Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Europe is currently mostly down. Futures here in the States point towards a moderate gap down for the cash market.

Let’s review what’s been going on…

The price charts don’t look too bad…they look like the recent action is indicative of a pullback within an uptrend, not the beginning of a downtrend.

Many indicators argue otherwise. They have structurally broken down and are sounding warnings of an impending sell-off.

Then we have the Fed which doesn’t want the market to drop. They want people to feel wealthier so they spend money.

I don’t know who/what is more dominant or important. I can make a good case for more upside and more near term weakness.

In the near term I’m wondering if yesterday’s strength was engineered to make it easier to take GM public. If so we could quickly be back at the Tues/Wed lows. But if the weakness Tues was due to bailout unknowns in Ireland and we get more clarity there, then yesterday may have been legit.

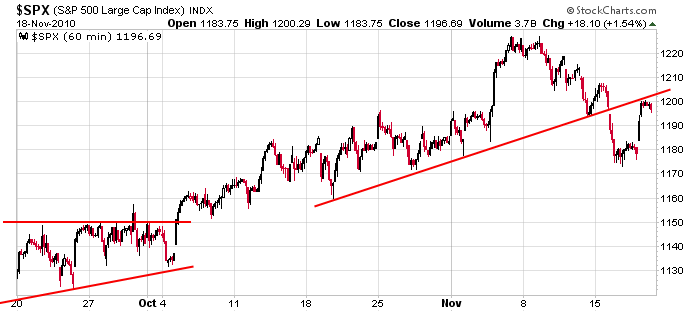

Here’s the 60-min SPX chart. The line I thought was key turned price back. The first move off a low is the easy move. Now things get tougher.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 19)”

Leave a Reply

You must be logged in to post a comment.

The concept of a rising stock market in a broke world with insolvent banks is hard to grasp. Thanks for keeping us focused on what matters in the market.

long island and aspen, thats the world. gap gets filled on the s&p.

Whatever you see at the watering holes, just recall that the banks havehold and hate derivatives that far exceed their means which are related to the bad debts held at market on their balance sheets. A bomb in the vaults so to speak. This is the story the Japanese live with, it can last and some in the society will prosper, but longer run its the road to surfdom, or has someone already coined that phase??

Today is a nowhere, and GM did not do well in its IPO the hype notwithstanding.

Neal: I’ve got some news for you. Chicago has the heaviest concentration

of gang violence in the United States. Don’t you watch ABC 20/20 or

any of the other TV show news programs? HW

go the irish—the only country to say the banks are bankrupt

SO BANKRUPT THEM

where is the usa bankruptcy laws

“You say goodbye….I say hello…”

If Neal says we are closing higher

I say we close lower today.

And anyway, with so much market

uncertainty who wants to stay long

over the weekend? If you look at the

Daily Chart (any index), we still

have overall downward pressure to

deal with at the moment. HW