Good morning. Happy Wednesday.

Yesterday the market gapped down pushed lower…rallied to fill the gap…and then was weak all day. Premarket futures trading suggests an open at or below yesterday’s low. Is there reason to be concerned?

This is what’s on my mind:

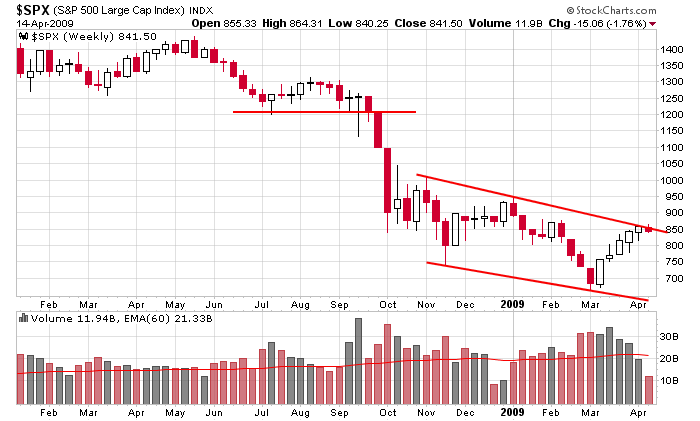

The market has put in 5 consecutive up weeks (it’s due for a break).

Volume has declined week after week.

The intraweek range has generally narrowed.

Many unfilled gaps sit below the current level.

The internals market breadth indicators are in overbought territory and at levels that have produced tops during this bear market.

And of course we are still in a bear market (one of the worst in history), so until proven otherwise, rallies are nothing more than rallies within a downtrend.

And now we can add a new item. GS beat earnings and announced a secondary offering. The stock dropped more than 11%. INTC announced earnings yesterday after the close. They beat expectations, but the stock is down more than 4% before the open. We are just now getting into earnings season, and if stocks are getting hit after beating, what happens when expectations are only met or companies miss?

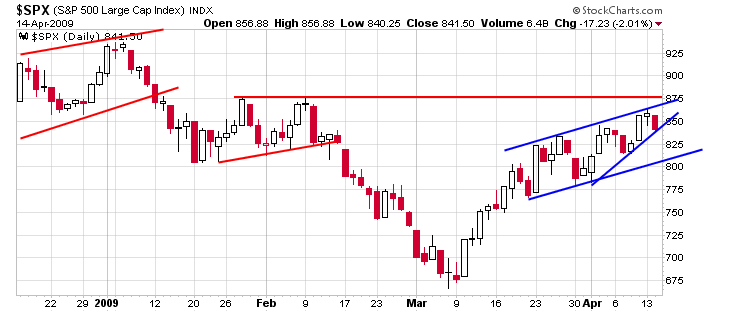

Oh and of course the SPX was very near resistance (between 850-875).

Give all this, it’s hard to justify being aggressive on the long side. Or being long at all. Maybe the market pulls back a couple days and then launches onward and upward again. Or maybe a top is in place, and we’re headed back to the lows. We don’t know (nobody does), so our job is to play the percentages, and the percentages right now don’t support long trades (I’m assuming you’re a small enough trader that you can exit the market and re-enter fairly easily).

Here’s the weekly SPX chart. It shows the 5 consecutive up weeks on declining volume and the presence of resistance just overhead.

Here’s the daily SPX chart. The index remains in an uptrend, but with resistance just overhead and a rising wedge (bearish) forming, I’d rather take profits on longs and force the market to prove itself than be forced to exit after profits have been given back.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

earnings & economic releases