (May 4)”

Leave a Reply

You must be logged in to post a comment.

What is the average dollar volume of the Asian/Pacific, Europe and US markets? How significant are they when you say, “The Asian/Pacific markets closed mostly down – there were a couple 1% losers. Europe is down across the board”

I don’t know what the combined market cap is of the Asian/Pacific (China, Japan, Australia) or European (London, Germany, France) markets nor do I assume the US market will act a certain what simply because the overseas markets are up or down. I just like to take a quick glance at them when I wake up in the morning.

The other aspect would be speculative, if one conceders Asia to be a speculative market. Is speculation funded by the Yen? Maybe you should include the currency markets. LOL