Good morning. Happy Tuesday.

The Asian/Pacific markets closed with huge across-the-board gains. South Korea gained 5%; Hong Kong and Indonesia better than 4%; Australia and Taiwan more than 3%. Europe is currently posting solid gains led by France and Germany which are up more than 4%. Futures here in the States point towards a large gap up open for the cash market.

We entered this week with the trend being down but it being too late to go short. Many of our short set ups had already broken down and hit their first targets, so it was wise to wait for either little flag patterns to form or a bounce to materialize. It looks like we’re getting a bounce. Don’t fight it and don’t be surprised by it. This is the fourth time in less than two months it looked like the market was doomed but instead the bulls stepped up and defended their turf. If you’re bullish, this lets you breathe a little. If you’re bearish, you get to short at higher prices. No one should be frustrated with a bounce.

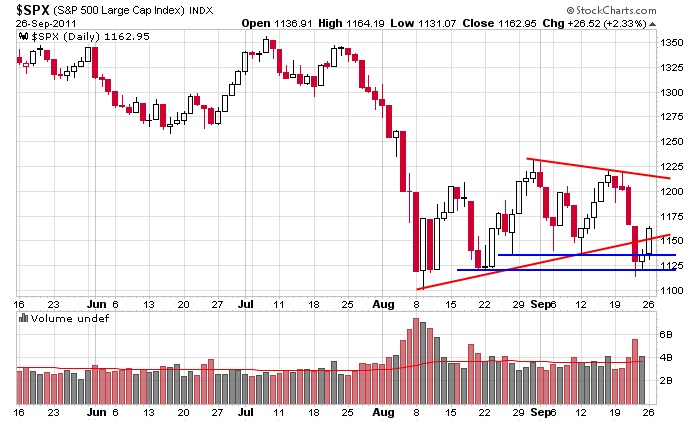

Here’s the S&P daily. The slanted support line was taken out last week as was the Sept low. Allowing for a little wiggle room, the Aug 22 low has held. Overall I’d consider this to be a distribution pattern within a downtrend which should resolve down, the direction of the trend. But as I’ve stated, triangle patterns are tricky because even after support gets taken out, there are lows from within the pattern which can bring buyers to the table.

I’m looking to short this bounce…hopefully it’s a big one. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 27)”

Leave a Reply

You must be logged in to post a comment.

Hi Jason,

Excellent bounce off support for us here in OZ. I don’t think it will be long lived but I’m trading the trade so to speak.

So far Dow futures have penetrated the 50% Fib level of the last sideways run so it will be interesting to see if that level can be sustained. We all know how crucial the 50% level is.

I’m already in profit almost 100 points on my Aussie 200 trade and 198 on my DOW futures trade so at $100 per point move I’m a very happy trader at $28,900 profit.

Off to bed now in Oz land with stops in place. Good luck overnight.

Elizabeth

http://www.theecmethod.com

People from Oz land have a tendency to lie. HW

Be nice Howard.

those are not uncommon results using cfd’s Howard

but Elizabeth is a better trader than myself

Elizabeth goes long when indicated

i sleep when the bulls come out and only short after they have had a run

WOW! We’re above SPX 1180 (a .618 retracement level) and have an opportunity to short at higher levels than I expected at this time yesterday. Apparently the overdone bearish sentiment that has concerned me led to this short covering squeeze.

While I had planned to short into a 1167 gap fill, the before U.S. opening futures prices made me want to wait for the opeining before making a decision. With the 50 day SMA at 1205 and dropping, the 80 week SMA at 1212 and chart resistance at 1190-1200, I’m going to wait for those levels to be tested OR a reliable reversal pattern to develop (whichever occurs first) before taking a 1/3 longer term sort position.

ESZ1: The 10:AM 1 minute bar is interesting. Maybe reversing.

Grabbed a small position in SDS @ 23.30 in the pre-market today.

The 2x funds do not erode, but I read on another blog that the

3x funds are so highly leveraged that they have a deliterious

effect to them if held for any length of time. HW

ESZ1 1d1m chart: Looks like a W pattern undertaking the upside.

The Rorschach Trader, I think this W pattern is morphing into a bear flag. Anemic volume.

