Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed with a slight bullish slant. Europe is currently mixed with a slight bearish slant. Futures here in the States are flat.

Last week was weak early in the week and strong late, and in the end the week closed close to where it opened and little changed from the previous week.

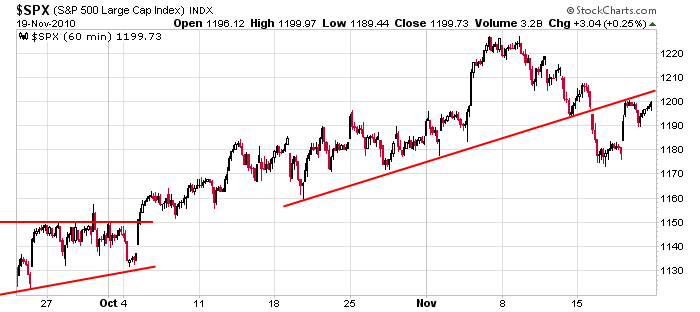

The index charts are still in uptrends when considering data going back a couple months, but over the last couple weeks, the charts are neutral. Charts of individual stocks definitely favor the upside (that just means there are many more bullish looking charts than bearish), but we haven’t been getting the same follow through as we have in the past.

The overall charts remain in good shape, the indicators are suggesting a structural change is underway. What’s right? What’s more dominant.

In the near term things aren’t clear, but over the next few months, odds favor a continuation of the uptrend.

Here’s the 60-min SPX chart I posted a few times last week. Upside resistance is at 1200 and at the slanted trendline drawn.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 22)”

Leave a Reply

You must be logged in to post a comment.

I say we are very likely to see a small pull back to last weeks lows. At that point we could see a nice run up through Dec. and Jan.

Low mid Dec with year end rally. Not too comfortable with 2011. Spain is on my mind today.

It may promote a Govt Deficit but would/could create liquidity in the BOP Figs thru expanding the M3 supply and Business confidence……

Neal: Unless you know Bernanke personally, I would not rely

too heavily upon those so called connections you have. It seems

to me you’ve got some credibility going with those pivot points

of yours. All is well here in NYC. As always, security

around town is very tight and will increase as we get

closer to the Thanksgiving holiday. Do they eat Kangaroo

down under? Hmmm..I’ll put that one in the Zagat survey. HW

mkt gonna get cosoed soon.

Kayman: please translate. I don’t speak Greek. What is ‘cosoed’ soon?

u get kangaroo at the outback steak houses in usa

ASSIES EAT BULLS

there is to much bull about world debt

ITS A PONSI—BEWARE—the house of cards—oops fed cannot be substained

t/a ly i need some more bulls to eat –oops short

AUSSIE: in American english: are you long or short? HW

just shorted some nq bull at r2 piviot–stop r3 but internals say it wont get there

ym futures are weakest,but already short dji from premarket at 11250

Howard–im long and short many times a day–depending on index trend on i and 5 min charts and inds

yes Neal –the big boys use them–ny pitt trader piviots -the are calculated every day at midnite and come live on my ESIGNAL charts—-thats were the bigboys have their index futures and cash buy /sell orders—thats why i use them

nqs and ndx now down to r1–will i close out my scap now or wait till fri high–oops we just went through fri high–next fri close piviot

at a 100 bucks a point on the dji –i try not to get to greedy

ill wait for some more bulls now—i like to close out on a tick extream –a internal ind that big boys use

usd to go impulsive up and euro down—-another ind

Neal: Forget about the train. It takes too long. I’ll send

my private jet to pick you up today after the market closes.

Happy Thanksgiving. (2) Have you ever taken the Gangsta Tour?

That white bus is awesome and those 2 guys that narrate along

the way are great. I also took the Duck tour when I was in Chicago. HW

Judging by the X and O chart I think it’s fair to say

we are going to break out heavily to the upside or

to the downside very soon. (probably ‘up’ since

the Thanksgiving holidays are so close). HW