Good morning. Happy Thursday.

The market traded range bound most of yesterday until the last hour when it surged upward. Maybe the charts were painted, maybe they weren’t. In any case, the dailies don’t look back. One down day on Tuesday coming off a couple up days isn’t anything to be overly concerned with. I’m officially neutral right now.

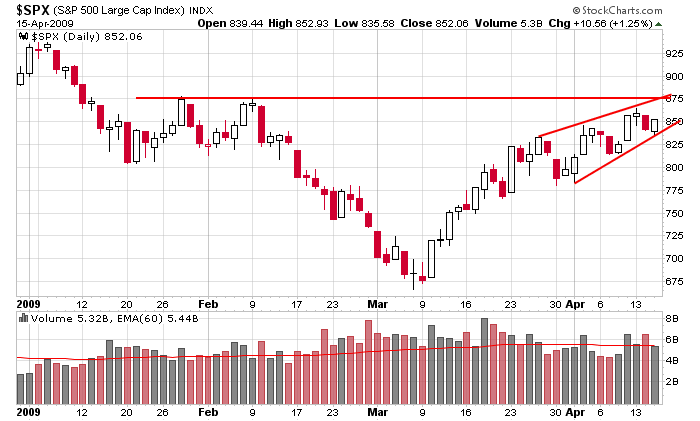

On one hand, the trend is up…every dip gets bought…the bulls have been very resilient. There’s a part of me that thinks there may be a threshold overhead that once crossed could cause a huge short squeeze and a parabolic rally.

On the other hand, the internal breadth indicators are in overbought territory…volume has declined as the rally off the lows has materialized…there are lots of unfilled gaps below…resistance is right overhead…and of course the long term charts are still in bear mode.

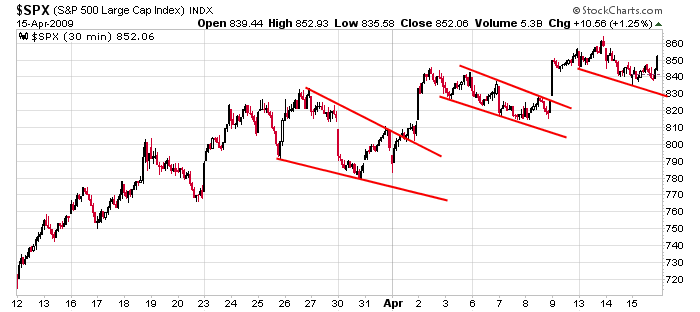

Aggressive trading should be done when the odds are in your favor, and right now I don’t see the odds being heavily in our favor in either direction. Overall the charts look good, but if selling begins, the SPX could be down 100 in two days. That’s how bear markets work. They lure you in and then pull the floor out.

Here’s the daily SPX. Gotta be more conservative up here near resistance, but overall, there’s nothing horribly wrong with this chart.

Here’s the SPX 30-min chart. Each successful pattern seems to be getting smaller and smaller. On light volume, this in my opinion is more bearish than supportive of the move.

Be conservative. No big chances right now.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases