Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. India and Malaysia lost more than 1%. Europe is down across the board. Every market (except Austria) is down at least 1%. Futures here in the States point towards a negative open for the cash market.

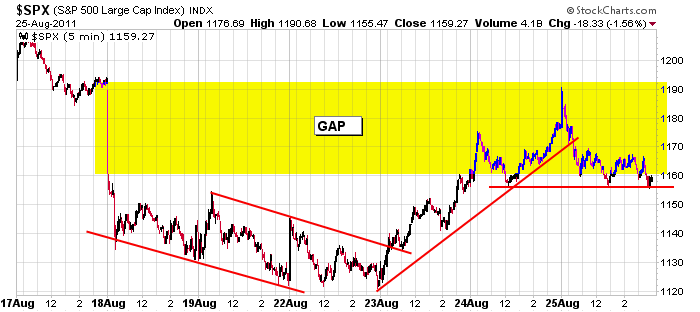

On a long term basis, my stance remains the same. The trend is down; I expect to see much lower prices in the future. On a shorter term basis, the market could certainly pop, but after looking at 500 charts last night, I can conclude the odds are not great. The charts are not healthy. There are too many downtrends, too many bearish patterns. Here’s the short term chart I’ve been working off of. The gap filled, and now the S&P is sitting on support…but futures suggest the S&P will open below support.

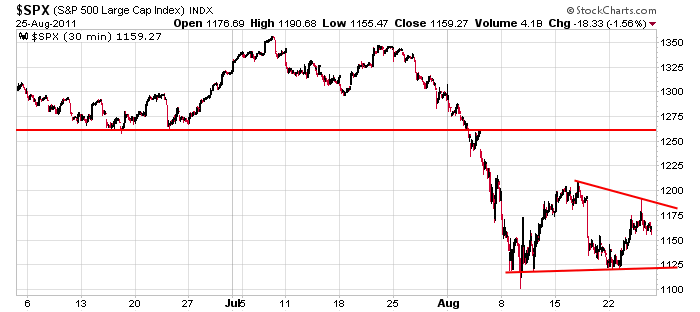

Backing up a little, here’s the 30-min chart. A 7-month horizontal trendline was broken earlier this month, and now we have a bearish distribution pattern within a downtrend. Yesterday’s high needs to be taken out quickly or else this pattern will break down, and the S&P could quickly drop to 1000.

HERE’S a link to my public list at stockcharts with some trading ideas.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 26)”

Leave a Reply

You must be logged in to post a comment.

Hi PeteM: I was watching CNBC live from Jackson Hole where your boss

Chuck Plosser was speaking to Steve Leisman. Well, anyway, if he is

concerned he certainly doesn’t show any panic of any kind. It’s

nice to know that they display this Boy Scout image on TV, but

behind the scenes things are murky at best. 2) I will refrain

from any kind of trading today until the final hour into the close.

today may be a lot about which way the weekly opts market makers are placed for event risk

charts are so hindsight things

i trade the tick and index arbertage inds

In other words, you just got whipsawed! HW

no HW-i was warning on a upside pop

as there would have been a lot of weekly puts

i may go short soon

whipsaw is great 2-5 min trades no trend

ESU1: The 3 minute looks too strong to short, but… there’s the FMOC emotion factor.

Why you so negative HW?

I believe-hope-analyze that 1170 is good for a bounce. HW

no no no bounce Howard –the economy is now up to a gridlock parliment

bernankes out of it

1172.64 high of day thus far.

the character of the market changed with the benanke report

no one bar up one down –we now trending again somewhat

Aus, that short is looking better and better.

still short covering -no real selling yet

Breaking News: by 2pm Friday afternoon the U.S.A. will be

officially out of the recession and they will announce

that unemployment is down to 7.8%. Standard and Poors

has recanted and reinstated the AAA credit rating to

the U.S.:) Yawn, did I just wake up out of a deep sleep?

Was that dream in color?

Neal: why don’t you tell everybody the truth. You shut down

your Dow 12,000 website, absconded with your subscriber’s

paid in money and now you are living with a hooker

somewhere in New Zealand, 1) living on the beach,

2) growing a beard, etc. etc. That’s the real reason

you didn’t want to see me and Cramer at the 92nd Y?

Send us a post card.

No tails on the mini-dip

Wait’n on a long nick

Finger on the short sell

Let’s hear it John D.

