Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed – nothing moved 1%. Europe is currently mostly down, but there are no big losers. Futures here in the States point towards a flat open for the cash market.

To quickly reiterate what I said over the weekend, anything goes here. While the overall trend remains up, the short term is not as obvious as it’s been and the technicals are not as meaningful or helpful as they typically are. There are lots divergences and warnings signs that suggest a correction should play out soon, but those same clues have been in place for a month. If the market finally decided to drop, you can hardly say it was because of the indicators.

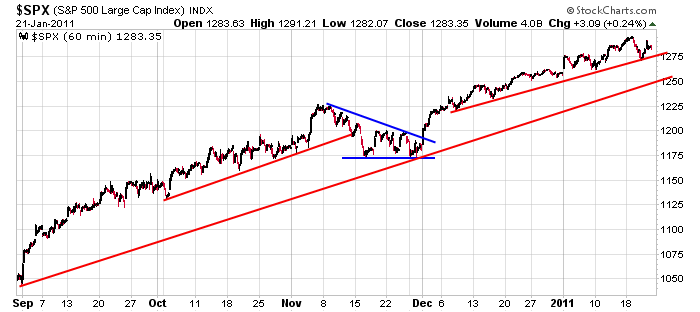

Here’s the 60-min SPX chart. One semi stiff down day last Wednesday has not changed the overall picture, and there is room to move down 30ish points and hold the longer term support line.

That’s it for now. After writing a lengthy report and recording my thoughts in a 7:50 video this weekend, I don’t have anything new to add. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 24)”

Leave a Reply

You must be logged in to post a comment.

Ireland will lead the way!

I think that 1250 is the attractor, but not directly.

Not playing in the traffic today, just watching.

A stock market drop can come out of nowhere as

we saw last Wednesday. But, as POMO intends to

keep this market up…..at least through the

President’s State of the Union I am thinking,

only thinking right now about going heavily

short at the bell Tuesday 4pm under the

auspices of a ‘pop and drop’ scenario

we might see for Wednesday morning. HW

sideways till next fri opts ex for ftse india and thurs oz

if the central banks are to be defeated ,it needs to be done in unicants

once the euro breaks the game is over

short the weakest ndx or if going long try the dji

daytrading is more fun than positioning

Whoopee all you cowboys! (that includes you too, AUSSIE

JS from down under). Let’s all give brother Neal a big pat

on the back for calling Dow 12,000 right on the money.

He’s even doing better than veteran Art Cashin from

the CNBC hall of fame. HW

yes,all us colonist inc usa must stick together

the british empire inc ireland must be saved

we cant have a good depression without truth in accounting

bankrupt all the insolvent banks inc the cental banks

god save the queen

My thought: What is the global consumption trend? What is the U.S. consumption trend? How much of the global trend is dependent on U.S. consumption?

Hey Neal: wasn’t it you the one who started the ‘don’t ask don’t tell’

policy while you were in the Navy? I think you dropped a bar of soap. 🙂

now all markets can fall in sinkrotation