RichE: In this whipsaw market with all kinds of Alpha trading

going on the 1min and 5min chart is a bit of a dinosaur. Now

I come to rely upon the 30min and 60min charts for better

ideas how to trade. Tonight, after the close, try it and

you’ll see what I’m talking about. HW

Howard – I usually don’t look at 1, 5, 15 min charts either, unless I’m trying to find a point to buy or sell because the longer term picture suggests a trading opportunity. Please take a look at the 1, 3, & 5 min SPX charts today and note the possible triangle formation that’s resolving in a breakout to the upside (as would be expected). If you believe, as I do, that we’re in the zone of resistance for a potential longer term shorting opportunity, the triangle may precede the last move up into this resistance area. I’m looking for signs of a failure coming out of this move up out of the triangle. Since I’m targeting 1190 and above now to initiate 1/3 of a short position, I at least have the parameters, size of position, and stop loss strategy to guide me in keeping with a risk/reward approach to trading.

Thanks Howard, I have tried and I’m more comfortable on a 1 minute guessing Overbought and Oversold. I’ve found the perspective is not the minutes, but ascertaining the reversal probability. In that vein it doesn’t matter the time frame, “caveat” there’s always drawdown to consider.

PeteM, Please keep posting your support and resistance. They’re better’n Pivot Points.

RichE – As we know, patterns can evolve into differnt patterns. Please take a look at the SPX 5 min chart. You’ll note what appears to be an early morning triangle that broke out to the upside but without follow through. Now, we may be seeing an evolving wedge (diagonal), which again, is often seen at the end of a move. This pattern, if I’m correct,is an EW “ending diagonal” pattern and it (I’ll say it again) comes in the area of longer term chart resistance. What I’m looking for now is the sign of a meaningful reversal with some confirmation for the potential for lower prices. I’m short a 1/3 position just above 1190 but I have no inclination to add to it until I see some weakness beyond normal pullback action.

Ditto! Looking for signs of a top.

P.S. I don’t get triangles and wedges, working on it. I focus on volume, long tails and long nicks, lower-highs and higher-lows.

ESZ1: Short! Volume don’t lie.

Got that one wrong. Oh, well!

I’m keeping an eye on SPX 1187 to see if there’s a break through to the downside that can extend to 1182.

ESZ1: The 1187 has been touched twice today along with 1181 which is being tested now.

The 12:51pm bar looks bearish.

If the “wedge/ending diagonal” pattern is complete, I can see 5 waves down on the 3 & 5 min charts completed now with rallies to between 1189-1191, after which we should break down with more force through 1187 and test 1182. At that point, we have to see continued weakness in rally attempts. But, first we have to see 1189-1191 as rejection.

I agree, it looks like it’s setting up to run at (test) 1200 tomorrow. Then it’s a question of US earnings, European debt, and China growth.

Later, The oiler’s broken on my chainsaw. Got to split the case and replace the tube. It’s a 14″ Chraftsman Farmboy

I’ve been able to get another 1/3 position on the short side just above SPX 1190 but I’m putting a stop loss on both positions just above today’s high.

The best laid plans of mice and men…. And that’s why I stick to a discipline of limiting my losses. Anyway, I’m still looking in this zone of anticipated resistance for a selling opportunity and I’ve not given up on the idea that a wedge/ending diagonal is still a possibility within the context of a distribution pattern occuring in this area.

If anyone is familiar with the works of PQ Wall he developed the “3 peaks & a dome” pattern as a topping formation and sign of distribution. I’m leaving open the idea that we may be seeing that on a small time frame. Of course, we could be on our way to who knows where on the upside.

Howard – do I want to “fa-getta bout it” (the short side) until next week?

just woke up –the last hour could be down

but the mutuals are still trying to manipulate their end month lier books

maybe they sell the junk now

Geez! Timing is everything, as they say. I’ve dipped my toe in again for 1/3 short position at the break down through SPX 1187.50 with a breakeven stop loss at 1187 now that we’re down through 1182. No sense lamenting about earler positions at 1190 that were stopped out just above 1193. It looks impulsive so far on the downside so I’d think about adding on a failed rally around 1182.

u can short the world now–gruesome and awesome -my dead cats have retired on the obarma lay away pension plans

AussieJS – I didn’t short the world, but I put on another 1/3 position at SPX 1180 when 1182 proved to be resistance on a bounce. It would have been nice to be short at 1190 as I was earlier today but I never thought I would see 1180 either at this time yesterday, so I can’t complain. I agree with you that we’re getting closer and closer to concerted downside action in all “risk” assets. In that regard, I have my clients buying Treasury ETFs on 30 yr above 3% & 10 yr at 2%. Before this over the 30 yr can test 2% & the 10 yr can test 1 to 1.5%, in my opinon