While out & about this AM in client meetings, I listened to the analysts parse BEN’s speech on Bloomberg radio. The consensus of opinon was that BEN sez that, despite weak economic numbas, everything is okey dokey enough so that “stimulus” is not needed (at least until the 2 day FED meeting in SEPT). Ben deftly sent a backhand across the net to the PREZ & Congress to “do something – anything!” to get that jobs numba down. BUT & HOWEVER! BEN slso mentioned that he still had some “tools in the FED tollbox”. So, stock market down (no “stimulus” today)& then stock market up (everything still okey doke because BEN sez so).

Apparently BEN’s “okey doke” meets Neal’s criteria for “let’s buy stocks” because, after all, you “don’t fight the FED”. We’ll see, I guess. In the meantime (Neal, close your eyes) from the technicals, I see still an EW 4 in progress (triangle or flat pattern) with resistance at 1190-1220. Whether it’s a wave 4 or RichE’s wave 2, we should go lower with a target of 1000-1050. Maybe then, BEN will be forced to dip into his “tool box” to spark a rally but I think it will be for naught.

On a two year daily SPX: I think Aug 2011 is type Wave 2 looking for support, wanting to continue the journey up, looking for sellers to hold and sideliners to buy. If we get that then Neal will be right and if we don’t, Neal will be on vacation.

our posts crossed same time Pete

the fed has had its tool box confiscated by the europeans/china

to stop it medeling and causing deverstation for the rest of the world

the mutuals will just have to get along with out their fix

and the BOYZ-big banks know all other banks are bankrupt –so no interbank lending

im looking forward to a complete financial melt down

i hope all yanks have overseas bank a/cs set up somewhere safe

the selling may be starting

good advice HW —triangles complete on dji/spx –ndx 100 filled gap

Well, I guess that proves my point that you can put 10 “Elliotticians” in a room and get 10 different wave “counts”. But I’m sure that you, like me, use other technical tools (I like trend lines & Moving averages)as complementary support. In that respect, I envy Neal. He’s never in doubt and in the FED he trusts! Keeping it simple, I guess and from what he says – it works for him.

You’ll have to excuse while I prepare for Hurricane Irene. Howard!!!! anchor down the blow up doll and make sure you have necessary provisions for MAX (say hello). It’s his 1st hurricane.

Elliott Wave: I don’t use count I use intent.

Indicators: Candlesticks, volume, KVO, (5 minute chart), tea leaves, and a buffalo head nickel.

I wish you guys would drop the blow up doll bit. It just tacky and not funny. If Howard uses a blow up doll that’s his business and not the thing to make fun of.

Howard – please accept my apologies for saying something that was tacky and not funny. I blame it on Neal but take full responsibility for my conduct which was inappropriate and unacceptable.

Thanks.

Now back to trading. I think I’ll leave a small lot short over the weekend.

RichE – there’s some talk that AUG 29th may be a Bradley turn date (which would make this

a topping area) which would fit in with the triangle/flat idea that I’m looking at. MON should be interesting.

Monday should be the tell. Have a great weekend all.

dont fall in love with any idea /pattern atm

NEALS UPSET ‘CAUSE HE HAD HIS dOLL CONFISCATED AT CHRISTCHUCH AIRPORT IN NZ.pERSONALLY I LIKE THE ‘BEN BERNAKE FARTING DOLL’ WITH ONLY A SPANNER AND A BROKEN HAMMER IN HIS TOOLBOX ….

Hello Web Admin, I noticed that your On-Page SEO is is missing a few factors, for one you do not use all three H tags in your post, also I notice that you are not using bold or italics properly in your SEO optimization. On-Page SEO means more now than ever since the new Google update: Panda. No longer are backlinks and simply pinging or sending out a RSS feed the key to getting Google PageRank or Alexa Rankings, You now NEED On-Page SEO. So what is good On-Page SEO?First your keyword must appear in the title.Then it must appear in the URL.You have to optimize your keyword and make sure that it has a nice keyword density of 3-5% in your article with relevant LSI (Latent Semantic Indexing). Then you should spread all H1,H2,H3 tags in your article.Your Keyword should appear in your first paragraph and in the last sentence of the page. You should have relevant usage of Bold and italics of your keyword.There should be one internal link to a page on your blog and you should have one image with an alt tag that has your keyword….wait there’s even more Now what if i told you there was a simple WordPress plugin that does all the On-Page SEO, and automatically for you? That’s right AUTOMATICALLY, just watch this 4minute video for more information at. Seo Plugin