Good morning. Happy Wednesday.

The Asian/Pacific markets closed down across the board. China and Hong Kong dropped more than 2%. New Zealand, South Korea and Taiwan lost more than 1%. Europe is mixed; there are no 1% movers. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar has taken out its high from last week. Oil is consolidating just under 100. Copper has put in a lower high.

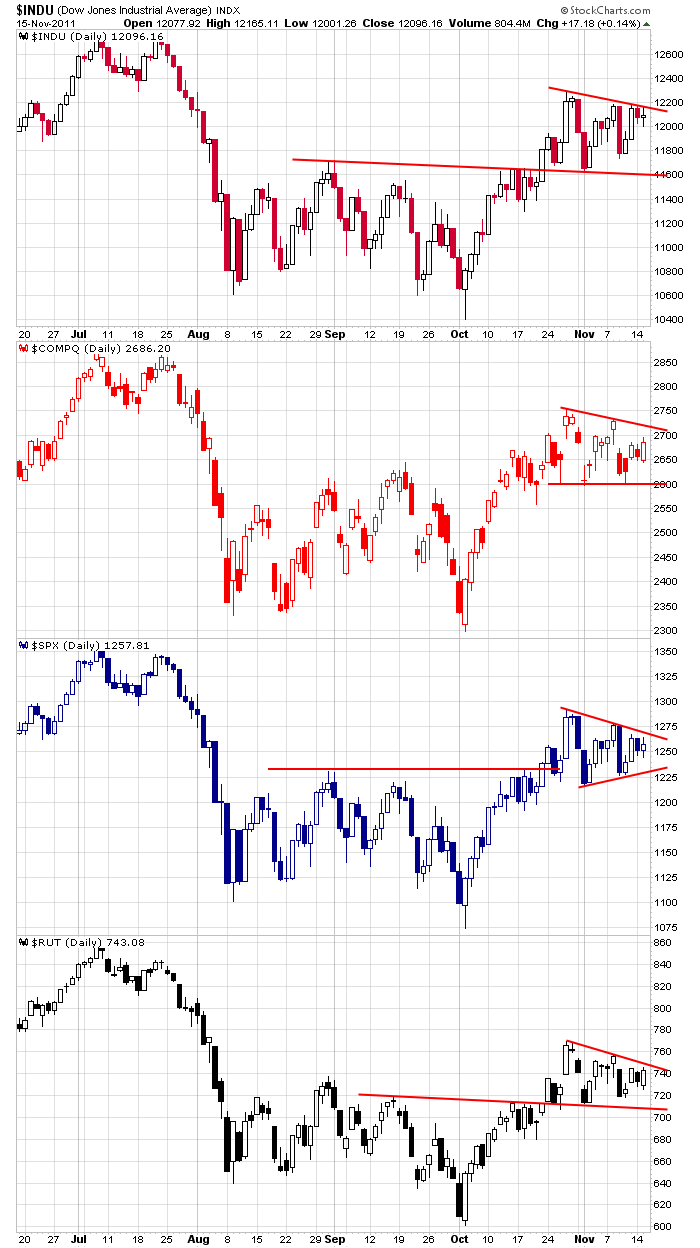

Technically the market remains in decent shape. A solid rally has been followed by three weeks of consolidation. News has mostly been negative, but prices have held up just fine. Relatively speaking this is a very good. I sense the market wants to move up, but right now Europe won’t let it. Here are the daily index charts. Again, they look good. We just need some good news from Europe (Italian bonds yielding 7% and Spanish bonds yielding 6% are not good news).

Don’t over trade. Don’t chop your account. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 16)”

Leave a Reply

You must be logged in to post a comment.

IWM is showing major relative strength. Keep your positions light.

Currently I am 100% in cash. You will most likely find me at

Starbucks for the rest of this week or until this triangle

plays out one way or the other. HW

You must be really focussed on Italy. “”Relatively speaking this is a very good.”” lol

The question in my mind is, is the “E” wave of a potential bullish triangle formation in place at this morning’s low or do we need to go lower? SPX 1336-1340 would be an ideal area for the completion of wave “E”, in my opinion, at which point one would expect a reversal to the upside.

On the negative (bearish) side is the fact that the daily MACD, RSI and STOCH are all in a downtrend. As I’ve mentioned before, the daily MACD has been a reliable indicator of the trend and makes me wonder if the bullish triangle idea is too obvious and may turn out to be a trap. All the more reason, I guess, to daytrade until the longer term trend reveals itself using tight stops and taking quick profits – something I’m finding difficult.

1336-1340? Do you mean 1236-1240? I’m putting the dip at 1200 with a bullish reversal breakout from there.

What I’m seeing so far since this morning’s low doesn’t seem to say that this is a bullish reversal so I’ll llok to get short somewhere around 1254 on signs of resistance and a reversal downward.

Well, I’m short SPX at 1254 but I won’t stay around for long if it can’t move lower into noon time.

Ooo! a mini triangle, more downside.

see Jasons charts—-not all markets are try-angles,but all markets are con ected

—–opts motivated trading into fri

europe trading was exciting—the apples led the way

I’ll give a tip of the hat to RichE regarding daytrading. I covered my 1254 short SPX position at 1251. Normally, my stop loss would have initially been just above 1256ish to start and would have moved down to breakeven. But, following RichE’s comments last week I got out when the downside couldn’t break below 1250 as per my expectations for downside acceleration. I’ll now take a fresh look as 1PM approaches. I still like the short side for a daytrade.

Thank you. You do a very good job at picking the intraday resistance. I would like to know your EW points (1,2,3) and (A, B, C, D, E) I find it hard to follow you without plotting on chart.

Going short does seem to be easier, but don’t focus on it or you’ll miss the longs. Like at the moment I’m long at 1250.25 ESZ1 even though the 5d5m pattern looks like bearish continuation.

Closing long. Too many inside bars.

Got out too early. Oh well. see ya tomorrow.

I’m short again and this time at SPX 1255 with the usual low risk stop loss.

If SPX 1242ish (.618 of wave D) is hit, followed by a sharp reversal, I’m gonna cover my short position. But, if it falls, I’ll look for 1236 as the next target and maybe hold on until tomorrow.

SPX 1238ish is close enough to 1236 for me, so I’m out of my short position at 1241. If I see weakness into the close I may short again since SPX is so close to breaking the triangle to the downside. Plus, the daily MACD is firmly down.

I’m gonna short the close

whilst im short the world from 2 hours ago –ive held till the open of asia in 3 hours

and will see where we go

europe/dax/ftse should gap down like last nite taking usa futures with them

moodies/fintch downgraded 12 german banks and their usa counterparties

the bears had partie pies