Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up, but gains were small. Europe is currently mostly up; gains are small there too. Futures here in the States are down a couple points.

Today is rollover day for the eminis, so you’ll want to start trading the Dec contract if that’s your thing.

There are many charts which are much improved the last two days. There are many more charts which are still in bearish consolidation pattern, and all they’ve done is move off their lows. This enables the bulls to sleep a little better, but otherwise doesn’t change the fact that the overall trend is down.

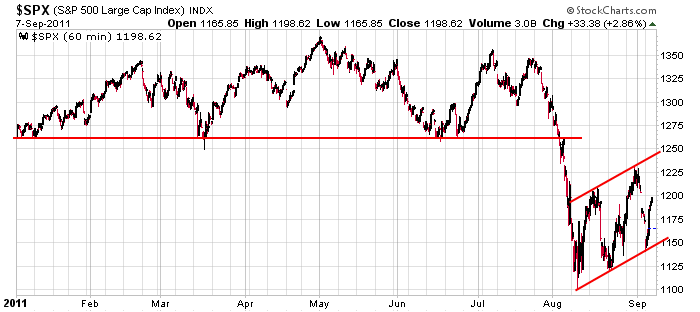

Here’s the 60-min SPX chart I’ve been working off. The Jan-Jul topping pattern broke down, and after a quick sell-off, the index has been resting in a bearish rectangle. Such a pattern becomes less relevant as time goes by because it needs to be proporational to the move into the pattern. We’re close to that point now. If the pattern doesn’t resolve down in the next week or so, it’ll be timed out. That doesn’t mean it can’t morph into something else, it just means I’ll stop watching this pattern and instead try to figure out what the updated price action means.

Down, up, down, up, down and now up. That’s been the last month. Gotta trade this market and be ahead of the curve taking profits, and you can’t worry about leaving money on the table. The turns are sudden and often involved gaps. Trade the market in front of you, not the market you want. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 8)”

Leave a Reply

You must be logged in to post a comment.

Still looks /feels like a wave 5….

Yesterday bulls seemed to be grazing to greener pasture.

What are signs of OVERSOLD reversal?

Jason makes a good point about “proportionlity”. It seems to me that the ultra bearish view needs to see an end to this rally by early next week at the latest (preferably contained below 1210-1230), or we likely see higher to sideways action for a period of weeks.

“proportionality”

ESZ1: short

nice entry 🙂

Thanks. Let’s see if I can make as good an exit.

how do you measure the proportion of the bearish rectangle to the topping pattern to decide when it is not relevant?

Nick…I don’t measure the rectangle relative to the topping pattern. I measure it relative to the move into the pattern. And I don’t actually measure it. I just eyeball it.

A flag-type pattern has a move in, then the pattern, then the move out. After you’ve looked at hundreds of them, you get a feel for how the different parts are correlated. When one part is too big or too small, the pattern has less meaning to me.

ESZ1: If 1187 holds I’ll cover my position.

ESZ1: Stops 1190.25

with the euro crashing–bearish,we have small moves to R1 res above prev high for the past few nites and traded in a small range

we are trading around mid rectangle range and a ideal pos for a down move

if this was a bull market this would be a ideal bull set up

but in a bear market it is a ideal pattern after a big impulsive move down

but fells like it is being held around this area would wide either for todays futures roll over–frid weekly opts or quad opts ex coming up

it doesnt take much to control market

atm only suitable for scalping–very short term intra day in/out

ESZ1: I’m tempted to go LONG 1 overnight. The volume on the closing is high.