Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down, but there were no standouts. No index moved more than 1%. Europe is currently mostly up – there are no big movers there either. Futures here in the States point towards a positive open for the cash market.

The dollar is flat. Oil is down slightly; copper is up. Gold and silver are down small amounts.

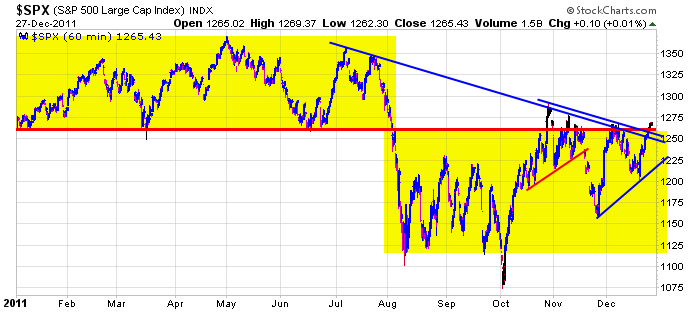

Here’s the 60-min S&P chart. The index is above the 1260 level which separates the two main ranges. Too bad volume is so light, and there hasn’t much enthusiasm behind the movement the last week. There’s an old saying: Don’t short a dull market. Today’s market is dull, so we don’t want to short this, but I don’t entirely trust it either. Don’t get lazy or complacent. I’m not predicting it’s going to turn around soon, just saying if it does, the market can fall apart fast.

Aside from the light volume and lack of force, in most cases, the wrong groups are leading. Consumer staples, health care and utilities are all doing well. Energy, financials and tech are lagging. This isn’t a good recipe for a sustained rally. I’ll send out a report after the close covering this.

The near term trend is up, but I’m not completely trusting it. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 28)”

Leave a Reply

You must be logged in to post a comment.

I was stopped out of my TYH @ $36.74 for an 8.52% gain over 6 days. I am now awaiting the next solid short or long signal….I guess the trick will be in determining whether the support/resistance is the real deal.

probably some luck involved there as well, but all I can use are the probabilities.

This AM I covered my SPX long position at 1263, just above breakeven, as the probability of an upside small wave 3 extension is fading, IMO. A bresk below 1242 would seal that, IMO, and suggest that the triangle breakout was a fakeout (Howard’s idea) and the rally from 1202 (and possibly from 1158) is over, with a resumption of the longer term downtrend from last MAY directly ahead. I’m not ready to assume or concede that quite yet, as the rally from 1203 could be a 3 wave, samll wave “a”, of an abc advance and we’re now in a wave “b” pullback prior to another advance (small wave “c”) to at least test 1292.

For now, 1242 is important from an EW perspective, but the 1230-1245 area is a broad srea of Fibo support if 1250 is taken out, as I see it. I’m not interested in trading this from either side until the picture gets a little clearer.

It wasn’t my idea. It was Max my dog his idea. 1 bark = BUY signal

and 2 barks = SELL signal. HW/nyc

Howard – would it be correct to assume that if Max doesn’t bark it would mean to “stand aside”? By the way, I’m pleased you haven’t returned him to the ASPCA.

the way the dollar and bonds are holding up and even thriving, and gold testing and retesting major support threatening to break down, i am wondering if we are slipping back into deflation. i was assuming that deflation was arrested and we would print our way all the way into debasement and inflation eventually, but perhaps the real deflation is beginning now that central banks are out of ammo and politics and public finances do not allow for any more stimulus. of course, metals are still holding up and so are stocks, so the jury is out there. if we see further selloff in gold and a turn down in stocks, we will need to congratulate PeteM and start getting really defensive.

happy holidays, happy new year, and a great new trading year all..

Max is telepathic –he reads the motives of the buyers/sellers

today was tax loss selling and perhaps some profit taking in the euro,with unwinding of carry trade

it could also be a key turning point as the 1267-70 spx was approached

could this be the end of the western world as we know it

nah—maybe another couple of days

Kunta Kinte & AussieJS – It appears the ECB’s Long Term Purchase Operations (LTRO) implemented on 12/21 will buy less time than originally thought for the EU banks (weeks – not months?) and it’s become obvious to even the most wide eyed optimists that the LTRO doesn’t solve the EU Soverign Debt Crisis. I understand there’s a “quiet run” on EU banks. By default, the U.S. Dollar is king. If that’s the case, a further rise in the Dollar is a negative for stocks and commodities, perhaps including Gold. That, to me, means deflation first before inflation later. It’s a sad state of affairs but, with the leadership world wide so lacking (not to mention the outright ineptitude of Benny & the FEDs here in the US of A), it’s almost inevitable that 2012 sees assets deflate, i.e. risk off.

Hello Pete..please post when you see some support or resistance as solid as last weeks SPX 1225-1231. I went with yours last week so I’m paying even more attention on the next go-around.

Of course no one is infallible..in fact with traders I’d say 60% is great..so I will be sure to blame myself when the trigger does not work.

Thanks

Pete,

to big to fail and to big to bail = end of central banks big ponsi = implosion

a break below todays close on the dax would not look good

could today be a small 4 -then a retest of 1270 for 5 ,by fri

italy has a inverted yeild curve and a obstensible line of bond credit with the ecb in a circlic fashion

everyone sees the ponsi so ofcourse the run on banks