Good morning. Happy Tuesday.

The Asian/Pacific markets closed up across the board. Hong Kong, India and South Korea rallied more than 2%. Australia, China, Indonesia, Singapore and Taiwan moved up more than 1%. Europe is currently trading mixed. Switzerland and London are up better than 1%. Futures here in the States point towards a very big gap up for the cash market.

I totally messed up yesterday. 🙂 I thought the market was open, but the opening bell never rang. I’m pretty sure it’ll ring today.

All my comments from over the weekend and yesterday stand. There are reasons to be bullish and reasons to be bearish heading into the new year.

The biggest reason to be bullish is simply because the market didn’t drop in 2011. It was thrown a massive amount of negative news, and in the end, after it had many excuses to fall apart, it was flat. Rallying or holding up in the face of bad news is a good sign. On the flip side, the situation in Europe is still on the front page, the wrong stocks and groups are leading the market and the small caps are lagging. Something has to give.

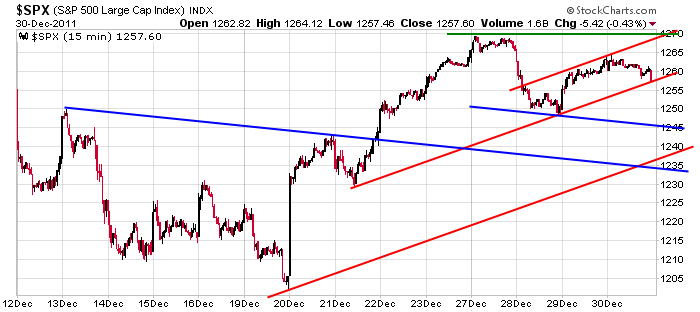

As of last night, my upside S&P target was 1270 and my downside targets were 1245ish and 1233ish. But with the S&P set to gap up almost 20 this morning, today’s open will be above last week’s high (heck it’ll be above last month’s high). Target #2 on the upside is 1290 per the chart below.

Can the small caps start to lead? Will money rotate into more risky stocks or will it continue to flow into safe-havens? Will new highs continue to expand? These are things I’ll be watching for in the next week or so. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 3)”

Leave a Reply

You must be logged in to post a comment.

take a look at SPX chart for end of year 2010 going into 2011… enjoy…

ndx 100 triangle e may be finishing

Best wishes to all for a happy, healthy & prosperous New Year!

I feel fortunate in that I placed a breakeven stop loss order on my SPX 1261 short position when 1256 wasn’t broken going into 3pm last FRI and got out without any harm. To the relief of some, I’m sure, I’ll post far less often in the coming weeks as I meet with clients throughout the month for annual reviews. It’s just as well as the EW picture, as I interpret it, is unclear with today’s rally as to where this rally may end. All I know is that we’re at the upper end of the daily Bollinger band, but trsding above the 200 day SMA with a test of 1292 in sight. That’s bullish, at least in the short term.

Good luck to all in trading this volatile market.

it may be time to put on my intraday bear suit,which could last for years

usd at bottom of its upward channel

euro at res