Good morning. Happy Friday.

The Asian/Pacific markets closed down across the board. South Korea and Taiwan dropped 2%, and Australia, China, Hong Kong, Indonesia, Japan and Singapore dropped more than 1%. Europe is currently mixed, and not one index has moved 1% from its unchanged level. Futures here in the States point towards a moderate gap up open for the cash market.

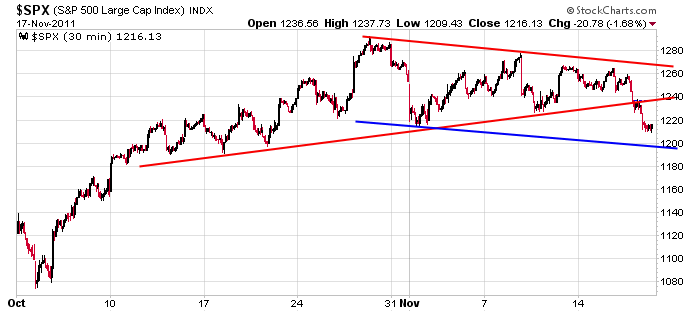

Here’s the triangle pattern on the 30-min chart we’ve been following since last week. The S&P not only took out support but also the two previous lows from within the pattern. I’m not one who likes to draw lines in the sand and say: if x price level gets taken out, the game is over. There are far too many false moves to be that rigid. Also there is usually another level to key consider. In this case, that level is 1200 which is a whole number, and it’s identified by a trendline drawn parallel to the upper trendline and through a low in the pattern. If that level is taken out, I will be more interested in selling rallies.

The market here is still being held hostage to the Europe, and since Europe is unpredictable, I’m being conservative with my trading. On any given day we can wake up and see the S&P futures up or down 50. No thanks. I’m trading but not being aggressive and not taking home big risk. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 18)”

Leave a Reply

You must be logged in to post a comment.

I’m looking at SPX 1224ish (50 day EMA and today’s high so far) up to 1230ish as an area to short on signs of resistance and a reversal. I think we may see another low ahead near term in the 1200-1207 area and then a reversal may be possible for a long position.

a boring small range opts ex day

so this is where the insto hedgies wanted it having sold all those calls to the unsuspecting retail and mutual bulls

true direction may not be known till mon

but looking at the ndx with 3 days LL’S———?