Good morning. Happy Wednesday.

The Asian/Pacifc markets closed mostly up. Chian dropped 1%; South Korea rallied more than 1%, and Indonesia and Taiwan rallied more than 2%. Europe is currently mostly up. There are no standouts. Futures here in the States point towards a flat-to-positive open for the cash market.

The dollar is basically flat. Oil and copper are up. Gold and silver are up.

Bernanke will be on Captial Hill the next two days testifying, so there’s an outside chance something he says induces a quick move in the market. Supposdely the economy is improving yet Bernanke says rates are to remain low through 2014. It makes no sense to me. If things are improving, he should be able to ease off the monetary policy. Failure to do so makes me wonder if he knows something we don’t know.

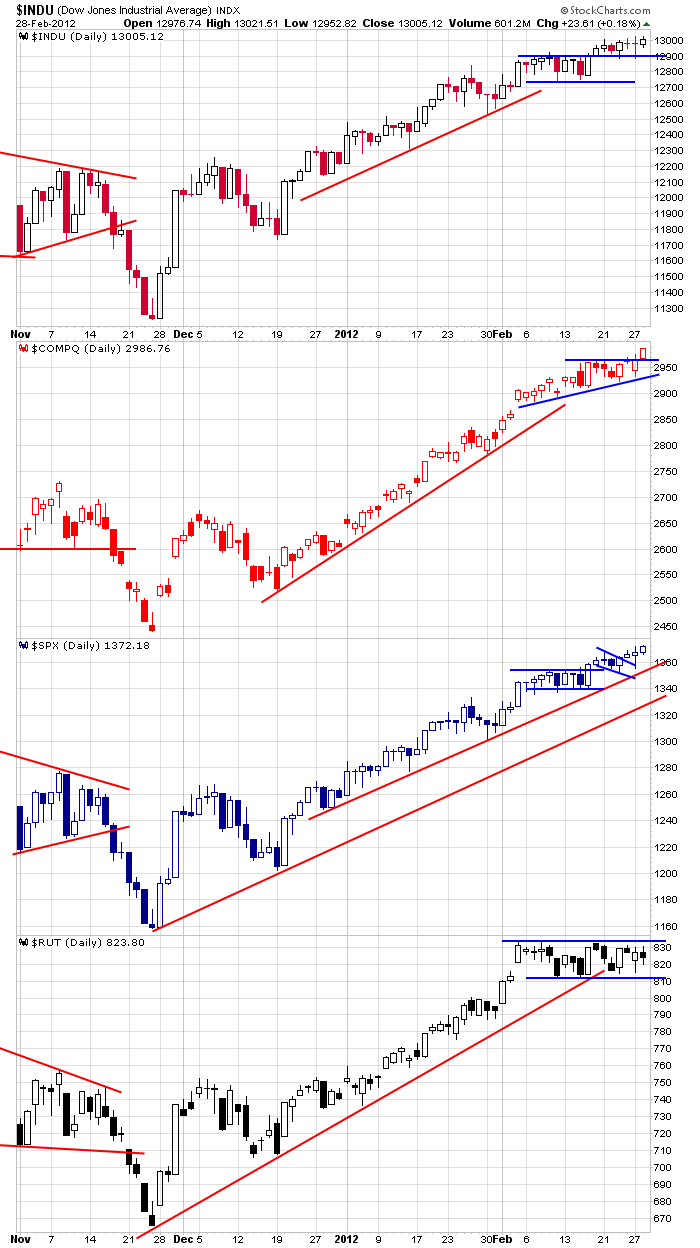

Here are the daily charts I posted yesterday. You can’t argue or fight with these. The Dow closed at a new high. The Nas broke out from an ascending triangle pattern. The S&P made another higher high and closed at a new high. But the Russell continues to lag. I want the Russell to bust out soon. Otherwise it’s onward and upward.

The trend will end with it ends, and there’s no sense guessing when that will be. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 29)”

Leave a Reply

You must be logged in to post a comment.

Portugal bonds push out again. It is not over. The EU banks took heavy draws on ECB loans.

The point is be long inflation – PM and a few large equities or indexes,and maybe high yield.

