Good morning. Happy Tuesday.

The Asian/Pacific markets got hit hard. Every index closed down at least 1% and a few (Australia, China, Hong Kong, Indonesia) lost more than 2%. Europe is currently down across-the-board. Austria is getting clobbered (down 4%), and Belgium, France, Amsterdam, Switzerland and London are down more than 1%. Futures here in the States point towards a negative open for the cash market, but the futures aren’t as bad as one would expect considering the overseas markets.

Oil and copper are down for the second straight day. The dollar is up.

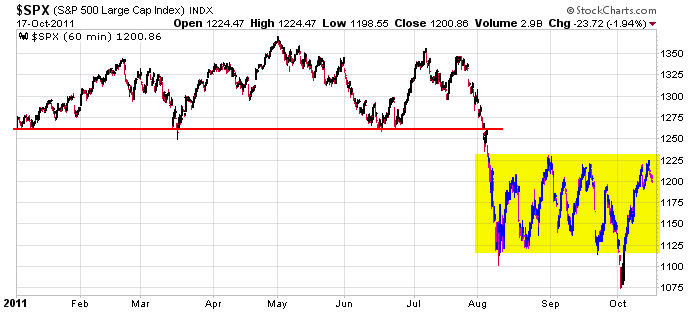

Here’s the 60-min SPX chart. Other than a brief move below the bottom of the range and a quick recapture, the index has been range bound for 11+ weeks. Rallies get sold, dips get bought. The move we got of the recent low was more impressive than any other 2-week period this year, but the market is still range bound.

During the 2-week rally, we got across-the-board improvement. The small caps had some days where they led. The heavily-weighted Nas 100 stocks did great – AAPL, AMZN, GOOG went on huge runs. The internals greatly improved. The market brushed off some negative news. It seemed like a step in the up direction, and barring bad news from Europe (or a lack of good news) I think a pullback gets bought. But this of course is a big IF. We have no control over what Europe does (or doesn’t do) or says, so although I lean to the upside right now, I am willing to abandon my view very quickly if the movement necessitates it.

Be flexible. Be open minded.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 18)”

Leave a Reply

You must be logged in to post a comment.

I agree, I think buying the next pullback is a good idea. This leg from 10/4 has a positive tone.

BTW: Zacks is up beat this morning. From Zacks {snip}

Taking Stock of the Earnings Picture

Despite some negative revisions lately, expectations for corporate earnings have held up quite decently. And contrary to some of the more exaggerated fears, we have had no unusual negative pre-announcements nor can we discern any negative trend among the handful of companies that have already reported results.

The current expectation of a roughly 10% year-over-year growth is about half of what we got in the second quarter, but it is not materially different from what was expected just ahead of the second quarter reporting season. Importantly, expectations are for earnings growth in excess of 13% for 2012. With more than two-thirds of the companies coming ahead of expectations in a ‘typical’ reporting season, I would expect the final growth tally for the third quarter to be towards the high end of the 15% to 20% range. This would be an impressive 8th consecutive quarter of double-digit earnings growth in this cycle.

50/50 split from some of the blogs that I have been following this morning. HW

From my perspective, the ability of SPX to bounce from 1191 (a support level I emphasized yesterday) this morning indicates the near term importance of that level. Having held, it appears SPX wants to test yesterday’s high but I think, on an intraday basis, it must first hold above 1207 on any pullback from current levels around 1210+/-.

Below 1191 would seem to suggest a further decline to 1168 or lower. My thinking is that it would be best for the bullish case that SPX test 1168 or lower in order to gather some support for a test off 1230 and possible higher.

Looks like fence sitting waiting for buyers. I don’t see any sellers.

I’m short and nervous at 1206.

RichE – I have a feeling short sellers are anticipating that this rally from SPX 1191 is the right shoulder of a “head & shoulders” formation on the hourly chart. I don’t know about that, as I can count a potential 5 waves up on the 15 & 30 minute charts from 1191 and that would be bullish. It’s a traders affair, perhaps just buying time into options expiration.

Back from my AA meeting. Jury is still out. I will wait for

confirmation on either side before I lose more money in

this market we call a gambling casino nowadays. Oh yeah,

Robert McHugh PhD has a turn cycle date for this Thursday.

I am now thinking out loud to myself about a double top

at 1226 to 1235ish in the next day or so then and down we

go. Don’t forget, or correct me if I’m wrong, doesn’t the

heaviest damage to the market take occur towards the

end of the week, around Thursday-Friday? HW

I like it! Short Thursday. How many others know? Do you think a squeeze is possible?

This attempted breakout (in what is now outside day to the upside) ideally should develop into a breakaway on expanded volume – unless it’s a fake out. It’ll be interesting to see how we close.

The SPX 200 day EMA (1234ish) was tested and now a pullback. I’m looking for a bearish sequence to the downside for a possible low risk short trade.

I’m going to go short on any break of SPX 1220 (from current 1225ish) as we approach 3:45. If I don’t see a dwonside acceleration from there, I’m out on the close.

SPX went the other way

So I didn’t play

Tomorrow is another day

And so, that’s all for today