Good morning. Happy Thursday.

The Asian/Pacific markets are mostly down – there are several 1% losers. Europe is currently down across the board – several 1% losers there too. Futures here in the States point towards a moderate gap down for the cash market.

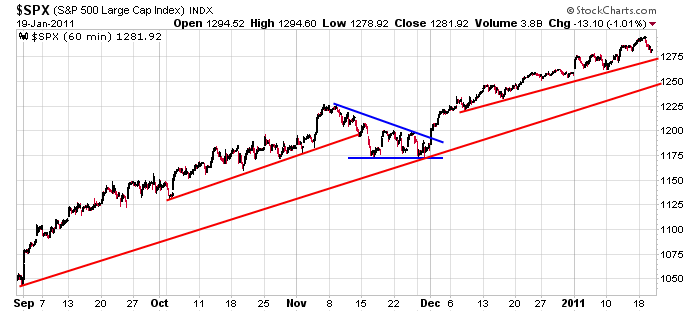

So after several weeks of grinding higher without taking any sort of breather the market finally came down hard. And I mean finally. So many indicators pointed towards a needed correction last week and the week before and last month. It finally happened, and coincidentally it happened right after the number of S&P 1500 stocks trading above their 200-day MA hit its highest level since last April, and the number making a new 10-day, 20-day and 52-week high hit it highest level since the beginning of the month.

Every analysis source out there predicts a pullback – the only argument being whether an impending dip will be shallow and short lived or extended. I too think we are over due and hope we get at least a week of selling to knock some confidence out of the bulls and allow the charts to pull back and reset. It’s not easy trading a market that only moves in one direction.

Here’s the S&P daily. A realistic first target is 1250.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 20)”

Leave a Reply

You must be logged in to post a comment.

Jason always said the first move is always the easiest.

That was Yesterday. All my troubles seem so far away.

Let’s see what happens today and holding the 200 day MA.

Professor Weintraub just gave me an A+ in honey jar technology.

Play what you see. Down for now, but maybe more up before the summer fade which will be tough I am afraid. I think we are in a secular bear that lasts until 2020. Yes a few rallies, but marching in place is the result.

Good news from the summit, they certainly get lot done, think of it. 35 billion in trade, 230000 jobs. Wonders never cease, neither does the bull.

Today I am short, and will be for a few days into OPEX which I think is essentially over.

Weinstein and Weintrub? Sounds like a musical comedy, I would like to hear the music, the words are not going anywhere.

From Zacks: and a mention of DOW 12,000. Neal, if I wore the Tshirt inside-out would I be a contrarian? LOL

Now don’t take that to mean the market is due for a serious correction either. I still don’t think that is in the cards yet. And probably not until we at least touch Dow 12,000. It’s just that the market as a whole may get choppy for a while after this long leg of the bull rally. And in particular, any stock that has a poor earnings report will be severely punished (just ask the owners of CREE who saw a -14% loss in the blink of an eye).

Just stay focused on the long term fundamentals. That continues to read as follows: rebounding economy = rising corporate earnings = higher stock prices.

opts ex tomorrow starts 1 week ago–shares are just pawns–all moves are to set the instos up for month ahead–the bid up/downs were to make frid smooth–the big boys like to start at the top and work down–most has already been done but tomorrow could be a gap up open–but we will see how to day finishes

the bear will return next week–no pull back –streight down