Today Ben will use his cloaking device to cloud Congressional minds. Nothing to it.

Go Romney, he can’t be worse than what we got.

Yo PeteM, if you’re monitoring, we now are in the neighborhood for individual/retail investors to get excited. How is your count progressing?

Yo Brian – Regarding SPX, my preferred count is that wave 3 of C is still in progress. The alternative is that wave 3 of C ended in mid FEB around 1350 and wave 4 of C ended around 1340 with an ending diagonal wave 5 in progress and nearing completion in the target area of 1375+/-5.

At this point, IMO, the EW count is irrelevant because the upside is limited until we have a more meaningful correction. I’m focused on the 10, 20 & 50day EMAs. If a pullback is contained in the area of the 10 day EMA, wave 3 remains in progress. If the the 20 day to 50 day EMAs are tested and hold a pullback, we’re likely seeing wave 4 of C with wave 5 of C still ahead. However, IMO, If the 50 day EMA is broken (currently at 1317ish) and, more importantly, if 1292 falls – then we can talk about wave C having ended with the alternative count. To summarize, I’m not interested in being long or short here. If a corrective downside pattern holds above 1292 (particularly between the 20 & 50 day EMAs, I’d look to get long.

I want to emphasize that my comments here are more intermediate to longer term oriented. If you haven’t been long since SPX 1202, you’ve been wrong. Raymond & Jason has been on the mark with their trading thoughts and ideas, i.e. the trend is up so buy the strongest stocks within the strongest sectors on breakouts and exist quickly if there’s no follow through.

Thanks for your opinion. Based on the channels I’ve concocted, wave 3 never accelerated out of the base channel (using origin of 1 and end of 2 with parallel at peak of 1) and breaking that to the downside requires a drop to 1348 or so. Therefore, I agree there is no confirmation of 4. But, that doesn’t imply that it is not engaged nor does it imply that it is not over. I am a long term investor. Therefore, most of my funds have been sitting in cash. If I am correct, the best money will be made when this C completes. And, since it has taken longer than I have anticipated, I have neglected to take advantage of the long side of this rise. Guess I was playing it safe but wrong. I let plenty of opportunity to make money just pass me by – oh well.

Brian – You may not recall, but back at SPX 1202, I indicated that it was a low risk buying opportunity based on my EW analysis and then I proceeded to do nothing! I chastized myself for several days. Since then, we’ve embarked on what I interpreted as wave 3 of C. I’ve never felt comfortable during this rise to get long because corrections were so shallow. And here we are 170 pts north of 1202! There’s a lesson (or lessons)in there somewhere. One of those lessons was that I allowed myself to get confused as to what kind of trader I was at that time, i.e. daytrader, swing trader, intermediate/long term trader. At this time, as I mentioned earlier, I’m more focused on the intermediate term and being patient waiting for the set up I’m looking for (getting long on wave 4 of C completion or identifying wave C as completed and looking for a favorable opportunity to get short longer term).

Clearly, this is truly an entertaining process – would’ve, could’ve, should’ve!!!

fed selling into window dressing for joe lunchboxs 1st of month contribution. dont count on it tomorrow. the market will be where the fed wants it. hold 13,000? who knows. maybe they will let it come down a little since the bailout went through.

TVIX working, not sure if just a day trade.

Roast Bernanke and profit taking day, seems to be more aggressive profit taking.

Its almost time to question the end of operation twist and another round of congressional grandstanding nonsense.

Be defensive and not aggressively short imho.

From a pure technical perspective, most likely we fill gaps and retest break out levels.

Still a few leaders remaining strong. Being able to handle volatility without being recklessly stupid is the way to make big money.

EWT types are banging the drum on finish if wave 5 start of corrective A. If trading was so simple.

Still more leaders staying solid, coming to the fore, amazing.

Raymond – I think the problem with EW analysis is that it is too often looked upon as a timing tool in and of itself. Like any technical tool, it’s best used in conjunction with other technical analysis. Sometimes patterns are clear and other times not. That’s why a trader has to always trade appropriate size with proper stop loss. It ain’t a science, it’s an art, as they say. As traders, we’re are our own worst enemy.

Indeed, there is no precision in speculation only tendencies / trends.

