Good morning. Happy Friday. It’s dress down Friday…is everyone wearing their Bears gear? 🙂

The Asian/Pacific markets closed mostly down. Indonesia, Malaysia, Japan and S. Korea lost over 1%, but China gained over 1%. Europe is currently up across the board. Belgium, France, Amsterdam and Norway are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market which will be above yesterday’s high and above Wednesday’s close.

Yesterday, soon after the open, I stated on the message board I didn’t think the market was going to completely fall apart because too many people had suddenly gotten bearish. That was yesterday. Today I don’t have as good of a feel. Swing trading is streaky trading. Sometimes you’re all in because the trend is rock solid and there are no warning signs; other times you’re laying low waiting for the dust to settle and better set ups to surface. The latter is the case right now. If you trade when it’s obvious and lay low when it’s not so obvious, you should be laying low right now.

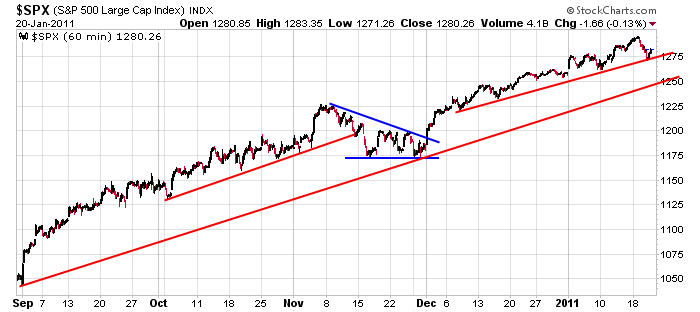

Here’s the 60-min SPX chart…a friendly reminder one down day doesn’t change too much.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 21)”

Leave a Reply

You must be logged in to post a comment.

Uh oh… Tepper isn’t 100,000% bullish on CNBC this morning…. panic….

1. We seem to be holding the 200 day MA on most of the major indices.

2. Today’s action should be very eventful indeed. Do we roll over

around the mid-day hour, or…do we push hard into the close.

3. Most analysts use end of day stats for their reports, however

Fridays’ closing data usually determines (more often than not)

how the trading sets up for the following week. HW

GE looks interesting. The dividend, and new Obama liaison with the Economic Advisory job for Jeff Imelt will not hurt their government connections. I will own a few in my dividends portfolio.

The BAC report is discouraging and confirms that Money Center banks are in a fade for Q1 11. I have taken a position in regional banks which appear to be gaining earnings.

The new inflation tracking system that MIT is developing may blow the CIP (BLS) data out of the water and show that inflation is more threatening than is believed.

This is a downer for equities if rate increases are in the book for H2 11…

I’m especially confident we will trade back up to the highs, possibly by end of day today. Then I expect to trade into a bit of a range heading into next week. This will mark the official short-term top, after which, I expect a nice little correction before resuming the trend upwards, perhaps as high as 1400 on the S&P. http://wethetrader.blogspot.com/2011/01/back-up-to-test-highs.html

Nah Jason, got my Packers Gear on though. It is hard when you are from Chicago and live in Wisconsin.

Say it ain’t so…you’re from Chicago. 🙂

STOCKS ARE PAWNS ,OWNED BY THE DERIVITIVE MASTERS

day going as planed –indexes taken to the top for open and the big boys can work their way down for opts ex

been short the world since open–may even be able to hold all day —WOH..!

BIG BOY INSTO OPEN INTEREST FOR FOLLOWING MONTHS WILL BE INTERESTING

we know the retailers and long onlys are bullish–even the fed and the POMO are bullish

they are usually on the wrong side

interesting to note the ftse has finished its bull run since 09 –or was that a dead cat bounce