Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

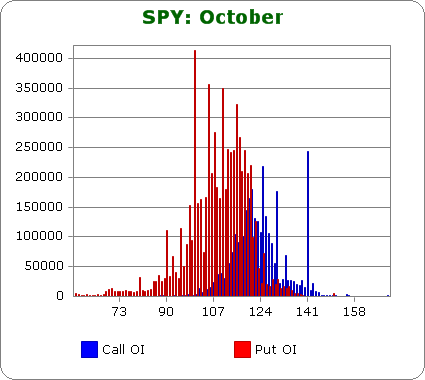

SPY (closed 120.23)

Puts out-number calls 2.4-to-1.0 – about the same as last month.

Call OI is highest between about 118 and 127, and there’s a huge spike at 141.

Put OI is highest between about 98 and 122.

There’s some overlap between 118 and 122, and with today’s close at 120.23, lots of pain will be felt by both call and put buyers. Flat trading the rest of the week will expire most options worthless, but since puts far out-number calls, a slight move up will cause even more pain.

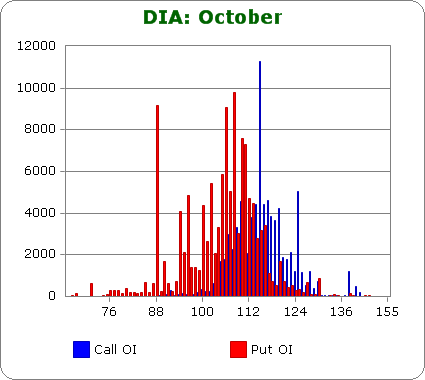

DIA (closed 113.90)

Puts out-number calls 1.3-to-1.0 – slightly worse than last month.

Call OI is highest between about 114 and 120, and there’s a spike at 125.

Put OI is highest between 105 and 115.

There’s some overlap around 114/115, and with today’s close at 113.90, DIA is already positioned to cause maximum pain. Hence flat trading is needed. But as I’ve stated numerous times in previoud reports, the OI is so low compared to SPY, it’s hardly worth looking at.

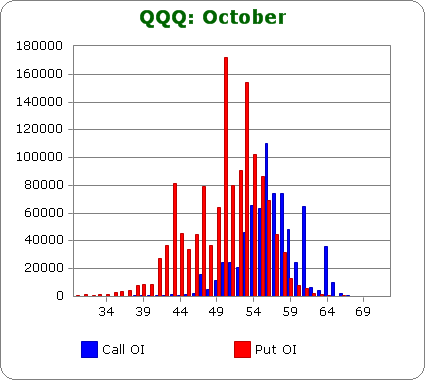

QQQ (closed 57.28)

Puts out-number calls 1.9-to-1.0 – more bearish than last month.

Call OI is highest between about 54 and 58.

Put OI is highest about 47 and 56.

There’s some overlap between 54 and 56. With today’s close at 57.28, at first glance, QQQ is slightly higher than it needs to be to cause max pain, but when you consider puts far out-number calls, QQQ needs to close slightly higher than the overlap. Flat trading the rest of the week is what’s needed to accomplish the mission of expiring most optins worthless.

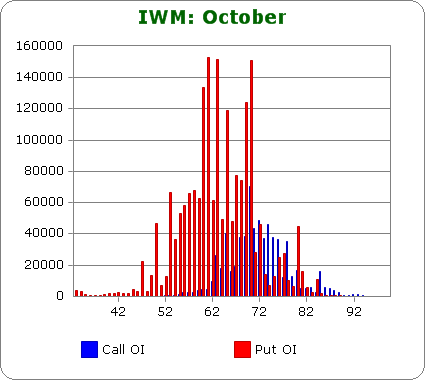

IWM (closed 68.98)

Puts out-number calls 2.5-to-1.0 – slightly less bearish than last month.

Call OI is highest between about 68 and 74.

Put OI is highest between about 57 and 70.

There’s some overlap between 68 and 70, and with today’s close at 68.98, IWM is already positioned to cause lots of pain. So flat trading or a slight move up the rest of the week would do the trick.

Overall Conclusion: Thanks to the rally that has taken place the last two weeks, the market is positioned to cause lots of pain among option buyers. Flat trading the rest of the week is what’s needed to continue this. A slight move up would be fine too. This analysis of course is purely based on an invisible hand theory which says the market will mysteriously gravitate towards certainly levels. Left alone, it happens often, but news obviously can trump everything on a short term basis.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

Jason

I had a sell signal generated if we gaped up today. That did not happen. All that means is I will not be trading until I get my pitch. The P/C analysis above is the best I have seen. It says don’t play ball.

Daddy Paul does not make a lot of sense at first glance, but let’s remember

one thing these are not normal times (i.e., the new norm is now 500 point

swings in a trading day). 2) I’m still getting over the flu so any ridiculous

comments I made earlier today about the Dow closing up 22 points is only

symptomatic of the high fever I must be running. HW

Khm, I’m not an expert, so here is my question: avg. daily volume for SPX options is some 20 times higher than avg. daily SPY options volume (I admit, august 2010 data :). So, shouldn’t you focus on SPX Options?

My second question: if you do this prediction based on SPX instead of SPY (DIA…), you’ll get the direction and in next step VIX will tell you how strong this move will be?

That’s impossible.

An ATM call option on SPX for November costs $40…that means one contract will cost 4 grand.

An ATM call option for SPY for November costs about $4.30…that’s $430 for one contract.

There’s no way the volume on SPX is greater than the volume on SPY. Impossible.

http://www.theocc.com/webapps/volume-query

This is source, volume increases but the ratio stays. Is this not that simple?

And again, can’t edit 🙁

Correct link for total volume

http://www.theocc.com/webapps/onn-volume-search

Update: I’m sorry, I didn’t know SPY is traded on multiple exchanges, but looking at current data, SPX volume is still higher for October 2011:

SPX (a $50): 20070694

SPY (a $10): 85046706

Sorry again (cant’t edit comments), correct data:

SPX (a $100): 20070694

SPY (a $10): 85046706

So more than twice of the SPY volume.