Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. South Korea and Taiwan gained more than 3%; Australia and Hong Kong rallied more than 2%. Europe is posting solid across-the-board gains. Austria, France, Germany, Amsterdam, Stockholm, Switzerland and London are up more than 1%. Futures here in the States point towards a large gap up open, just like yesterday.

The indexes have now tested their lows twice – yesterday and Friday. Is that enough? Can they double bottom here, rally to fill last Thursday’s big gap down and then test last week’s high? That’s what the bulls hope. In my eyes the trend is down and we’re going to see much lower prices, so any decent bounce is a gift that will enable us to short at higher levels.

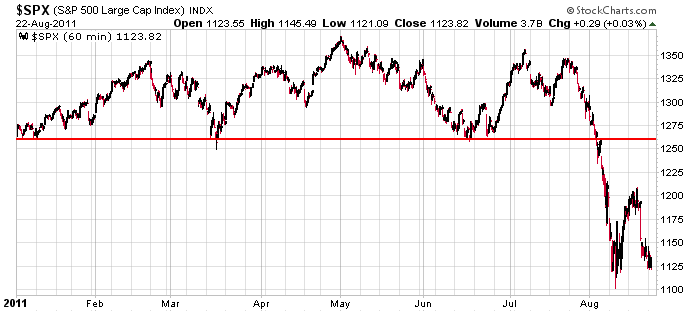

Here’s the S&P 60 min chart. A large 7-month consolidation period…then a breakdown and swift sell-off…then short-lived bounce…and now a test of the lows. I said two weeks ago a bounce back to the prior support was too easy and wouldn’t happen…that a bounce would either come up short or go much further. As it happened, the bounce came well short. Now we’re back in the same situation. If we bounce, I’ll look for it to come up short again or surprise everyone and go further than expected. There’s definitely a growing consensus the market is doomed which slightly increases the odds a rally develops some legs. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 23)”

Leave a Reply

You must be logged in to post a comment.

Neal: Since when did you become an Elliott Waver?

I heard Robert Prechter is looking for a guest speaker

for his annual convention in the Fall. Maybe you can

prepare something that he would be interested in? HW

My invitation is still open to you if you want

to see Cramer Dec 5th at the 92nd Street Y HW

Boring

Yeah, right.

Only if they can loan shark. Look for a bank favorable change in the lending regs.

A TV personality? Better not tell Cramer that when you see him.

After all, he is there to entertain as well as make you money.

Neal’s comments notwithstanding, I think it’s another bearish sign if this SPX rally can’t get above 1155 near term. That’s not a daytrading comment, it’s just a comment in the context of the move down thus far off of the May high.

As to Jason’s comments, my understanding is that Jason is a swing trader and addresses the market movement from that perspective. Neal has made it abundantly clear he doesn’t think consistent profits can be made from trading (I assume he means leveraged trading). But let’s be clear here. If my memory is correct, Jason has also said that everyone needs to decide what they are, i.e. investor, daytrader, swing trader, etc and trade consistent with what they are. I don’t care what you are – you better pay attention to risk mangement (position size, proper stop loss etc).

On the 60 minute this almost looks like a Wave-1 up trend. I define Wave-1 as the break-out wave, high volume, rapid price advancement, wide spread.

“blessed are the meek” is a scam?

oppinion please

the dax leads the ndx

the dax may have finished a 5 wave down and starting a wave 2 up

or is still in wave 5–sub 2

the ndx 100 after making a july all time high looks like finished wave 2 and in wave 3 down

of something or is still in 2 having double bottomed

in a bear market double bottoms dont count

spx definitly going to 1000 its just how we get there—then we can have Neals 40 -60% bounce so after has averaged down like all good amatutre fundamentalist mutual alpha fund

manager –can get out

Question: why does the DAX lead the NDX?

because europe leads the usa

europe is bust and about to break up so the fed is irreverant

dax lead ndx

ftse leads dji

neal leads the spx

thanks

Mars, according to girlfriend last night.

NEAL WHY DONT U BUY THE DIPS–AVERAGE DOWN–THATS A GOOD ALPHA MUTUAL –AH

it must be time to go short soon –just woke up

go the bulls –i want to short u

think i will have a mutual sandwich with buy the dips filling,for breakfeast

I think that sanwich needs some opinion relish to spice it up a bit.

Good for you Neal! Buy your mom stuff.

I’m short. My indicators are being contrary today.

Neal the banks cant help anyone –everyone is now broke

hear is one for Neal or Pete

where is apple going –it has the same pattern as ndx 100

but looks like some worms got into it from the 1929 chart

im short the world now from R1 piviot

Damn! That felt good.

next bar: ooops somebody’s buying.

hope all is well over there in the quake

A 5.8 magnitude earthquake has hit the Washington, D.C. metro area, prompting the evacuation of the Pentagon

5.8 quake its virginia

I’m in New Jersey across the river from Philly and, while talking to a client, my whole house shook. I thought at first Howard’s doll baby blew up or the stock market was crashing in a supercycle wave 3 third of a third of a …. but then I heard neighbors outside saying it was

just an earthquake!

Anyhow (Neal, close your eyes), from an EW standpoint, my opinion is that we’ve completed 5 waves down from SPX 1356 which completes the 3rd wave from the May SPX high at 1370. We’re now in a wave 2 corection that should complete at 1155-1175 and then we go to 1000-1050 for the completion of 5 waves from SPX 1370. That’s the BEAR case.

The BULL case (Neal, you can open your eyes now) is that 3 waves down has been completed and that’s it (an abc 3 wave correction)and from here we head back to at least test the May SPX high of 1370. Longer term, from my perspective, I still think we go to 1000-1050 for a larger wave A, then a B wave corrective rally back to 1200+/- and then down to 850-950 to complete wave C. At that point, my EW crystal ball gets reall cloudy. Armageddon is postponed for now, in my view.

Thanks Pete

my crystal ball tells me the break up of euro union will be more important than usa

china cant bail it out forever

Aus, is there a US DAX and FTSE look alike? My feed doesn’t do foreign symbols.

the dax or gdaxi or $dax-xet codes is the only one that has moved below aug lows and still at around aug lows–closet look alike would prob be ndx composite or maybe rut

ftse is not actually a english index it has world leading banks -comodity -oil ect shares

bhp cheveron exon ect–fits pos to spx or dji because of its leading stock nature

A correction of my previous post – I meant to say that we’re now in a wave 4 (not wave 2) of an anticipated 5 wave decline form the May SPX high at 1370.

PeteM, nice call re: 1155. I didn’t think it’d make it.

Neal – I used to date his daughter but she was a little too wacky for me, unlike her father.

Erwin was a pretty good Elliottician too!

“There’s definitely a growing consensus the market is doomed which slightly increases the odds a rally develops some legs”

Jason you nailed it!