Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. India moved up 2.1%; Japan moved down 1.6% – those were the only 1% movers. Europe is up across the board. Germany is up 2.2%; several other indexes are up better than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

Yesterday morning was a reminder that when the market is range bound, it’s better to be proactively ahead of the curve taking profits rather than passively trailing stops behind positions. Then yesterday afternoon was a reminder the market is still very much being held hostage to what happens in Europe. Does Greece default – yes or no? Hence the market presents a great day trading environment but not a swing trading environment.

Longer term I still believe a top has been put in place and a downtrend underway. We are after all trading in a bear flag beneath intermediate and long term support.

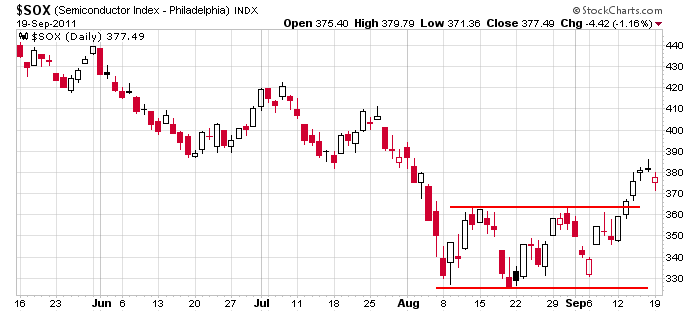

The Good: Semis have done well lately.

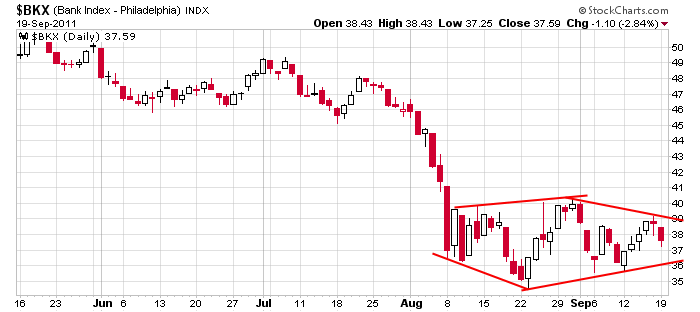

The Neutral: Banks are range bound. Any rally without the banks will be short lived.

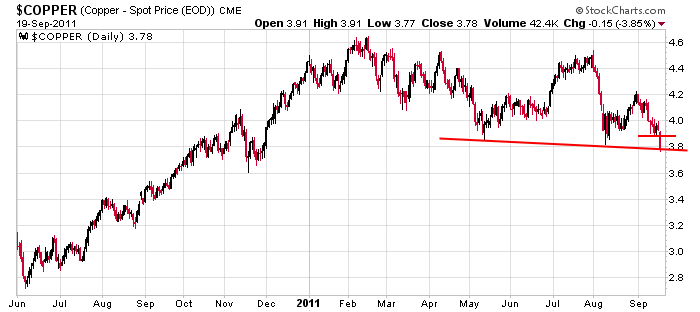

The Bad: Copper is breaking down.

Be conservative. The near term is cloudy and tomorrow in an FOMC day.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 20)”

Leave a Reply

You must be logged in to post a comment.

Sometimes I should listen to my own advice (which I never do).

On Friday I said to myself be on high alert for whipsaw action

until the Fed meets, and that’s exactly what we’ve got. I should

have taken profits yesterday when the market was down 250 points

but if anything at all I have just trimmed my postions in the

premarket: Went flat on 500 shares of SPXU@17.20 HW

Nah, Jews for Buddha is where it’s at.

Sorry you decided not to be an oarsman. Was looking forward to a practical application of your academic knowledge.

ESZ1: Straddle time. I think it’s going down a wee bit.

darn you cut Howard’s most interesting thought’s, so insightful this guy !

I don’t remember Howard saying the market was going down before it did, matter of fact only one person did, wonder why that is ?

Sorry Howard, I was referring to Neal.