Good morning. Happy Friday. Happy Quad Witching Day.

The Asian/Pacific markets closed with across-the-board gains. South Korea rallied almost 4%, and Japan and Taiwan moved up better than 2%. Europe is currently mostly up. Germany is the sole 1% winner. Futures here in the States point towards a moderate gap down for the cash market.

NFLX is getting crushed in pre market trading. Some of the losses are due to them losing many customers after they raised prices a few months ago, but it’s also due to competition. The technology to stream video is well within the grasp of many tech companies. Funny how business works. When NFLX only physically mailed out DVDs, nobody wanted to get into the business, but as soon as they started streaming video, they attracted competition. Cannibalizing their own business (which is absolutely necessary) has had unintended consequences.

RIMM is also getting hit hard before the open. No surprise there either. Funny how tech works. You’re a leader one day, and then a revolutionary change is made (as opposed to an incremental evolutionary change), and you get crushed. Every tech company out there needs to pay attention. No position is safe.

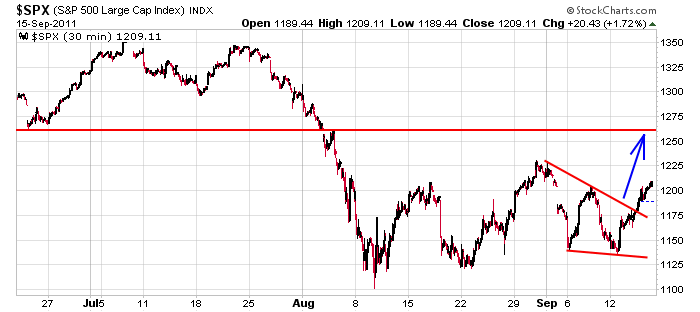

The market…we’re in a 4-day win streak – the longest since June. The bearish rectangles forming on the indexes are in tact, but they’re in the process of getting timed out because they’re too big. These patterns will morph into something else – perhaps just a range. The S&P has closed above last week’s high (albeit not by much), but there’s still work to be done. The mid August high is just overhead and of course the late Aug high near 1230. Here’s the 30-min chart. I still consider the falling wedge to be in play.

Today is quad witching. I think these days are over-rated. Traders have had plenty of time to square off positions, but you never know. An end of day run is not out of the question if traders start positioning themselves for the next option or futures cycles. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 16)”

Leave a Reply

You must be logged in to post a comment.

Before the Bell shopping, looks staged to me.

as long as we dont go to much outside y/day high the bears will be happy

a start at the top and a slow grind down would be ideal with most of the work done already by the bigboys in the week leading up to the 4 witches

hopefully a boring day

Looking for a pullback day perhaps an opportunity to add in. Many leaders AAPL BIDU AZO ISRG JAZZ etc have already put in a strong run.

We find out by next week if this is a range bound sideways market or a complex triple bottom with a repeat of the Sept 2009 and on bull run.

Good Luck

cash markets basicly stalled at or just above R1 piviot,for a pos false break high

does a tommato have emotions

does a coin have a structure or memory

of course or they would not exist

but who creates the memory

i talk to the tress and have 2 dead cats–gruesome and awesome

Looks like a LOWER-HIGH in the making.

the trees told me this is a bear market

but my dead cats said they may do some bouncing with usa/china bailing out europe and a europe tarp

i say down with the banks we want honesty

but could we stand the truth

im short from todays dead cat bounce–for how long –who knows

Looks as though SPX is flirting with 50 day EMA today. A weekly close above 80 week EMA (1211) may put 200 day EMA at 1250 in play as per Jason’s wedge target area.

Raymond makes an interesting comment (please comment more often) regarding next week. From an EW perspective, this may be a complex “double zig-zag” (ABC X ABC pattern) evolving or a “triangle” pattern which are both corrective. As Raymond commented, next week may help determine if what we’re seeing is not corrective (my opinon) but something more bullish suggesting a resumption of the 2009 bull market.

I agree with Jason, i.e. it’s a daytraders domain for now and not a swing or longer term trading enivronment at the moment.

i am going with a normal false break high opts ex and have married my worldly short positions

and am going to have a cat nap

ESZ1: Lower-highs and higher-lows >>>Doji 1200 close.

We appear to be breaking out to the upside from a small triangle pattern that formed today. The target based on standard measurement would be SPX 1230.