Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across the board – Hong Kong, Japan and Indonesia gained more than 1%. Europe is mixed with a bearish bias – only Stockholm (down 1.8%) has moved more than 1%. Futures here in the States are flat.

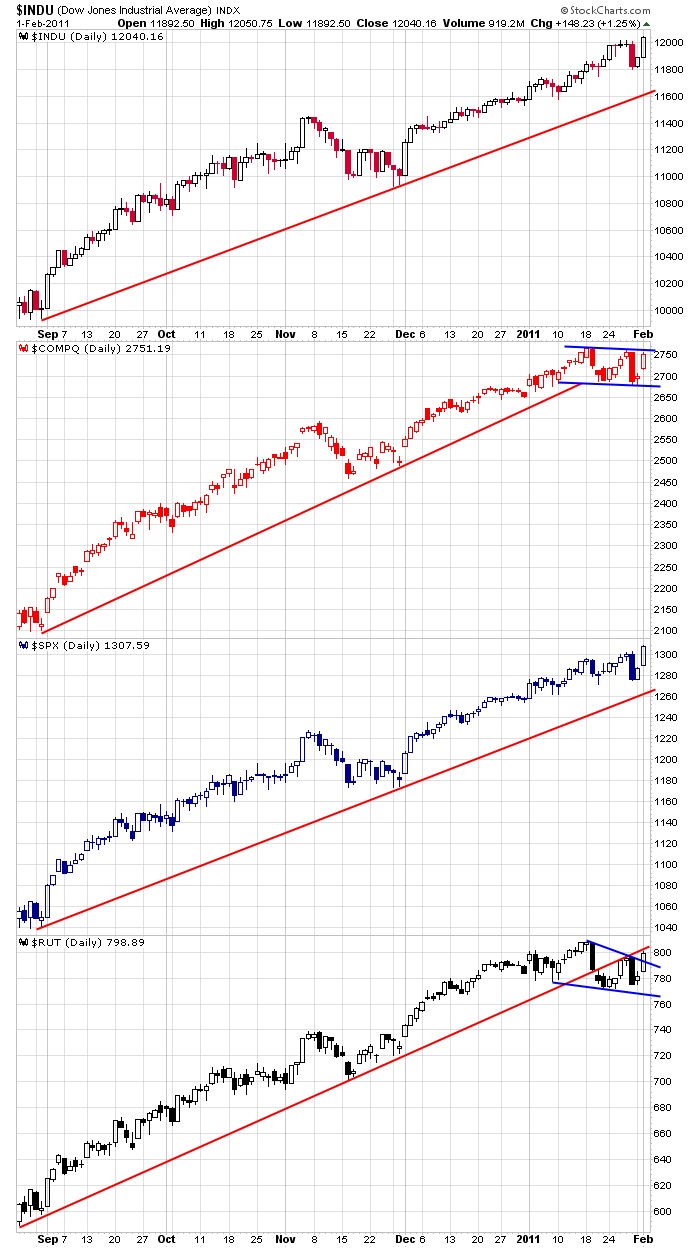

Last Friday was the single biggest down day since August, and it has taken all of two days to completely recover the losses – not bad. The Dow and S&P are sitting at new highs. The Russell is breaking out of a falling wedge. The Nas looks great – it’s forming a bullish consolidation pattern within a solid uptrend. But as I stated yesterday, I want more. I want to make sure yesterday wasn’t one of those “first day of the month” scenarios. Here are the daily charts.

I posted many set ups on the message board yesterday. The fact there are so many (relatively speaking) good looking charts is a good sign. But I still think we need at least one more good up day to solidify the beginning of this leg up. The market took a step in the right direction yesterday, but it still has some proving to do. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 2)”

Leave a Reply

You must be logged in to post a comment.

Jason,

There’s a broadening top pattern on the RUT/TF daily chart that you’re missing. Go back to the 12/21 bar and then draw your upper and lower trend lines. You can clearly see that 820 area is the next target.

Also, go to the RUT/TF weekly charts and look at the bar pattern starting at 5/04/2009. Those 4 bars are just about what is going on now. If this repeats, there will be a strong up-week (next week) followed by multi-week selling. This time around though, the 772 RUT area will probably not hold and the 12/01/2010 index gaps get filled.

I see what you’re saying. I’m long and staying on my toes. My now my uranium plays are doing great (UEC, URZ, URRE, URG, DNN). 🙂

Michael, I ask you, what about a double top scenario

on the Rut of 808? Check the short term chart.

2) Do you know about the end of month/beginning

of month bullish cycle? Regarding that matter,

the selloff could begin over the next few days

thus avoiding the strong week for next week

scenario. HW

As usual a little news can undo the enthusiasm. EDP is suggesting that euphoria is not without its detractors. But the day looks like a set for a further decline some time in the next two weeks. I am long many setups but a little hesitant.

Yep…I’ve been “long but staying on my toes” for about a month now.

Whidbey: Let us know when your ‘pop-o-meter’ says

time to go short. Maybe on Friday when we get

the employment report at 8:30am est. HW

Neal: There must be an easier way to lose your money

other than call ratio back spreads and put ratio

back spreads. Here is the scoop. HW