Good morning. Happy Friday. Happy early New Years.

The Asian/Pacific markets closed mixed. China rallied 1.2%; Singapore dropped 1%. Europe is mostly up, but there are no 1% gainers. Futures here in the States point towards a flat open for the cash market.

The dollar is down slightly. Oil is down and copper is up. Gold and silver are up.

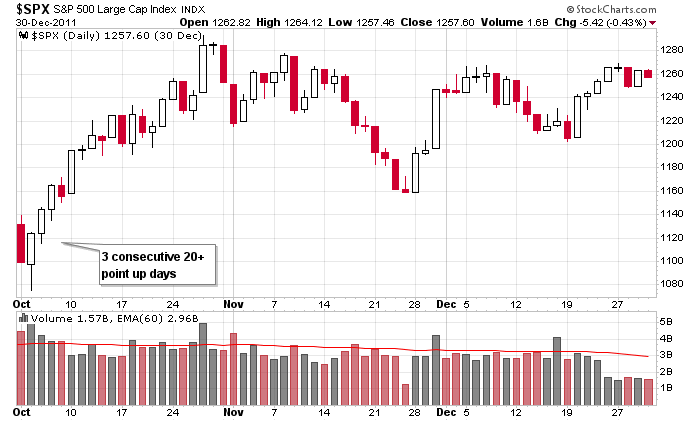

Here’s the S&P over the last 12 months. We got a 100-point range Jan-Jul and then a 140-point range Aug-Dec. There were many ups and downs, many big gap opens, many sudden reversals and very few steadily trending moves. In the end the index will close pretty close to where it opened. There have been lots of very good trading opportunities, but unlike previous years where a more obvious dominant trend enabled us to hold swing trades longer and for greater gains, we’ve had to be content swinging for singles and doubles.

This is the market we’ve been dealt. This is the market we must trade. A key to success is being flexible and being able to make slight adjustments. You can’t force a trending strategy on a range-bound market. You’ll get chopped up. You’ll get frustrated. You don’t have to make major changes – just slight adjustments based on what’s being offered. If you haven’t made necessary adjustments, hopefully you’ve learned your lesson. Hopefully you’ve learned you are not the boss; the market is the boss. You can’t do what you want; you have to recognize what the market is offering and take it – and be happy about it. Stubborn traders never survive.

Have a great New Years. Be safe. I’ll see ya next year.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 30)”

Leave a Reply

You must be logged in to post a comment.

I wish one’n all a Happy/Healthy/Profitable New Year : }

The congestion in the SPX resistance area I mentioned yesterday, prompted me to take a short position a short while ago at 1261 afer SPX could not trade back above the day’s open. I’m looking for a test of 1256ish and make a decision on covering or holding depending on whether it holds.