Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed down across the board. Hong Kong lost more than 4%…Australia more than 3%…all other down at least 1%. Europe is currently getting hit hard. Losses are in the 2-4% range. Futures here in the States point towards a large gap down for the cash market.

I don’t have anything to add to my weekend comments. The overall trend is down (it’s been down since early August). The short term trend is down. All the key groups such as the financials and oil the semis are trending down.

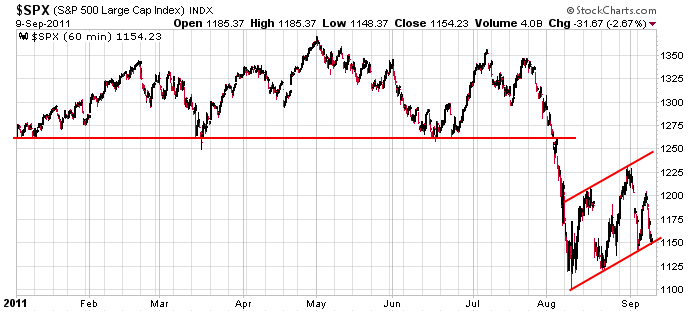

Here’s the 60-min S&P chart I’ve been posting for two weeks. Last week started with a big gap down, but the index was in the middle of its range. Hence it had a cushion to work with. This week will also start with a big gap down, but there’s no cushion because prices closed Friday near support. Today’s open will take out the last two reaction lows and put the index near 1125.

Right now Greece is in the world’s crosshairs. If they default on their debt, we could wake up and see the S&P down 100. If they get bailed out, the opposite won’t happen, but we will get a nice relief bounce.

One of the problems during the financial crisis here in the States was how connected everything was. Once one domino fell, the entire system unraveled. If the same connectedness exists now, a similar scenario could play out. My S&P target remains at 1000 for now. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 12)”

Leave a Reply

You must be logged in to post a comment.

EZU1: Looks bullish at the moment.

NOT FOR LONG !!

McHugh once made a statement something to the effect that once a pattern

gets established and everybody in the media knows about it somehow it

fails to materialze. I am referring to the Head & Shoulders pattern

which is the current rant among all the EWavers. I stayed flat over

the weekend because I had a feeling something like this might happen.

This doesn’t make sense. The EUR/USD is up, the UUP is up, and the SPX is up. Drachma to EUR to USD to SPX?

ESZ1: currently short.

is it a quad witch

a german dax bottom

small 2 of wave 5 down

a normal gap fill as daytraders like

or

is a a gigantic big bad black bear with pink pokerdots

Black Bear w/pink polka dot? What’d you have for breakfast?

ESZ1: Covering short.

ESZ1: I’m FLAT, but this dip doesn’t look supported.

im eating big bad bulls for breakfast

short at piviots

EZU1: I’m waiting for 1145 go short.

ESZ1: Darn! Shoulda stayed SHORT.

S1(1137) R1(1146.25)

EZU1: short S2(1131)

i didnt try to milk it

piviot to piviot —world scalps on all six indexes i trade

have u switched over to the new contract,RichE………..ES.Z1

Yes.

ESZ1: Looking to short 1142.5

im going to sleep

I’m going to lunch.

EZU1: looks like S3(1127.75) may hold.

For those with a non-daytrading perspective (swing or longer term), I call your attention to today’s trading thus far at 2:30PM (EDT) in the context of Jason’s comments last week regarding the SPX movement since the AUG low at 1101. I referred to it as a “flag formation”. Jason remarked that if the trading continued much longer without a downside break, it might evolve into a longer term sideways trading range. I think he may prove correct, absent a sharp sell off today/tomorrow.

The implication is that, while we could go slightly lower (but hold 1101-1120), what appeared to be a “flag” formation could morph into a “triangle” formation – as just one possible pattern. Furthermore, if 1101-1120 support holds here, it may prove to be an opportunity to get long for a swing trade with an upside target of at least SPX 1160-1175. From an EW analysis perspective I would see this type of behavior as more confirmation that we are undergoing a 3 wave decline from the MAY 1370 top. However, regardless of EW analysis, the longer term trade is to use any rally under this scenario as an opportunity to get more agressively short above 1160, in my opinion.

I agree. It’s got to follow through soon or else it morphs into something else.

One final comment for today. The trading today has the look of an “ending diagonal” which may be ending (or has already ended at SPX 1137). A break above 1151 would appear to confirm that and suggest a test of SPX 1158-1160.

What good news just happened?

RichE – maybe AussieJS covered his short positions and went long.

The battle now should be between the bulls & bears to see if the bulls can close the day above the lower “flag” trendline or if the bears close trading at or near the day’s low and hold short overnight

no just woke up—this looks like normal opts ex action

big hedgie market makers like to have a few runs at a strike before moving on

there are a lot of puts out there so a little sideways/up would not suprise

but what would give a added boost was if the german dax has bottomed–its fallen 2/3rds of 09 dead cat bounce–tonite gave a doji bottom

the dax controls the ndx

So the last hour isn’t news related?

AussieJS – thanks for your insight on the DAX. I’m looking at the weekly DAX chart. From 7500, it sure does look like 5 clean waves down, so a bounce of some fair size could be ahead.

I guess I’ll have to get another monitor.

aussieJS – and by the way, weekly RSI in deep oversold area with MACD looking overdone to downside as well.

Geez, that’s from S2 to R3.

apparently the rumour today was italy asked china to buy its bonds

what has that awesome dead cat been up to now

Awesome’s been breathing helium.

I’m sorry, but Chinese wearing Italian suits?

See ya’ll tomorrow.