Good morning. Happy Tuesday.

The Asian/Pacific markets closed up across the board – gains were small. Europe is currently mostly up – there are a couple 1% gainers. Futures here in the States point towards a moderate gap up open for the cash market. As of today’s open, assuming the futures don’t change much, more than half of Friday’s losses will have been recovered. Not bad considering Friday was the single worst day since August.

I can’t overemphasize that from a technical standpoint the market should have dropped a couple weeks ago, but it has other ideas. Numerous divergences and indicators have been ignored. The normal ebb and flow of the indexes has been nonexistent. So even though Friday should have marked the beginning of a pullback, it doesn’t have to. There are forces at work we are not aware of. Also Egypt can trump everything right now. If things settle down there, new highs will be right around the corner. Lesson? – don’t assume anything.

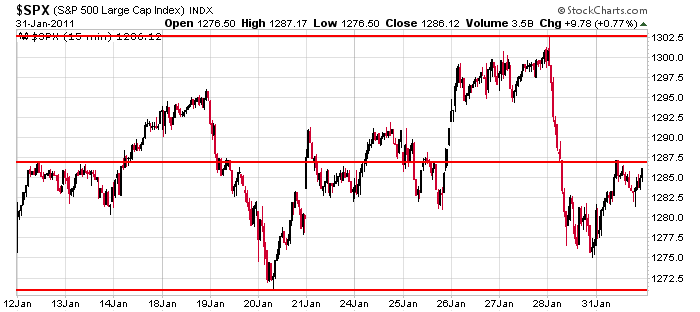

Here’s the SPX 15-min chart over the last 3 weeks. Despite the two noteable down days (19th & 28th) the index has been range bound and is currently in the middle of the range. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 1)”

Leave a Reply

You must be logged in to post a comment.

“There are forces at work we are not aware of.”

What exactly do you mean by this statement ? Thanks

The Fed is pumping money into the system…we know that…they’re admitting it. But we don’t necessarily know when or how much. This is why the market just won’t go down. Every time it hints at wanting to give a little back, an invisible hand seems to step in a buy.

“If things settle down there, new highs will be right around the corner. Lesson? – don’t assume anything.”

We do know that investing is driven by earnings YOY and this LAST year the numbers look good, We APPEAR to on a growth run, why is less clear. It is likely 2010 cost-cutting earnings year. We need across the board demand growth in ’11 and it is not here yet. It does not come this half of the year, it will be a severe disappointment.

“We do know that investing is driven by earnings YOY”

Well I don’t “know” anything, yet I still make money.

That is wonderful, best of luck. I know you must live off the land, never a question of how things work.

The finance departments of many fine universities in this country are filled with very smart people who know how things work, yet are flat broke.

Arrogance and ego get you nowhere on Wall St.

I’d rather admit I don’t know…then I can focus on making money rather than solving an unsolvable puzzle.

good stuff jason!

THERE WERE 3 PERMA BEARS AND THEY KEPT HUFFING AND PUFFING AT THE FED THE ECB ,CHINA AND JAPAN

and every time the markets droped from dji 12000 the fed/ecb and china was forced to put in more money to prop up the EURO

FINALLY –when all the bulls and baby bulls were coralled in the markets and china/japan/fed were bankrupt –on the third puff by the 3 perma bears of dji 12000,THE MARKETS GAVE AWAY AND WENT TO ZERO

JUST GOES TO SHOW ITS GREAT FUN BEING A PERMA BEAR and blowing down the euro–inverse to usd

we are expecting a massive cyclone to hit north oz tomorrow so i will miss the top of market possibly unless the power comes back on in townsville norh queensland

Thanx Neal and I am enjoying your ‘Dow 1200’ site,,,,and ONEDAY I’ll get that photo u requested for the wonderful DOW1200 T-SHIRT YOU PROVIDED….Thanks and will miss your insightful comments from here

Jay GoldCoast Australia (near the Black Stump ! ) ; }