Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed and with a bullish slant. Only Singapore (up 1%) moved more than 1%. Europe is almost entirely down. Amsterdam is down 1%. Futures here in the States are down.

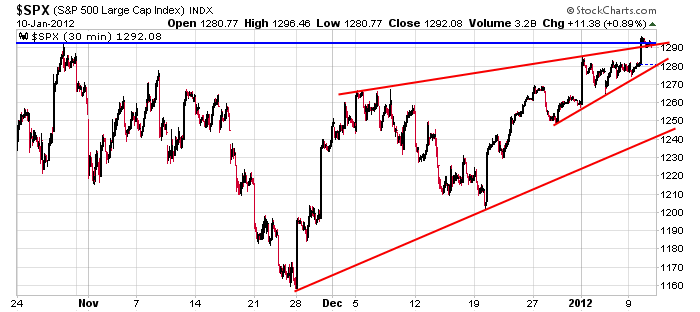

Here’s an update of the 30-min SPX chart I posted yesterday. Allowing for a little wiggle room, the big and small wedge patterns remain in place and now the October high comes into play. This is a key place (for the S&P). The index either 1) surges upward, 2) immediately drops or 3) does a false breakout.

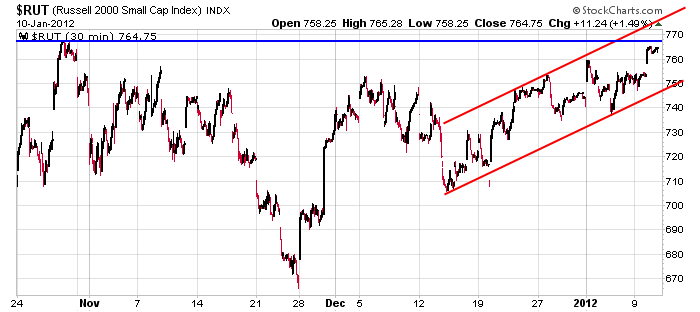

But, the Nas and Russell aren’t at the same place, so there is a much less sense of urgency. The Russell is approaching its October high, but unlike the S&P, is not being squeezed by converging trendlines. The Nas is lagging and also not being squeezed.

It’s not that something has to give, it’s that the S&P is in a place to make a solid move, but the other indexes aren’t there yet. This could lead to 4) the S&P drifting around for a few more days until the Nas and Russell line up.

The trend is up, but be on your toes here.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 11)”

Leave a Reply

You must be logged in to post a comment.

Great observation. Earning season is in place and for the most part, I think we will see good earnings reports (second quarter will be the real challenge). As such, I am bullish and will bet on some momentum that I see (last year, momentum was impossible to trade)

Re: Earnings >>from Zacks

<<<<<<<<<<<<<<<<<<<<<<<<<<

Any Whispers this Earnings Season?

So far there have been a modest 22 reports this earnings season. Unfortunately their results are sub-par which has some concerned about what happens the rest of earnings season.

Here is my guess. We have enjoyed 11 straight impressive earnings seasons since we bottomed in March 2009. I think that the positive trend is still in place. Yet, this one will be a notch less impressive. Perhaps the word "mixed" is more accurate.

Meaning that those already fearful about demand from Europe, China or other developing nations will have enough weak reports to point to as proof of our coming demise. Yet, when we pull back to the big picture, most companies will have exceeded estimates and given solid guidance for the future, which will support higher stock prices.

These mixed results also point to there being BIG winners and BIG losers this earnings season. Even more so than usual. So those with an effective earnings whisper strategy have a BIG leg up on the rest of investors.

Gladly we have a highly effective whisper strategy at Zacks which has a 77.9% accuracy rate. If you are not familiar with it, then now is the time to get moving.

About Zacks' Earnings Whisper Strategy: http://at.zacks.com/?id=9562

Best,

Steve Reitmeister

Executive VP, Zacks Investment Research

From Zacks:

“So far there have been a modest 22 reports this earnings season. Unfortunately their results are sub-par which has some concerned about what happens the rest of earnings season.”

Long way to go and some of the big guns are doing very well. I think we will see a good number of positive reports that will boost the market indexes. Even the Euro is quiet during this period.

I’d like to comment on Jason’s 30 min SPX chart from an EW perspective.

IMO, going back to the OCT low of 1075, the rally has been a 3 wave advance, i.e. from 1076 to 1292 is wave A, the decline from 1292 to 1158 is wave B. From 1158, we appear to be advancing in an EW ending diagonal pattern where you have 5 overlapping waves forming upward, i.e. wave 1 from 1158 ended at 1267, wave 2 ended at 1202, wave 3 may have ended yesterday at 1296 or may still be in progress. A decline to below 1267 (an “overlap” of wave 1) would confirm wave 3 was completed at 1296 and wave 4 down was completing below 1267 to be followed by another move above 1296 for completion of the ending diagonal. Depending on what unfolds today, I think the upside target is now narrowing to the 1310-1330 area some time this month.

Near term, I watching today for a possible fill of yesterdays gap up just below a .618 retrace level at 1283ish where the lower trendline support line on Jason’s 30 min chart (the smaller wedge).

Since 11am EST, SPX has been floating upward towards the opening level. A failure in this area of 1290-1292 and a reversal may be a good place to short with a tight stop, looking for an attempt later to close the gap around 1282.

If we are now completing b of 4, then playing c of 4 can make some money. However, tight stop is key to prevent a small gain into a loss. I’m in the camp of 5 yet to play out to complete an ending diagonal.

Brian – I hear you. The reason I took a short position was today’s opening level is also at the .618 retrace of the move down form 1296 to today’s low at 1285ish. Now that I’m short, I’m looking for some sign of impulsive downside action. If I don’t see it, I’ll cover sooner at breakeven.

Are you seeing 1296 to 1285 as wave “a” of 4 and the rally to 1292ish as “b” of 4, and assuming 1296 completed wave 3 of the ending diagonal?

Correlating to the MAR futures, I believe 1292 to low today 1279.25 as “a” of 4. But, not sure “b” is done. So far the action doesn’t appear impulsive. I think odds are fair that you’ll get stopped out. Let’s see.

You make a good point about “b” not yet being completed. I agree that the impulsive move down isn’t there so I’m getting out at breakeven.

By the way, if we’re looking at an ending diagonal, wave 4 should overlap wave 1 (SPX 1267ish). If that’s correct, this pullback (so far) may be a 3 wave down sequence for a larger wave “a” of and abc decline, IMO.

I’m short SPX at 1291.50 and I’ll cover at 1293.

I’m liking this action. I think “b” of 4 is very near an end. We’re in 4 of e of b of 4. “c” of 4 ahead with a couple of more point rally (5 of e of b of 4). That should be about 1295 in the SPX. Just my opinion of course. And, as always, I’m still entertained.

Brian – are you teasing me? I think I’m getting a headache!

Seriously, it’s not intentional. I look at short bars. More later, got to go.

As Jason says—-the ndx100 is holding up proceadings

dji is ready for zero

spx is holding hands with ndx—-all are telepathic with the world

this is a insto affair so as they can bee short for years

instos deal in derivitives

im a alien telepathic horific bear