Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Hong Kong lost more than 2%; India, Japan, Singapore and South Korea lost more than 1%. Europe is currently trading up. Austria is up more than 2%; Belgium, Germany and Norway are up more than 1%. Futures here in the States point towards a gap down for the cash market.

My overall stance has not changed. I believe we are in the beginning stages of a downtrend, and lower prices are coming. But in the short term, a bounce is a definite possibility. How far will a bounce go if it materializes? My attitude is the same as two weeks ago. To say the market will bounce to last week’s high or to the previous support level is too easy. It’s more likely the market bounces further than we think is logically possible or comes up short. The odds favor it coming up short because the trend is down, and the market is so weak but there is a reason to entertain the other scenario. Namely because everyone is so bearish. Everyone assumes the market is going to fall apart, and when everyone gets stacked on one side of the market, surprises can happen.

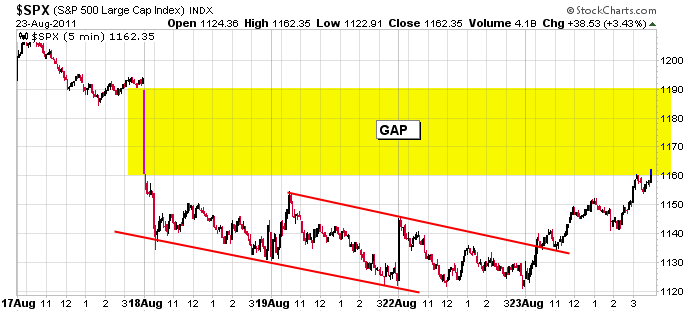

Here’s the 5-day, 5-min SPX chart. As of now today’s open will be near 1150 – that’s not too bad considering yesterday’s near 40 move. Filling the gap is step one for the bulls.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 24)”

Leave a Reply

You must be logged in to post a comment.

The landscape of the stock market has been scarred deep with intrinsic damage.

(RichE know what I am talking about). And tell me who was buying the market

yesterday, thus causing the Dow going up 322 points? Neal would tell you

it was M/M John Q. Smith reading their glossy mutual fund brochures over

the weekend and they decided to call their broker and buy with two fists.

No idea what you thinking about. Is it same thing my girlfriend, breakfast?

No idea who buying, pumpers and dumpers?

Zen master is giving a lecture at 2pm today.

Won’t you join us for cookies & milk afterwards?

You really want to go there?

Where Money Manager put cash? In pocket?

We hit your target PeteM? It’s looking toppy.

RichE – I’m not sure about it being toppy but this is an area to look for a reversal to the downside. However, we may have to see further upside and another test of 1200 (EW analysis aside)where the 80 week SMA is sitting around 1209.

Speaking of EW, the wave count got awfully difficult to make out in the past few days (what else is new with EW analysis)but, from a longer term perspective, it just seems to give more weight to things unfolding in broader 3 wave sequences and not the impulsive 5 wave sequence that you would expect if we are beginning (or already in) something like a supercycle 3rd wave. But that’s just my opinion.

RichE – I’m not sure about it being toppy but this is an area to look for a reversal to the downside. However, we may have to see further upside and another test of 1200 (EW analysis aside)where the 80 week SMA is sitting around 1209.

Speaking of EW, the wave count got awfully difficult to make out in the past few days (what else is new with EW analysis)but, from a longer term perspective, it just seems to give more weight to things unfolding in broader 3 wave sequences and not the impulsive 5 wave sequence that you would expect if we are beginning (or already in) something like a supercycle 3rd wave. But that’s just my opinion.

Sorry, I hit submit twice (subconsciously the 2nd hit may have been for Neal)!

Get real the real economy is dead –germany –2nd bigest exporter is desperatly slowing

euro union to break up–Neal have u been listening to cnbc again or those long only mutuals

now here is a joke from bloomberg

one bank analyst said about b of america—well they have enough money to cover their short term debt and a little left over to cover some of their longer term so its alright but boa—-

they are bust –insolvent arnt they–so bankrupt them

those long only mutal mindsets really get me going

buy the dips–average down—yuk

Neal, for all our sakes, I sure hope you’re right!

However, until debt is restructured to allow debt to paid over time this U.S. economy has no where to go but down. The FED and the political hacks in DC continue to address the problem as a liquidity issue when , in fact, its a solvency issue. How can a U.S. economy that is 70% consumer driven grow when the oonsumer has no choice but to deleverage? Emerging market countries are not yet in a position to take over the consumption wagon and begin pulling it in place of the U.S. consumer. I’m afraid we have several more years of economic “adjustments” ahead of us and once that fact becomes even more recognizable than it is now, it’ll be tough sledding for the stock market – in my opinion.

dont u have bankruptcy laws in usa

why restructure

boom /bust is a great cycle

bust is where u buy things cheap

delflation is a gem to look forward too

europe just close and all indexes have been very polite today

each waiting for the other to get set and then continuing on

up to now its been all europe driven–its opts ex in many parts of the world this thurs/fri

now over to the retailers and fed manipulation for lunch 2 hours

maybe those mutuals might wont to have a go—rent a bargin

Back to the techicals – so far the rally from SPX 1121 is a 3 wave pattern, but as long as 1152 holds on this pullback, we could see 5 waves on a break above today’s high (1175)- which would would imply even higher prices on this rally.

EW: Where you put markers? You on 60 minute chart? What intent of wave?

I’m flat for day. Got to find girlfriend. She not back from shopping. Maybe I give her too much money.

1152 on the 60 min would be wave 1 or wave a. Today’s high may be wave 3 or c of some degree. It’s too early to think about a possible triangle, in my opinion.

spx could be a small triangle forming same with dji

ndx 100 looks like a wave 3 started with a gap to try to fill

german dax has broken lows and could be trying for a 3 thrust to the low before wave 2 up–maybe today was it

“… dems do anything…” That funny, imply Republicans have ethics.

If no job where consumer get money to spend?

You believe in body language Neal? Same thing tech analysis.

Have to say, SPX looks “impulsive” so far making me think things hold up inot BEN’s speech on FRI. Neal should be happy that the “technicals” are confirming his idea that the May-Aug selloff has been “contained” – so far! Of course, the real test (EW nothwithstanding) will when/if the SPX can get above the 80 day SMA at 1209 at which point we can really start to think about whether the bull market has resumed.

just woke up –hope i get a chance to short for the asian/europe session

if it goes higher we will need a QE3 from the hellie chopper–i doubt it–causes to much world inflation and would allienate the world with a currency war/collaps

looks more like the hedgies are sucking in the mutuals –if the big banks–hedgies are going bust at least they will have their puts

dji 11000 spx 1100-50 are good strikes to write puts—the hedgies did this at the top

and sure looks like they are doing it now

europe banks are in bad shape and there will be a roll on effect

why do i get the feeling this seems more like a wave 2 than a 4 of 1

after labour day we u go back to work we will know if the hedgies or mutuals win

With EW, one never really knows, does one? The next resistancw begins at 1180 and there is an unfilled gap in the 1190-95 area. Maybe now that we can count 5 up from 1120, we have a pullback tomorrow from 1180ish down to 1150+/- before another attempt to rally deeper into 1180-1210 resistance.

yes i noticed the 1180 –almost like price gets held a certain levels whilst puts/calls are writen

stocks are only pawns –derivitives rule the world

we have opts ex in oz today

Thanks Neal

just woke up again for asian session and im short dji-spx-ndx-ftse-dax from close

all futures down

apple after hrs down 5 %