Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed down across the board. Hong Kong and Indonesia dropped more than 2%. Several other indexes lost more than 1%. Europe is currently suffering stiff losses. Austria, Belgium, France, Germany and Amsterdam are down more than 2%. Futures here in the States point towards a large gap down for the cash market.

I don’t have anything to add to my weekend report. Last week was a decent week; it was nice to see the semis do so well, but the market is hardly in bull mode. Several indicators moved up but not to the degree one would expect considering the 5 straight up days. Banks did relatively well but are still lagging, and it’s a concern copper and oil did not participate in the rally.

In my opinion the indexes are range bound, so we still need to be ahead of the curve taking profits. That means you can’t just put a stop below a recent low and let positions run their courses. Instead it’s better to exit when you can, not when the market pulls back and forces your hand.

The dollar is up 0.8% – that’s not helping things this morning…the market likes a weak dollar.

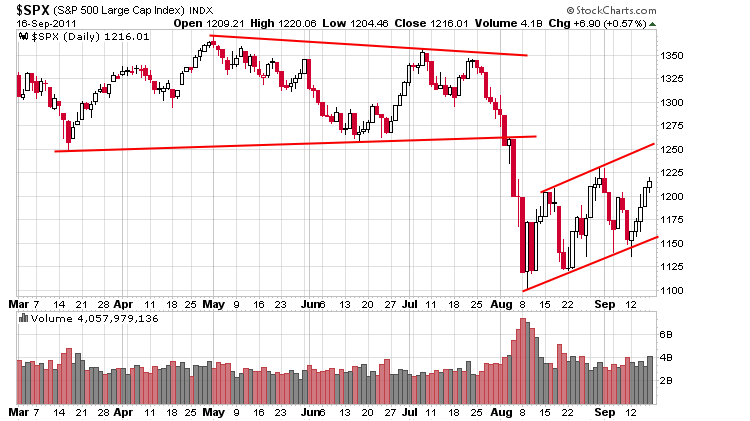

Here’s the SPX daily. The overall trend remains down. Last week’s move was nothing more than a bounce within a 5-week range (perhaps to piss off option buyers who were positioned to profit from weaker prices).

Be conservative out there. This isn’t a time for big bets. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 19)”

Leave a Reply

You must be logged in to post a comment.

Same question from last week: What does Warren Buffet and PeteM have in common

with each other? a. they are both on Ben Bernanke’s payroll. So now Obama named

a new millionaire’s tax after Warrent Buffet, maybe Ben & Jerry’s ice cream

will name a new flavor after PeteM, ‘double bottom scoop’ Don’t stop until

the market drops 1700 Dow points and you finish all of your PeteM ice cream.

Same answer as last week, Quality Control.

I’m going to change my answer, “Who cares”.

Hi Howard,

Great comments – sentiment shared by many but ignored by those in the decision making arena. I throw my hands up in desperation more often than not.

I love Jason’s work – otherwise I wouldn’t receive his alerts. I regard it as mandatory reading.

Our last trade closed out with a 297 DOW point profit. I hope you were in on that trade.

No more alerts at present but looking like one coming up. We have passed the quarterly options expiry rubbish but Jason will have more insights in store.

Happy trading.

Elizabeth

you should post more often,Elizabeth

Looks like the European River Cruise market is scrambling.

Single supplement waived! Offer applies to select 2011 Europe departures in certain cabin categories.

Why don’t you post the Pivot Points? Make that your daily contribution to the group.

“…said the spider to the fly” Neal, I don’t trust you. Post your pivots here and prove your point.

Thanks Neal, I’m looking forward to understanding your trading style.

You don’t need to know where I live and I think Howard is your Sybil.

P.S. It doesn’t matter what you’ve done, unless you want a medal. What matters is what you can do.

I only day trade the ES. Currently short.

How would you know what baby Jesus was like?

extrasensory perception or extra short

Good one Aus!

Black and white or color?

The current month.

Are you serious? I’m surprised you don’t know what the ES is.

Thanks. Post your comments also. An EOD swing trader would need to know the probability of a reversal. As a day trader I’d like the pivots to predict High and Low and will the High be before first or second.

piviots are big boy suport/res and very usefull ,especially on ES

Retailers use minior major s/r and draw lines on charts

retailers are important too–but not as much as instos

Aussie (and anyone else with knowledge of the following),

I trade the ES typically using a 4 minute chart and a few other things.

Below is from a website on the internet that shows how to calculate pivot points.

They seem to be based on a Day Chart versus a minute, tick or volume chart. Can anyone tell me if they also work for 20000 volume charts or 4 minute charts, etc on the ES?

I can see their use on a Daily Chart, but otherwise…

Thanks in advance for any comments.

How to Calculate Pivot Points

There are several different methods for calculating pivot points, the most common of which is the five-point system. This system uses the previous day’s high, low and close, along with two support levels and two resistance levels (totaling five price points) to derive a pivot point. The equations are as follows:

R2 = P + (H – L) = P + (R1 – S1)

R1 = (P x 2) – L

P = (H + L + C) / 3

S1 = (P x 2) – H

S2 = P – (H – L) = P – (R1 – S1)

Here, “S” represents the support levels, “R” the resistance levels and “P” the pivot point. High, low and close are represented by the “H”, “L” and “C” respectively. Note that the high, low and close in 24-hour markets (such as forex) are often calculated using New York closing time (4pm EST) on a 24-hour cycle. Limited markets (such as the NYSE) simply use the high, low and close from the day’s standard trading hours.

Neal, you should be the one posting the virtues of and how to use PP, not Aus. No offence Aus.

“In my opinion the indexes are range bound”

I agree to a point. I do believe we are due to a few days of profit taking. Had we gaped up this morning all of my mathematical models would have indicated a 5-7 day sell off. That did not happen. Now my models are telling me nothing. I think it is time to ride the pine until the pitcher starts throwing my pitches.