Yesterday I posted numerous stocks that had broken out during the last week or so, but what I didn’t mention was that most of those stocks came from “safe-haven” groups. When push comes to shove, money still rules, so if we watch the flow of money, we get a hint of what the psychology of the market is. When money flows into higher-beta, speculative groups, the market tends to do well. But when it flows into lower-beta, safe-havens, investors are essentially saying they lack confidence and are opting for safety. Let’s look at some key groups and see what’s leading and lagging. Then we’ll know what investors are doing, not just thinking or talking about.

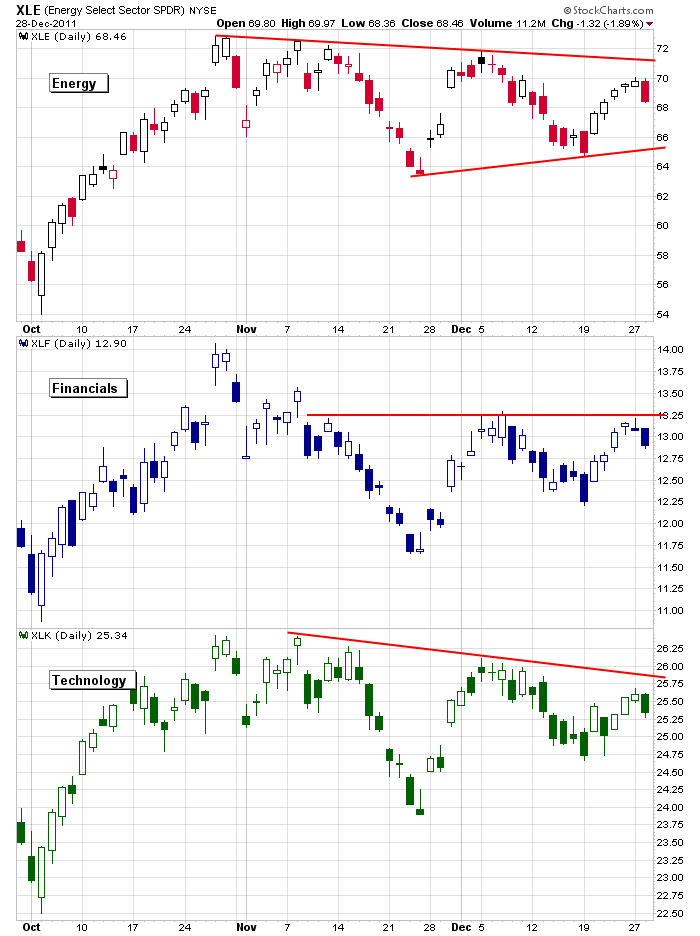

Here’s energy, financials and tech. These would be considered leadership groups – groups I’d like to see doing well when the market moves up.

None of these groups are doing poorly, but none are doing great either.

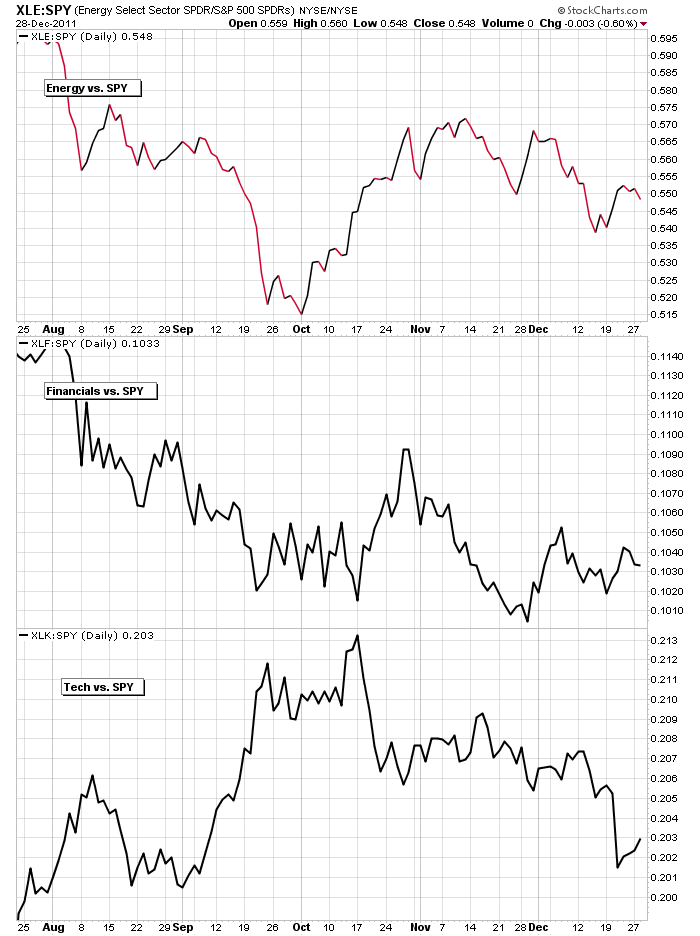

Let’s now compare them to the S&P 500 via SPY (see below). In each case the group is under-performing – not a good sign going forward.

