Good morning. Happy Thursday.

The Asian/Pacific markets were mostly closed today. Europe is currently mostly down. Futures here in the States point towards a weakish open for the cash market.

The market did well Mon and Tues to recover from last Friday’s big down day. Then, just as I wanted some follow through to prove the beginning of the month wasn’t just 401K money being put to work, the market rested. I still want follow through, but with most of Asian being closed, half the US somewhat papalyzed by snow and freezing temps and tomorrow’s looming jobs report, I’m not sure today is a good day to expect or demand follow through. ‘Stuff’ happens, and as traders we need to be flexible.

Let’s not over-analyze here. I’ve made it pretty clear the last month the market isn’t acting normal from a technical standpoint, and now there are outside issues that need to be dealt with before the market can take a deep breath and play out as it wishes.

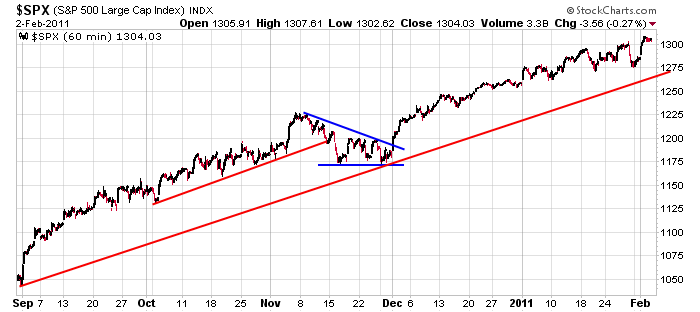

Here’s the 60-min SPX chart. I still see no reason to guess a top. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings Reports

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 3)”

Leave a Reply

You must be logged in to post a comment.

The market is as it will be,it is a very democratic place. But Jason is saying what we all feel. There is some concern for the putative effects of QE2.

The traders are rightfuly concerned that without the liquidity the Fed provides the buying pressure might be excessive and could even lead to a correction.

In the meanwhile I think we must presume that we are seeing is what is likely the market we get. I am invested about 50% with lots of dividends and waiting to do more than scalping with the indexes. By the way short swings are not winners so far.

Neal, leave anytime and OZ seems good as anyplace. Best.

The futures are holding up remarkably well this morning

in view of the fact Egypt is getting ready to explode.

Some ‘tag along’ comments as I see them: 1) Tom Demark

was recently interviewed on CNBC, and according to his

charts the markets are due for a 10% correction soon.

2) The whole meaning of ‘normal’ as it applies to the

markets just doesn’t exist anymore. 3) The markets

have been taking on a life of their own based upon

news events, which is not necessarily good.

Neal Weintraub (our in house guru), can tell you

about the old days where ‘money followed earning and

earnings followed money’ That isn’t true nowadays,

unfortunately. HW

Does it matter?

In these days , one needs to be much tighter with S/L’s and trade more frugally…and Neal your welcome down here anytime !!

ps., I do understand Jasons’ correlation.

Jay-Gold Coast, Australia.