Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down – there were a couple 1% losers, but China gained 1.2%. Europe is currently down across the board – losses are moderate. Futures here in the States point towards a moderate gap down for the cash market.

Yesterday was a “coffee day.” The US bond market was closed due to Columbus Day and the Canadian markets were closed due to their Thanksgiving. The action here was muted – range was small, volume light, but now we get back to work.

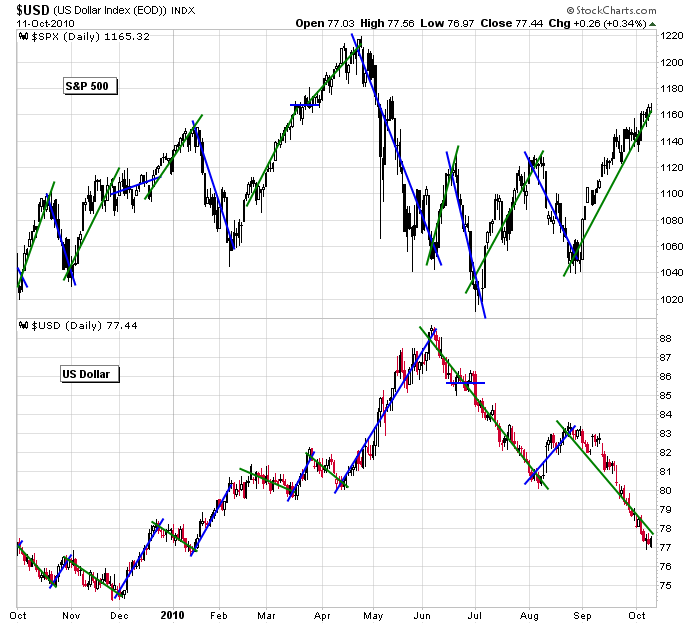

Yesterday the US dollar very quietly put in a pretty good day. It opened near its low and closed near its high. The chart is hardly bullish, but a bounce within its downtrend would put a big road block in front of the market because the dollar and the market have moved opposite for many months.

Here’s a chart that relates the US dollar and the S&P 500. No correlation (or inverse correlation) is perfect…this one is as good as it gets. If the dollar bounces, the market’s uptrend will be temporarily halted. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 12)”

Leave a Reply

You must be logged in to post a comment.

I watch the EUR/USD one minute (and the USD separately) too and have been a long time. In fact I have a chart taped to the wall showing the SP500 and the USD superimposed from 10/14/2009. The sp500 clearly shows it was a precursor to the fall of the USD around 04/05 of 2010.

However, I am not sure if the tail is wagging the dog currently. I have seen instances during the last month(s) where the 500 would move before the USD (and other currency markets) would move. I have also seen the USD apparently move before the sp500 too.

Today the USD (and others) started the move up early this am along with other pre-market futures. That doesn’t mean in itself that the markets were moved independently of each other.

It does appear, in today’s environment, that the USD / sp500 correlation is not in itself a solid prediction of current events. It has been helpful as a weak confirmation of current moves and that is about it.

Bad news seems to be the bullish movement of late. A lot of folks are expecting the Fed to go ahead with QE2, but I don’t believe the current political conditions will allow flat money insertion until after the November elections. Even then it is problematic as the GOP side has already voiced opinions to the contrary.

My opinion, your mileage will vary.

Neal, your racist innuendos are not funny and VERY politically incorrect, not to mention insulting to a lot of people.

China to Add Emerging-Market Currencies to Reserves

Bloomberg – Ye Xie – Lilian Karunungan – 21 hours ago

Do you have the link to the article? My understanding; China is reducing the USD in their reserves.

AAPL: Buy-high, sell-higher.