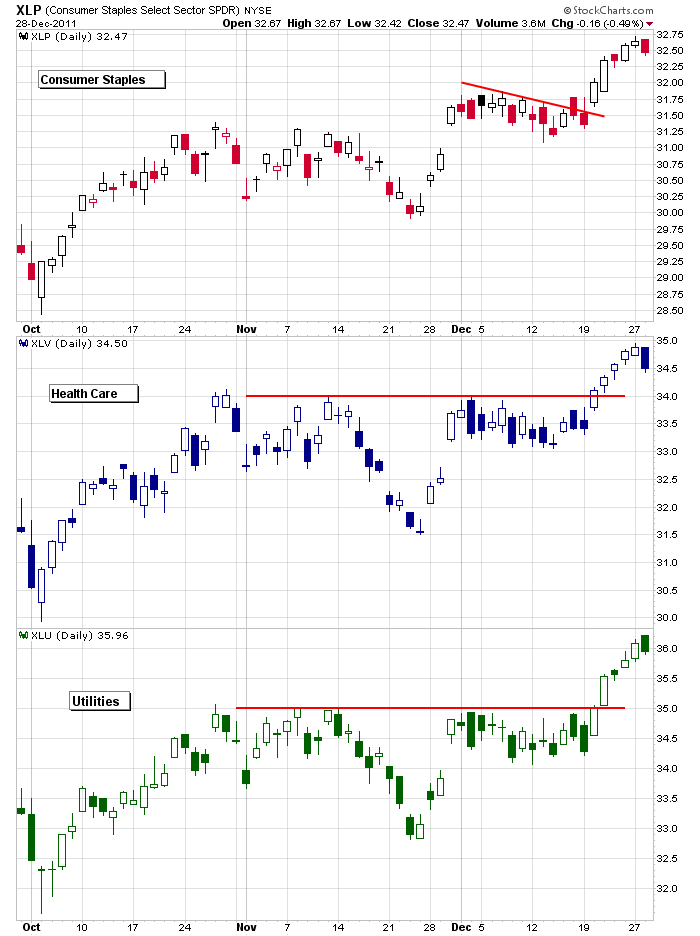

Now let’s look at consumer staples, health care and utilities. These groups would be considered safe-havens – money will flow into them if investors lack confidence.

All these groups are doing well; they’ve all broken out in the last week and are rallying nicely. Hmmmm.

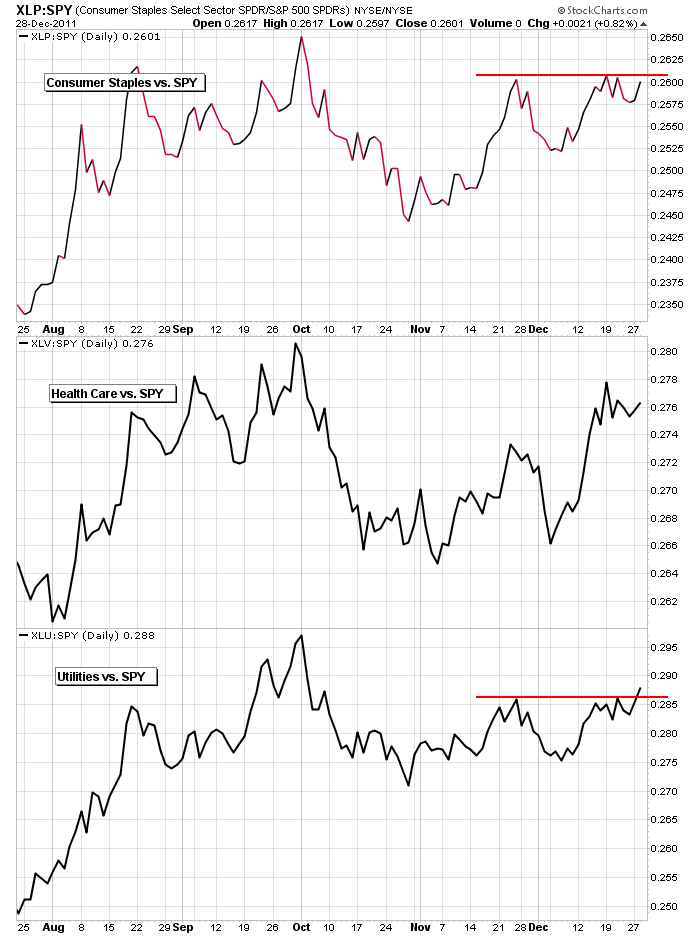

Let’s compare them to the S&P 500 via SPY. Over the last week each group has kept pace with the market, but over the last month each has out-performed – not a good sign if you’re bullish.

So it seems money is flowing out of the higher-beta, speculative groups and into the lower-beta safe-havens.

Be careful out there. Don’t get complacent, and don’t entirely trust the recent strength.

Jason Leavitt

0 thoughts on “Watching the Flow of Money”

Leave a Reply

You must be logged in to post a comment.

Jason,

You charts of consumer staples, health care and utilities show a red candle today along with the rest of the market. Do you consider this a profit taking day for these safe havens or rotating into the broader market for a late year/new year rally?

Hope the climbing and skiing is going well 🙂 Climb on!

When the market drops, everything drops…the safe havens drop less.

If the market drops, I do short. There’s no victory in losing less than the market – it’s still a loss.

Whether today was simple profit taking or the beginning of a move down is not something I know. I do know that I don’t like how tech has lagged so much while boring sectors such as utilities have done relatively well.

Jason

You are right on the money. This market is very hard to predict. On one hand I do not want to short a dull market but I did anyway yesterday as my models told me we would have a pullback. It was a very quick profit today.

Given the fact that the NASDAQ had a few too strong days over the last month or so tells me we are in for at least some pullback over the next few weeks. When the NASDAQ goes up 4+% in one day those gains are almost always given back and then some.

Daddy Paul

Nice work Daddy Paul. Good to hear from you.