Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Taiwan rallied over 2%; Australia, India, Japan, Singapore and South Korea gained more than 1%. Europe is posting solid across-the-board gains. France, Germany, Stockholm and London are up more than 2%. Futures here in the States point towards a positive open for the cash market.

The big news out overnight is that Greece won’t be defaulting on their debt any time soon. They’ll receive rescue funds as part of a bailout. Considering this news, one would think futures here in the States would be up more than they are. Perhaps we know from our own financial crisis that kicking the can down the road doesn’t solve the problem, it just delays it. Greece will need more bailout funds again, and there are other countries following in Greece’s footsteps.

News out of Switzerland is that a rogue trader has caused the bank to lose $2 billion. Unless UBS has to unwind positions, this shouldn’t affect the rest of the market.

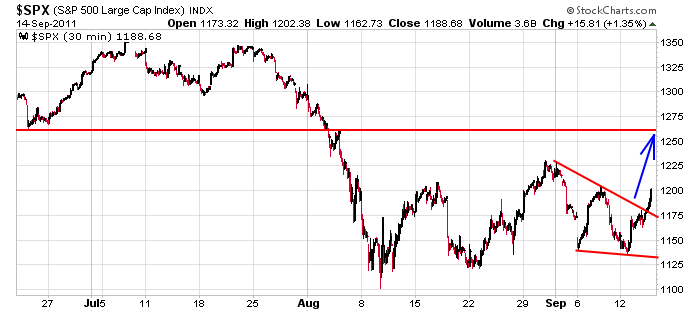

I’ve seen significant improvement from individual stocks the last couple days. That doesn’t mean the bulls can get complacent, it just means they can relax a little because the market isn’t sitting on the edge of a cliff. We entered the week with many charts sitting on support and Europe being down big. After weakness most of Monday, the market has rallied nicely. Once again a disaster has been averted…or delayed. The range continues. The S&P is unchanged over the last 6 weeks, so despite all the bad news, you have to admit the market has done a pretty good job absorbing and digesting an unfavorable situation. Here’s an update of the bull wedge drawn on the 30-min chart. It has positive implications but will not have a smooth ride up. Yesterday, the index was rejected by last week’s high near 1200, and even when/if that’s taken out, 1230 will bring some sellers to the table.

I’m still of the opinion we need to be ahead of the curve taking profits because the current trading environment is better suited for day traders than swing traders. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 15)”

Leave a Reply

You must be logged in to post a comment.

Let’s not get too far ahead of ourselves. When this market is

ready to go down again it will catch everybody by surprise

and move down in dramatic form. I am already hearing stuff

out of Europe that will put us into shock and awe mode

over the weekend. Not too sure what they meant by that,

maybe it’s another slow news day or an effort to shake

out some more bulls, bears, pigs, cats gruesome and

awesome, whatever. HW

Attn: PeteM Yesterday you mentioned the fact that S&P should stall

out somewhere in the area of 1208-1211. However, Jason is insistent

upon the fact that we run it up into the 1260 area. Comments please. HW

Neal, if you are still drinking from last night I can understand your point.

If it weren’t for spell check your cryptic message would be totally unable

to be read. Hopefully, you’ll sober up by the time you come into New York City

to see Cramer live at the 92nd Street Y.org in the Fall.

pump and dump opts ex

world central banks are buying the euro in a corelated atempt to save the world

sir tim is bailing out europe—give him enough rope and he will take up knitting

this could be a short experiance

Dax is up, it suggests that if it is still up at its close today, the US market will follow. Long calls on NDX. Just a scalp, but staying alive.

The European Central Bank & the FED (according to Bloomberg) made an “historiic” decision to coordinate their policy and create further “liquidity” for the major banks in order to “assure” the large Euro Banks will be well capitalized (at least for now). Folks, these guys don’t seem to understand that when you’re in a hole the first thing to do is stop digging! I’ll repeat, we don’t have a “liquidity” problem – we have a “solvency” problem. The solution is to restructure debt, and not to continue to keep the creditors “solvent” at taxpayer expense. I’ll get off my soap box now.

Howard – today’s news seems to bolster Jason’s technical analysis and raises the probability that the SPX may test the 200 day EMA at SPX 1250. However, this morning’s early morning rally (in spite of poor U.S. economic news)should be watched carefully. This could be a knee jerk reaction that fades as the day wears on. I’d look for a FRI close above 1211 (80 week SMA)as signal that 1250 is the next target. AussieJS’s emphasis on the DAX & Euro$ is on the mark as they both have room to run up from oversold. When their rally hits resistance, it’s time to pay attention. In the meantime, we’ll have a chance to get long term short at higher levels. My compliments to Jason for his analysis. We learn from each other!

res on euro is 1.3900—to 13970

we are their now

but the rouge traders will fix that

“I love the smell of napalm in the morning” Looks like it’ll be a two monitor day.

I think we need a word that means, “Kick the can down the road”

ESZ1: the 9:30 crowd is selling.

nah thats just me going long dax short es

but my time limit is 10 minutes

high noon is when the euroland after hours traders leave after the cash closes at 11.30

“do not forsake me -oh my euroland”

there u are i just sang a song

dax is only one i will go long–dji short –spx looks like it has hit the market makers price for fri opts –1200–strike—they have a little room to move it up or down before fri open

they are talking about alpha portfolios on bloomberg ,Neal

ESZ1: I think it’s touching bottom, covering shorts.

Just do it Neal. Stop talking about it and start doing it. You know you want to be a Day Trader.

markets are deadly quite for this time of day

am flat and will watch a movie one t.v and wait with one eye on my screans

Early lunch.

AussieJS – If we’re watching Euro Land as leading indicator, would you target 140 as upside target for Euro$ and/or 6000+/- for DAX upside target?

spot on Pete,

dax closed at 5508 –but futures currently at 5575–likly to open tomorrow at 5800

if so ndx would be about 2300–have to see how they handle opts ex—remember both ndx100 and dax in wave 2 ups–the only ones im aware of apart from pos aussie axjo

euro is hard to say with every one rushing to buy euros -china/japan usa and all the asian countries to stop usd going up–inflation??–about 140 top imo

ESZ1: Short because I’m bored.

a close at these levels is very bearish and will ensure a melt down for opts ex tomorrow

remember the insto hedgies are only interested in the open for the index futures

i may be able to resueme my bearish tendencies