Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed and for a change were relatively quiet. Europe is currently mixed; Germany is up 1.4%. Futures here in the States are all over the place. They were flat…then they dropped vertically…now they’re climbing back. There’ll be much more movement between the time I write this and the opening bell.

From a trading perspective yesterday was a tricky day for the bears. The short term trend was down, and the indexes had closed right at support. Ideally you’d want a flat open or perhaps a gap up open. Instead we got an emotionally based gap down which opened many stocks below support. This is the worst case scenario because, with the S&P down about 60 off the previous week’s high, it’s tough to chase shorts to the downside. If you chase and the market bounces, you got a horrible entry. If you don’t chase and the market falls apart, you sit and watch. At the end of the day, the indexes plus many stocks charts had taken out support, but thanks to a late-day rally, they closed either above support or right at support. The “textbook” says a trendline must be taken out by 3% to be confirmed. Not only did we not get that, in most cases we didn’t even get a close below support. The jury is out. The overall trend is down, and I’m confident lower prices will be seen, but short term anything goes. We’ve alreay seen the S&P rally hard a couple times the last month; it could happen again.

Several groups I highlighted over the weekend did well yesterday.

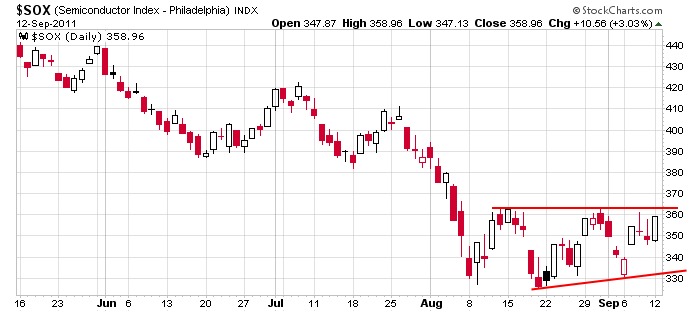

Semis being one have upside potential to around 390 before running into the next stiff resistance level (provided horizontal resistance is taken out).

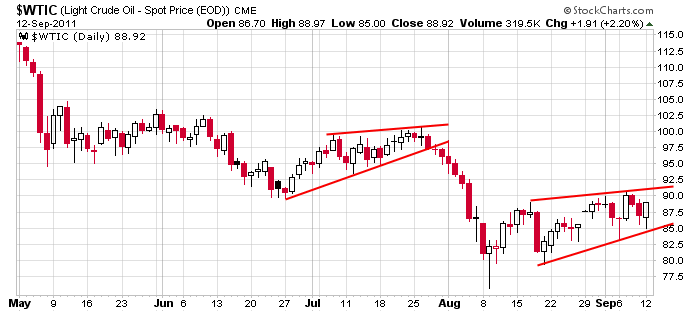

Oil also did very well. Since energy is a good % of the indexes, the bulls want the bear wedge to be invalidated.

Things are tricky right here. Support was taken out, but we didn’t get any follow through and in many cases we got a close back within the patterns. I don’t think the market just sits here. Be flexible. Be on your toes.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 13)”

Leave a Reply

You must be logged in to post a comment.

sure is opts ex time —we have completed a abc already with preopen

will we repeat it when cash opens

ESZ1: Long @ 1155.25 stop 1155.75

YC is acting as resistance, 9:15 dippy was bought, It’s currently bullish, I think.

I don’t know what to think right now. I’ll wait

another hour or so til Zen comes in with his

extemporaneous – teachings – thoughts or was

Zen banned from this website? HW

I think “I’ll be back” is waiting for DOW 12,000.

Waiting is Tao.

ESZ1: short

Maybe I’ll get to break-even and maybe I’ll learn to wait.

RichE: today, much like yesterday, appears to be

shaping up like a whipsaw day. The stock that

Cramer is in love with, JNJ is only up 2 cents

last time I checked. If I had to take a stab at

it I’d say they they run it up +100 points towards

the end of trading today and then I may hold a

small short position overnight. Right now I’ll go

to my AA meeting and reevaluate later on in the day.

Thanks. I just need to grow-up, settle down, and learn to be wise person.

Your girlfriend is affecting you in more ways than one.

She wants to marry a husband with his two feet on the

ground, not a whacky EWaver who’s counting waves in

his sleep….eerrr…I mean sheep. HW

its 2 choppy ,even for robots

will quiten down after europe closes

the dax bouncing of bottom has had quite a effect on ndx

weakest for shorts is dji/ftse

spx looks like trending

its pos the small corrective is over and soon impulsive down

today the big boys are rolling over their opts

AussieJS – I almost always pick up something constructive from others and your comments on the DAX yesterday & today are examples. I think the DAX has plenty of room to run higher and I think SPX does as well. Your comments have me leaning to the DAX being the leader here.

Today’s pullback in SPX appears to me to be more corrective than impulsive so far and I’m looking to see if the SPX 1150 area holds up. If it does, I think we can see a renewed move up to higher levels on this rally from yesterday’s low to the SPX 1185 area and possibly higher to retest the 1200 area. If that happens, I believe it will provide an ideal longer term shorting opportunity.

If that happens I hope it keeps going up.

there is no real buying in usa ,where as with the dax its coming of a big down bottom

my tick ind is giving extreme extrems every hour–this means the instos are selling into strength–well they are holding price at a certain strike whilst they deal with the opts

in other words there is a pump /dump going on–instos roll over up to 1 week out only retailers hold opts to the last minute—thats if they dont get called up or put down

this will all be over in a day or so—so i dont see another move up

infact the dji may be starting a inpulsive down from todays high

but ill trade it as it comes

thats negative extremes—-minus 1500 and above

I was just feeling sorry for everyone with a 401K.

Thanks for the insight. I think we both are looking at the same thing today, i.e. how is today’s sell off is taking place – correctively or impulsively? It’s OK that we may see it differently as long as we’re clear. For others who may be viewing our comments, I think that we agree on the bigger picture, i.e. we’re going down -from current levels or from higher levels and the idea is to get short at a low risk place.

After all that I’m short and ahead.

EZU1: 1 day/1 minute chart is so looking like a lopsided HS.

At this point, I’m inclined to view yesterday’s rally as impulsive and today’s action as corrective off the move up from yesterday’s low. SPX 1180-1195 looks to be a reasonable target with 1195 of particular interest. A breakdown below 1162 FIRST from today’s high would probably change my thinking and suggest the rally may be over at whatever today’s high is.

From an EW perspective, yesterday was 5 waves up, today is an evolving (or completed) corrective pattern and I’m looking for another 5 wave pattern (or ending diagonal)to complete a larger (5-3-5) ABC 3 wave advance from yesterday’s low to end this rally in the 1180-1195 area. Regardless of what happens, it’s now time to watch for a shorting opportunity, in my opinon, and not get too obsessed with counting wave structures. If the DAILY MACD has a negative crossover, that will confirm for me a resumption the bear market, EW analysis not withstanding.

I’m thinking that once we have an end to this rally that began yesterday, we should see a dramatic accelerated move beginning to the downside. The move down in the last half hour doesn’t fit that description so far in my mind. Shorting in here is for scalpers only, in my opinion.

Hi Pete

just woke up—dont know if u will get to view this

i was counting y/days high,then todays preopen sellof ,as europe went to test y/days lows

and then back up to new highs as a ABC ,with this leg up as C when it completes ,which may be now

thats on the 24 hour futures chart as cash is only a derivitive of the futures

hope that clears up what i was looking at