Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down – China, Hong Kong and India each lost around 2%. Europe is currently mixed with an upward bias – gains and losses are small. Futures here in the States point towards a positive open for the cash market.

Yesterday was a nasty day for the market, and from a breadth indicator standpoint, the indexes are in their worst shape since before the rally began.

Yesterday was the first time in a couple months new lows exceeded new highs.

The number of SP1500 stocks making 10-day lows hit its highest level since Aug 24.

The number of SP1500 stocks making 20-day lows hit its highest level since Aug 25.

The number of SP1500 stocks trading above their 10-day MA is at its lowest level since Jul 6.

The number of SP1500 stocks trading above their 20-day MA is at its lowest level since Aug 31.

The number of SP1500 stocks trading above their 30-day MA is at its lowest level since Sep 1.

But the difference between the end of Aug and right now is the market moved down the entire month of Aug to register these low levels. Today’s market has reached them in a little more than a week.

Thus far I’ve treated the pullback like a pullback within an uptrend (even though I went to cash the week of election & FOMC). But we have to look for clues that a structural change is underway, that this is the beginning of a move down, not a counter move within an uptrend.

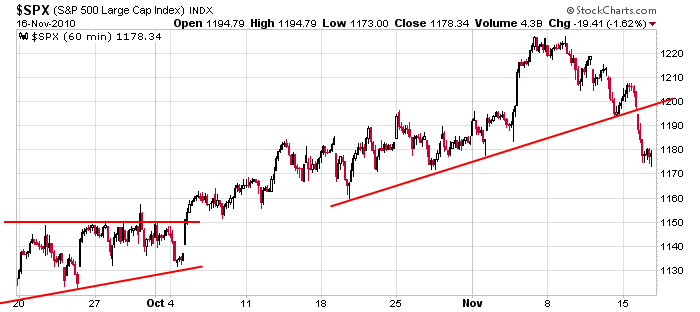

Here’s the SPX 60-min chart. I DO NOT believe in “lines in the sand.” I do not believe there are magic levels that once taken out guarantee a quick move. I’ve seen way too many false moves. Right now I’m mostly interested in the underside of the trendline near 1200. If it can’t be reclaimed on a bounce, a bigger move down will play out.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 17)”

Leave a Reply

You must be logged in to post a comment.

Neal: Why would you be ‘racing your money to America?’

What about the ‘slow boat to China’ and….while

you’re there you can visit with AUSSIE J all the

way down under. Regards, HW

Neal ,u say some wise things,

but europe controls usa open and for the first 2 hours many a day

they are just closing and looks like they want their fri opts strike at ftse 5700-dax6700

with QE2 usd went of shore with the carry trade–fear off

now with fear on in europe the carry trade is being taken of and usds repatrieated back to usa

sending the usd up—so yes the yanks are pulling their money out of the euro into usd

not good for world shares

so its up to the POMO to hold shares up till the GM ipo

i used to be a holden or GM person when young,but now drive a ford

intra day the nyse pit trader pivots are just great,but atm its still all in the usd

(#1) to AUSSIE J: If I understand you correctly

the boyz are holding the market up into the bell

tonight and then tomorrow we take another swan

dive down to Dow 10,800 and S&P around 1160. HW

(#2)Pardon my ignorance, but what exactly is POMO?