Every mrkt analysis is essentially curve fitting of past / recent data to confirm a hunch or bias.

The trick is to be disciplined enough to know when you are wrong or right and act decisively and appropriately.

But some tools are more like an axe, others a fine carving knife. Choose and use your tools well. And never hesitate to aggressive take money or get the heck out.

Current scientific theory is just a best guess based on known evidence intended to be disproved as new evidence is revealed. A real scientist accepts that real truth is unobtainable, what we know is as close as we can get with the observations thus far. If you believe that human behavior may be quite predictable, then learning to do so is a long scientific endeavor to closely approximate precision. Otherwise, call it an art.

remember last year when we went up on the liquidity pump? remember the commodities bubble? sugar, cotton… everything. fed has figured out how to keep them and inflaton low while they jack the market. copper was down 2 1/2% at the bottom today

Koolaid punch bowl still not being pulled away, just drawing down. Big money looking for signs of a refill or a shut down.

The tired quip its the economy stupid should be revised to its the incentives / QE stupid.

euro down to boost european stocks to show the euro public bailout is good. so consequently dollar is up, so US stocks are down for joe. its a win win. this market is not real. its a staged presentation.

At brk out levels, look for failure or a bounce

Yo Brian – from an EW perspective, every pullback during this grinding advance has been a corrective 3 wave affair so we’ll have to see how today’s intraday downturn evolves to perhaps give a clue that it’s more than just an opportunity for bulls to eagerly “buy the dip”. At the moment I’d be interested to see if a rally off of SPX 1365 encounters resistance at 1373ish.

So far the movement off today’s low doesn’t appear impulsive and was rejected at 1373 and change. I’m interested in how the market behaves with a retest of today’s low.

Taking a dive. Things could get a lot more clearer soon.

Pete – so far so good. Futures so a 3 wave decline with A ~ C. Now I’m watching any attempted run up to 1363 in the front month contract. It is doing that now after-hours. The reasonable volume at the end may lead me to believe this pull back will be short lived and a buying opportunity – again!!!

come on 1350, baby needs a new pair of shoes

Continuing to increase cash position.

Transitioning to more shorter term to no trades.

yes santelli just suggested looking at the 10y may indicate the fed has brought out the mop. well duh… big question is for how long

1/2 out of AAPL, other leaders still strong.

AAPL is not the mrkt but does have a significant herd influence.

XRX GM GE CSCO INTC MSFT GS they’ve all had their turn as the mrkt barometer as pumped by the charlatans and idiots.

Time to be more defensive, hit and run, or get off and stand aside for awhile.

UNG has bounced at support for the 3rd time, closed the gap, now the test for evidence of a base & brk out or dump.

USO has come back down to break out levels, ditto

oil, gold, commodities and stocks all down because dollar is up. funny. you’d think if the greek bailout was good the euro would be rocking… lol it’s not

Is there a EURO bond ETF/index?

this doesn’t seem to be about the euro. fed is trying to block commodities (oil), while propping up the market. I don’t see much happening in currencies

10y london gilt is up 6.5%

In trading as in hunting you have consider all things but focus on your prey.

If you are going to hunt bear, focus mostly on bear, not their prey, habitat, etc. Those are just supporting data.

Correlations come and go, haves some influence at different times and and mrkt phases. Some times there is a solid correlation some times not. This is the nature of tendencies / trends.

And play the odds.

But words are cheap, doing is difficult.

how bout if you’re riding a bear and eating rabbits? hahaha

taking more profit on the fatty stocks WTW HLF VVUS

that Sema is hot… I may eat her too

Brian – please note my reply to your 2:49pm post.

AA neckline $10. Buy @ 10.05. come to daddy

bought 1/2 @ 10.15. shes bashful

Still an up trend, but more stalling.

Leaders still strong. More rotation.

Cleaned out the weak inventory. Raise more cash. Look at new focus lists.

Best of luck.

we’re due for a touch of the 20. thought it would come today for joe. let the market show us whats up. 1% bounce off on the sp would be all’s well. last time they took their hands off, we dropped like a rock

Comments here use to be so interesting and witty…..NOW they’re soooo Boring !!!!!