Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

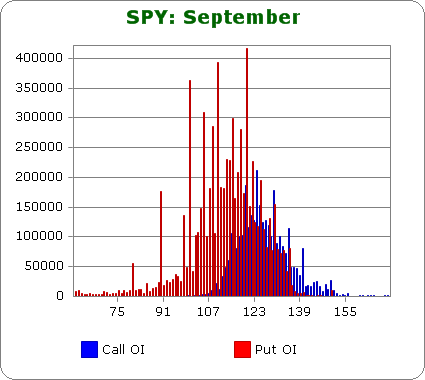

SPY (closed 116.67)

Puts out-number calls 2.3-to-1.0 – about the same as last month.

Call OI is highest at 115 and then between 118 and 132.

Put OI is highest below 125 and as you can see, there are several huge spikes at what seems to be random strikes.

There’s some crossover between 118 & 125, but since puts far out-number calls, let’s focus on those. A close in the upper half the overlap (122-124 area) is needed, and with today’s close at 116.67, much work is needed. As of now, most of the call buyers will lose everything. The put buyers on the other hand will ring the cash register this month. If the market wants to cause the most number of traders to lose the most amount of money, it’ll need to rally a bunch the next 4 days.

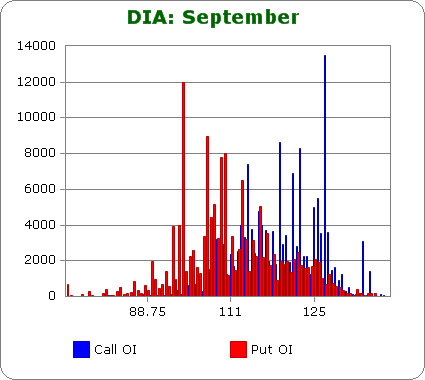

DIA (closed 110.51)

Puts and calls are about equal – same as last month.

There isn’t much rhyme or reason here…spikes at random strikes with no flow or pattern. These numbers don’t matter anyways because the open-interest is so low. As a comparison, high OI for SPY is several hundred thousand. High OI for DIA is 10K. Saying DIA is just as important as SPY is like saying a tiny stock is as important as GOOG.

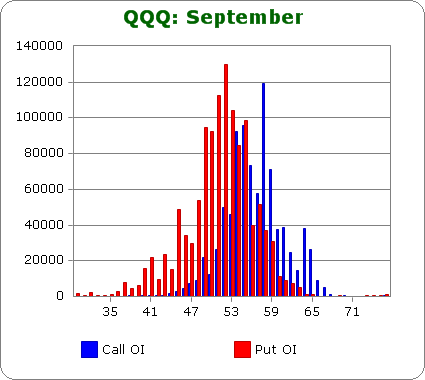

QQQ (closed 53.86)

Puts out-number calls 1.4-to-1.0 – about the same as last month.

Call OI is highest between 52 & 59.

Put OI is highest between 49 & 55.

There’s some overlap between 52 & 55, but since puts out-number calls, a close near the top of that range is needed to cause the most pain. With today’s close at 53.86, closing here would cause some pain, but a slight move up would cause more.

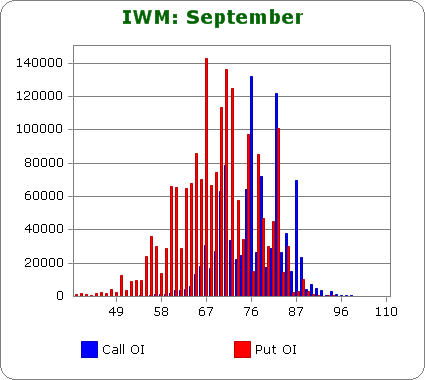

IWM (closed 68.08)

Puts out-number calls 2.7-to-1.0 – more bearish than last month.

Call OI sporadic. There are spikes at 71, 76, 78, 83 & 87.

Put OI: there are spikes at 75, 77, 79 & 83, but the bulk of the OI is below at 72 and below.

Since puts dominate calls, let’s focus on those. IWM closed at 68.08 today, so a big move up (to at least get close to 72) is needed to cause lots of pain.

Overall Conclusion: The situation this month is the same as last month…absent a huge rally over the next 4 days, the put buyers will once again cash in. QQQ says only a small move up is needed, but SPY and IWM – where most of the volume is – says a small move is not enough. We need a full blown rally. How likely is a rally? Well, I’d say a big rally is just as likely as a big sell-off on a short term basis. The biggest rallies always happen within downtrends, and even if you have a short term memory, you know we’ve had a couple very quick and sudden rallies the last month. Be on your toes.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

We got a nice technical bounce today. I say the bears reap a nice harvest this month. That said I don’t think the market has much downside left and I am buying the dips.

Jason , I’ve been doing alright selling out of the money puts on big down days and out of the money calls on big up days , less of the calls though. I think that the market needs a total washout but I don’t think that the big guys pulling the strings will allow it to happen , the stock market is the only thing that the economy has going for it

I agree that it’s the last straw…everything else has crumbled…at least people have the bulk of their 401k’s in tact.

Great analysis and fascinating. Will you be updating at all this week? For instance, we have risen on the SPY to 119.37 now.

Thank you.

I’m impressed, it works. Can you maybe help us with some source for ETF’s option chain historical data, for backtesting purposes?