Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed and with a bearish bias. India and Singapore dropped more than 1%; South Korea rallied more than 1%. Europe is currently down across the board. Austria is down 2%; Belgium, France, Germany, Amsterdam, Norway and London are down more than 1%. Futures here in the States point towards a flat open for the cash market.

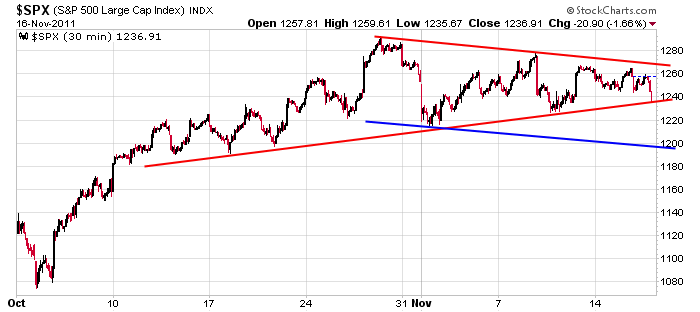

Here’s the triangle pattern we’ve been following the last week. The S&P has made lower highs and higher lows, and with the price at its current level, it won’t take much for one of the trendlines to be taken out. My target on a downside break is 1200. It’s a big, fat whole number, and it’s where a trendline drawn parallel to the top of the triangle and through the low of the pattern intersects the right axis.

Europe remains the dog that wags the entire market. First Greece. Then Italian bond yields moved up to 7.5%. Then Spanish bond yields moved above 6%. Now the French – they struggled with a bond auction today. Contagion is building. Nobody really cared if Greece went bankrupt or got bailed out, they just wanted to know whatever bad happened didn’t domino throughout Europe. Italy is its own problem – they’re not struggling because of Greece, they would have struggled anyways. But France is a different story. With their borrowing costs going up, everyone’s worst fear (contagion) is coming true.

Personally I continue to play it safe. I see no reason to be a hero here. There are too many unknowns and too many things outside my control that have the potential to push the market hard in either direction. The nature of swing trading is the market alternates between “easy” trading periods and “hard” based on the trend and sentiment and mood. Right now it’s hard. We’re not getting follow through, and the we can’t count on the market rescuing us from bad trades. Things can change fast though. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 17)”

Leave a Reply

You must be logged in to post a comment.

Big picture

Look at the investment clock

http://www.google.fi/imgres?imgurl=http://www.paritech.co.uk/paritech-site/education/beginners/images/investment-clock.gif&imgrefurl=http://www.paritech.co.uk/paritech-site/education/beginners/strategies/clock.asp&h=296&w=503&sz=19&tbnid=twsaH6xQvGi8LM:&tbnh=67&tbnw=114&prev=/search%3Fq%3Dinvestment%2Bclock%26tbm%3Disch%26tbo%3Du&zoom=1&q=investment+clock&docid=0K26nYV-wgIsTM&hl=fi&sa=X&ei=xxfFTsq5C6SL4gSEsuGfDQ&sqi=2&ved=0CC0Q9QEwAg&dur=16799

The clock is now between 4 and 5, I think.

The share prices start to rise again in august -september 2012.

Don´t fight with the trend.

All stock markets, gold, silver, euro are now again starting to go down. USD is going up.

;-))

Having been whipsawed so many times in recent weeks, I understand where Jason is coming from. Yesterday, for a change, I actually got on the right side twice and got short a third time on the close based on the assumption that the SPX bullish triangle idea may be incorrect. Today, I’m focused on the the 50 day ema at 1225ish which is about where wave C of the ABCDE assumed bullish would be. If 1225 is breached and we trade below it, the door is open, in my opinion, for a deeper correction of the rally from early OCT. Fibo retracement levels would be from roughly 1210 down to 1155ish with 1215 the first test if 1225 is falls. I’m only going to cover my present short position here if 1225ish shows to be at least temporary support. But, now that the daily MACD is down and the daily Stoch is down but not yet oversold, I’ll continue to sell the bounces into overhead resistance.

Here’s another perspective from an EW point of view. From the SPX OCT high at 1292, instead of a bullish triangle formation, we could be looking at one of 2 counts (only my opinion)i.e. from 1292 to 1215 is either wave 1 or wave A, from 1215 to 1277 is wave 2 or wave B and from 1277 down we’re seeing a smaller sequence of 5 waves being either wave 3 or wave C. Either way, we would expect to see further downside to at least Jason’s 1200 area. Below 1155 would leave open the more bearish wave count, i.e. a 5 wave sequence from 1292 as opposed to an ABC count.

From a time cycle point of view, based on the cyclical analysis of others, it seems to me that we’re running out of time to look for a test of the May high. Unless SPX holds 1075 (let’s say in the FIBO area of 1155-1210), the chances of exceeding even 1292 diminish, much less the May high – from a longer term perspective, that is.

So far today, the question in mind is, is SPX building support just above the 50 day ema in advance of a sharp rally or, is SPX consolidating prior to a resumption of a move down through the 50 day ema? I’m thinking that a failure to get back above and trade above the day’s opening level, leaves SPX vulnerable to selling later in the day and I’d be tempted to add to my existing short position.

I’ve been uncomfortable with an open trade during the noon hour in recent days so, absent a complete breakdwon in price, I’ll cover my existing short position and reconsider things after 1PM.

Looks like buying. The slide is a-pausing.

Well, SPX has broken through the 50 day ema and we’ll see if it can become resistance as the day continues. I’m going to stay short for now after this breakdown in price and watch to see if 1215 can be tested. I want to give this some room but at the same time I know we’re oversold on an intraday basis. But it sure does look some 3rd wave downside action now of an impulsive nature.

Don’t mind me. I’m thinking out loud! the .382 Fibo & lower daily bollinger band come in around SPX and Jason’s 1200 target is not that far away (also wave C = wave A around 1200). Just some things to consider if things get mor ugly after 1PM. But first – 1215 support.

.382 & lower Bollinger band is SPX 1210

It should base here (1200). Well! so much for the market fishing flat or a bit up. LOL Bears rock!

I covered my short position at 1215, figuring that today’s low just above 1210 was close enough to stimulate a bounce. I’d short again if SPX gets back to 1225 and finds resistance.

darn—–i missed the sell of—-just shows u have to be watching always

will have to wait for a bounce

I bailed at 1220.

Sorry you missed it Aus. I’m not sure this one will have a bounce. I don’t think it will be pretty.

RichE – I’m thinking any bounce in here may have difficulty getting above SPX 1220, after which I could see a new low for this move to the 1200 area. I’d like to get short again if there’s a test of SPX 1220-1225.

Looks like its setting up to down some more.

RichE – suppose we go straight down, with no bounce to my 1220 first, into the SPX 1200 -1210 area (the 50 day SMA is at 1205, whereas the 50 day EMA is now at 1224)and there’s support. Is that a good place to go long looking for a rally back to 1224? I’m thinking about it.

By the way, since the PM began, we’ve started to develop a downward “wedge” pattern which may be signaling the end of this move down from SPX 1262. If so, the inital upside target after a reversal would be 1218-1220.

1226 spx has what is now horizonal res

PeteM,

Too much damage! I’m not going long until I see some muscle, some resolution, some valid reason for the market to go up. I don’t like this. Besides, I need to help GF with Turkey Day. That’ll be a good reason to not trade. Have fun.

P.S. I don’t see it going below 1200, but I didn’t think it’d go below 1230 on this leg down. I truly did think it was going to be a bullish breakout, but not now. I see it hovering around 1200 for the rest of the month then a slow climb back up. The market has to start turning or it will be light’s out.