Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Taiwan lost more than 1%, but Australia, China, Hong Kong, Japan and Singapore gained more than 1%. Europe is currently mostly up; gains are not quite as big as in Asia. Futures here in the States point toward a positive open for the cash market.

Yesterday after the close Steve Jobs announced he was stepping down as Apple’s CEO but will be it’s Chairman of the Board. The stock lost a couple % in after-hours trading but right now is only down 7 bucks – no big deal. This is sad news. There aren’t many companies out there who innovate like AAPL does, and although there are lots of very smart people at AAPL, make no mistake about it, AAPL was his company. He was the visionary behind the products. He would not have stepped down if he was in good health, so we can only hope things aren’t too bad.

Also announced after yesterday’s close was that margin requirements on gold are being raised by the CME. Considering the rapid fire raising of silver margins the last two months, this news should come as no surprise. Between last night and this morning, gold is down about 100 and down about 175 from its high hit just two days ago.

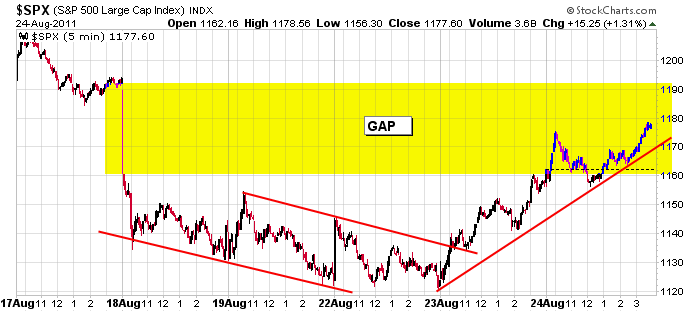

Here’s a repost of the short term S&P chart. We’ve had a nice move up the last two days (almost 60 points, geez). Half the gap has filled, and dare I say the intraday movement has felt like the market wants to move higher.

Tomorrow is Ben Bernanke’s Jackson Hole speech. Will he say something about QE3? I hope not. QE1 boosted the market some. QE2 has much less effect. QE3 isn’t likely to do anything but cause a short term pop. And besides, it’s not like any of the QE has helped the economy. The money was supposed to trickle through the economy to give it a boost. I think it tricked to Wall St. and stayed there.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 25)”

Leave a Reply

You must be logged in to post a comment.

Neal, I’d like to join you owning AAPL but, since it pays zero dividends, I’ll wait for the $250-$300 price area.

things must be bad–buffet had to bail out bank of a

ouch!–i got caught with the gap up announcement–even with stops

reentered now but mostly europe

All the prerequisites have been met to count the rally from SPX 1120 as a smaller EW 5 wave sequence into today’s high. A pullback to 1155-1175 wouldn’t invalidate a subsequent attempt to completely fill that gap at 1090-1095 on the way to a retest of 1200-1220.

I’ll say it again, since the SPX 1370 high, I see a 3 wave decline to 1100. That can mean 2 things from a EW point of view: 1) this was a corrective pullback within the longer term bull move from MAR ’09 (Neal’s position, I think) or 2) As long as 1295 isn’t violated, we may be in wave 4 since the 1100 low (perhaps a larger wave 4 triangle developing) with wave 5 yet to come to my target of 1000-1050. There’s also a 3rd possibility (bearish) but that can wait if/when 1220 is broken. All this is just one way of looking at things from one mode of technical analysis. Tomorrow through MON should be interesting.

What up with that open? I’m short and a tick in the black.

I’m not a daytrader, but if I was, I’d short a buounce that fails near today’s SPX open.

…and it looks like this bounce is failing.

q. What does PeteM and Warren Buffet have in common with each other?

a. they are both on Ben Bernankes’s payroll. HW

And we both collect social security.

By the way, if I was a daytrader and got short on a that failed retest of today’s SPX open around 1175, I’d think about covering if I saw 3 waves down into 1148-1156 from today’s high. Now, if it was 5 down from today’s high, I might hold on for more downside. But, I’m not a daytrader.

PeteM: call the close for Melisa Lee and the CNBC Fast Money crew today.

I don’t know if I can do that. All this intraday wave counting gives me a headache, which

is why I don’t daytrade. And if I did daytrade, I’d be wondering if I should have covered

at SPX 1160 already. See, it’s just too hard for me in my advanced age, which is why I

leave it to you, RichE & AussieJS.

What would being on Ben’s payroll imply? Maybe we should all be on the, “Turn America Around” payroll.

How is the Merc going to kill me?

Looks like this bounce is going to fail tooooooooo.

today will be a key signal reversal day to start sub 3 of 5–target 1000spx dji 10000

ndx will lead the way,which is startin wave 3 of 3 of large 333

333 is the target for spx

PeteM: I don’t want to humiliate you in a public forum, but what the heck.

I was born 02-21-1954 (age 57) and Ben Bernanke is about 6 months older

than me. So, unfortunately we will both have to wait a few years before

we collect Social Security. Please make a note of that. HW

You get up on the wrong side of the bed Howard? Eat some bad pizza?

I didn’t get enough oxygen when I was a fetus. HW

http://www.ratracetrap.com/the-rat-race-trap/25-ways-to-enrich-your-brain-experience.html

Howard – you’re still a young whippersnapper. Just don’t let daytrading age you faster than necessary. In the meantime, we’re moving around today in waves of 3 as I see it.

“Grumpy old Men” diatribe!

Back to trading: ESU1: Looks like this bounce will hold. Long a small lot.

Stops to break-even.

Stopped out. I’m going shopping. TTFN

If I’m that daytrader who got short on the failed test at today’s open, I’m looking to cover soon around SPX 1156, but if I’m more bold, I may want to see if this trade can see 1148 before covering. But that may be a little too greedy.

At 2pm (EDT), if I didn’t cover at SPX 1156 , I’m putting in a buy stop at 1166.50 to cover my shorts and getting out on the close if I’m not stopped out sooner.

Having gotten stopped oput at 1166.50 for a 10 SPX point profit, that same daytrader (being a glutton for punishment) might be thinking to reverse now and go long around 1165 or better ( with a stop loss at 1162)and get out at the close if not stopped out.

PeteM

Really appreciate your Ewave explaination and you at least are putting the calls of what you are doing prior to the market.

shaero – I usually don’t have that much time on my hands during the day, but today I thought I’d make believe I was a daytrader. Having taken 2 positions for a net gain of about 7 SPX points, I can’t imagine getting in and out of trades all day long in shorter time frames.

Had I taken more of swing trade approach I would have been short on the failed retest of the day’s open and would still be short with stop loss earlier in the day at breakeven which I would have moved down to 1168 at 3pm with the intention of staying in overnight.

Longer term, I’m still thinking we’re in flat or tiangle 4 the wave from SPX 1370 but open to the idea that our good friend, Neal, could still be correct that we saw the end of the correction at SPX 1100. I guess my point is that no matter the trade time frame you gotta have exit points to cut losses and protect gains based on some trading system.

Neal, mirrors, blind spot? Are you worried someone will stab you in the back?

Good call PeteM. Can you start a little earlier tomorrow? Please.

i set my stops and just woke up—couldnt stand all the chop

still short the world–this key reversal will take us to a marginal new low

for less than impressive wave 2 up

bring on the grand depression we should have had

and get rid of debt so all can prosper

i dont want to live in a world of zombies and self centered liers