Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Hong Kong and Indonesia rallied more than 1%, India more than 2%. China dropped. Europe is currently mostly up. Austria and Amsterdam are up more than 1%. Most other indexes are up. Futures here in the States point towards a negative open for the cash market.

I’ve been saying for almost two weeks my bias is to the upside, and as of now I see no reason to change. News trumps the charts, and since there are no guarantees in Europe, anything can happen, but absent market-moving news, the indexes should breakout from their ranges and attempt to leg up.

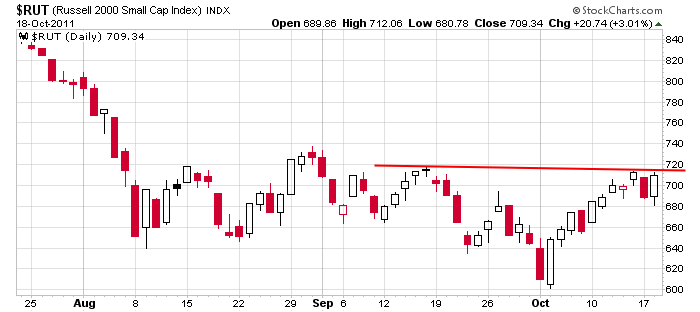

The small caps have done well…the heavily-weighted large caps which control the movement of the indexes have mostly done well…the movement of oil, copper and the US dollar supports the upside…the internals have supported a rally…even secondary indicators such as China and junk bonds have moved in the right direction. Also this bounce feels different than previous bounces. Dips are getting bought and some bad news has been brushed off. All-in-all things have looked very good the last two weeks, and again, barring very bad news, I favor the upside.

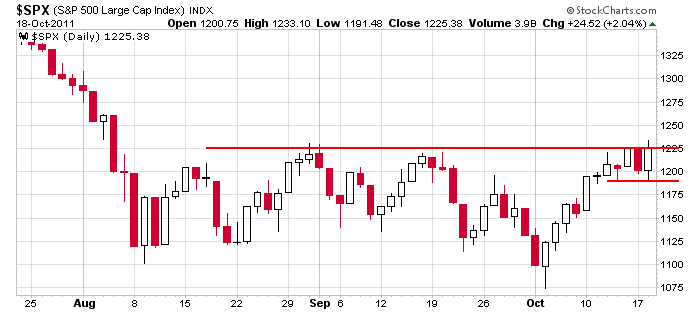

Below are the S&P 500 and Russell 2000. Both are sitting right at resistance. Whether they want the “all clear” sign from Europe or a few more earnings reports to be released here in the States, they are nicely positioned to run.

Two weeks ago I was bearish. What the heck. I’m not stubborn. If the market wants to move up, I’m certainly not going to fight it. You gotta be flexible to survive in this business. The goal is to make money, not be right. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 19)”

Leave a Reply

You must be logged in to post a comment.

Up maybe but the weekend tells the story…maybe. Just setting tight hoping that some stability will return to the wall street traders.

ESZ1: pancake flat until 5AM which looks like late bloomers. Currently there’s selling going into the 9:30 bell.

My prediction for today: it’ll try to sell off, test the holders. As I’ve been saying for the past two weeks this wave from 10/4 feels like an EW wave1up breakout. It’s building pressure.

If SPX 1233 was at least a temporary top to this rally from 1075, you would want to see an break below 1220 that accelerates downward to 1210 (at the very least) anytime now, in my opinion.

It remains to be seen whether SPX has begun a new bull move from 1075. What is clear is that NDX is the strongest of the Averages and the Tech sector is the strongest sector component of SPX. However, a few things still disturb me longer term. If we’re experiencing a resumption of the longer term up move since 2009 in the major averages, wouldn’t we see a pick up in volume by now? Granted, I can see more upside from here and make a case for SPX 1250ish or even 1285ish, but I think that would still be in the context of a longer term rally in a cyclical bear market that began this past MAY.

Please take a look at AAPL on the daily chart. Now, add the RSI & MACD indicators. If AAPL leads NDX, do you think AAPL is a bullish looking chart going forward? I’m just asking.

At the moment AAPL is being sold off.

If AAPL sells iPhones to China then the new tech sector will be social networking.

I don’t disagree with RichE & Jason about the short term bullishness of the major averages, but right in here I think it’s dangerous to get long above 1220 or on a move to new highs. In my opinon it would be better for the bullish case for SPX to retest the 1200-1210 & find support before attempting to take out 1234 (200 day EMA). I think the more important support below is the 13,20 & 50 day EMA in the 1188-1195 area. In my opinon, if that’s broken in an impulsive manner, the bears may take back control.

Since I don’t like to day trade, my focus is to find what I believe to be low risk positions on the short side, in tune with the longer term downtrend that I believe is still in place. I have no interest in being long, but that’s just me and I congratulate those who got long during this rally from 1075.

It’s too close to Christmas, I don’t see a sell off. I do see it retracing to 1200.

If SPX is topping out (and that’s a big “if”), we’ll probably trace the beginning back to last WED.

15:06pm now. every symbol shown on my X-Stream is in red! Oh, VXX is in green, up 7%. Short term bullish? Unless we see a crazy run in next 40 mins, I don’t see any bullishness. The MMs simply manupilate the market before this Friday’s option expiration.

Looks like we’ll close above 1200. I don’t see it as topping. I see it as a wave2 looking for buyers. Where would be a good place for a sweet spot 1180?

That’s freaky!

The 23.6 fib points to 1191 and the volume profile points to 1193.

The 50.0 fib points to 1149 and the volume profile points to 1146.