Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. India, Singapore and South Korea lost more than 1%. Europe is currently down across the board. Belgium, France, Germany and Stockholm are down more than 1%. Futures here in the States point towards a weakish open for the cash market.

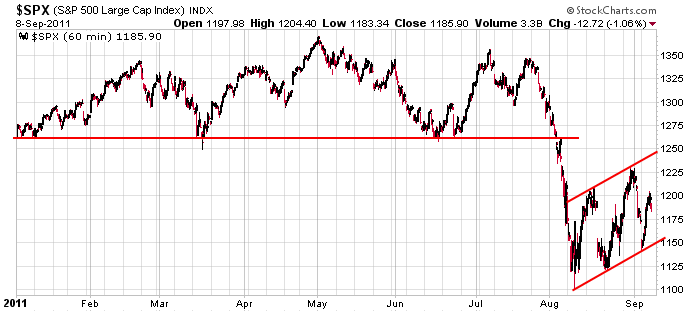

Let’s keep things simple here. The overall trend is down. To reverse this the market needs to rally big to invalidate the bearish rectangle pattern. Or it can simply keep moving sideways in which case the rectangle will morph into a neutral range. Until one of these two happens, I’ll consider the current movement to be a consolidation pattern within a downtrend. Rallies can be sold and shorted, and then it’s the bulls job to defend their stance when the lows of the pattern are approached.

Right now the S&P’s range is approx. 1150-1250. With yesterday’s close at 1185, we’re a little below the midpoint. Shorting the top of the range is easy because you risk a little for lots of downside potential. Buying a visit to the low comes with a little more risk but the risk/reward is still favorable. Entering positions here near the middle is more of a gamble…especially since day to day movement hinges on whatever major news just came out.

Here’s the 60-min chart. Despite the gaps and news, the pattern is pretty. It pays to back up and see the bigger picture…even if you mostly focus on short term charts.

Be flexible. Don’t over trade. Don’t churn your account. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 9)”

Leave a Reply

You must be logged in to post a comment.

Jason just gave us his first lesson in how to Day Trade:

“Be flexible, don’t overtrade and don’t churn your account.”

i doubt that thats what Jason ment for daytraders,Howard

Sorry, Aussie. I think I’ll go back to

sleep now since I was waiting for the Obama

rally which never came today. Damn, and

I bailed out of my SPY puts yesterday

just a little bit too early. Oh well..HW

yes i may go back to sleep to—-having bailed out of my ftse-dax-ndx-spx-dji shorts from preopen—just after cash opened and have been waiting for a europe close bounce

dam just missed a scalp as i type—looks like the impulsvive has started down at least in europe

daytrading is not a position trader and no intraday bias is a must,whilst u can be awear of the overall trend—the intraday TRENDS are unique to the intraday trading

there are usulaly a few trends in a intraday –up sideways up–down sideways down

or just sideways chop all day,or down all day or up ect

one is constantly asking oneself –has that trend now changed to down from up and visa versa

i think Jason was refering to be flexable on a larger time frame

AussieJS – I agree that Jason was talking in regard to the larger time frame. At the noon time hour in the USA, we are looking at the second test this week of the lower trend line of the “flag’ formation on SPX from the AUG low. On the hourly chart, the move down from yesterday’s high has an impulsive look. We could see an acceleration downward on a break of 1140.

if we change trend to up into the close from here, i will short europe for a hold over w/e

as europe futures still trade till end usa close

but whilst we are at S3 piviot and no sign of a reversal yet we could easy go down to S5

but ill be watching for any change–currently short from S2 piviot

Knowing the intraday trend is an elusive must.

elusive..haven’t heard that word in over 45 years since

‘Bright Elusive Butterfly’ by Bob Lind was a hit single.

Elusive Global Intraday Trend(s); how much credence Auss? Does Asia flow into Europe into America into Asia? How effective are they in determining each global market intraday trend? Who is the cursor, who the reverser?

ESZ1: BTW I’m long @ 1149.75. The dip has some volume. It needs to get over the 1155 and 1160 else I’ll be scratching out a living today.

elusive—-nuh—-just have es/ym/nq 1 and 5 min charts and euro or usd charts open

24 HOURS a day and u see the correlation

also noting that there are 3 currency time zones–japan/asia—then europe –then usa

and noting we have curency wars going on instead of trade wars—-no not star wars yet

and traders are buffetered by risk and yeild

Thanks.

ESZ1: Languishing, sidways-down, looking to short.

are u using the tick ind RichE and if so how do u find it

it takes a bit of getting used to but imo invalueble

No, the TICK was too busy for me. I only have one screen.

I use the KVO and volume bars on a 1 minute 5 day candlestick.

SHORT: If the low is a lower-low on I short the next high. Especially if there’s been some long nick. I’ve not found volume to be helpful in overbought.

LONG: If the high is a high-high I go long the next low. Especially if there’s volume, tails and a Hammer.

STOPS: I adjust stops to the highs and lows. If I get a higher-low while SHORT or lower-high while LONG I tighten.

This doesn’t feel like a lower-low. Oh, there it goes.

20 Quotes that Prove the European Financial System is Doomed

http://email.angelnexus.com/ct/6677687:9782139504:m:1:245173307:105A5E6C43D704CC0B29AA5B4F770ECF:r

If SPX can hold 1150ish today, we can see a rally to at least 1162, in my opinon. I’d favor a longer term short positions from 1162 to 1176 if we can get back there, figuring a test of 1100-1122 at minimum on the following decline.

Short position 1162-1176? Don’t you mean 1176-1162?

Have a great weekend. It doesn’t look like the market is happy with Obama.