Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. South Korea rallied 1.3%; Australia, Hong Kong and India moved down about 1%. Europe is currently mostly up. France, Germany and London are up about 0.8%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is flat. Oil and copper are up. Gold and silver are up about 1%.

The market felt weak yesterday, but the closing numbers weren’t too bad. The small caps dropped about 1%. Most other indexes dropped about 0.5%. Volume did expand, but in the grand scheme of things, it was just an innocent down day within a solid uptrend.

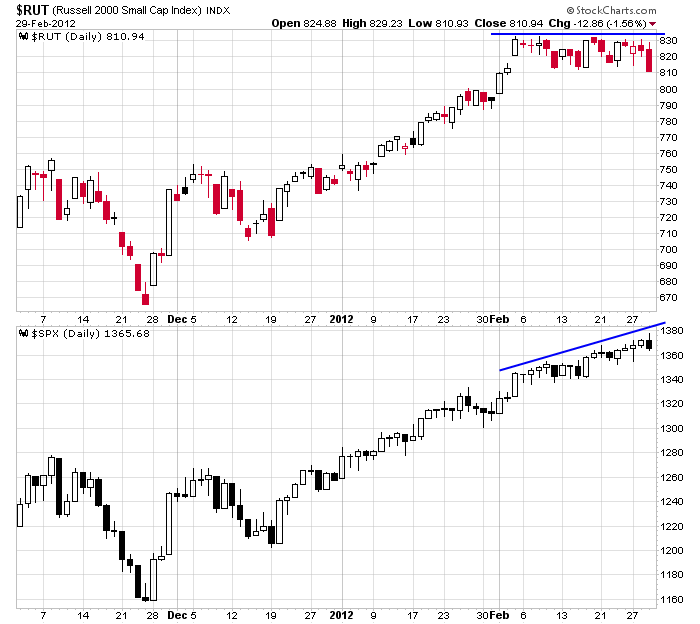

In the near term, it’s becoming more worrisome the small caps are lagging. Here’s a chart that compares the SPX and RUT.

The market has had many reasons to drop the last month, but so far it has completely ignored all of them. Opening gap downs have gotten bought. Intraday dips have gotten bought. Worse-than-expected earnings and econ news have been ignored. Bears who’ve continuously tried picking a top or hesitant bulls who haven’t been able to pull the trigger have felt some sort of pain. Playing the best stocks from the best groups has worked well. The trend will end one of these days, but there’s no sense guessing when that will be. Having said this, the market is not very correlated. That means you can’t rely on an up-trending market to rescue you from losing positions. On any given day the market is flat, there’ll be many stocks up 2-3% or down 2-3%. This is a good thing; it makes trading easier because the winners can more easily stand out, but it also means you have to manage your positions wisely. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 1)”

Leave a Reply

You must be logged in to post a comment.

WS will lean on the market to see how the men in hats respond

Still good to be defensive, a stock pickers market.

Good timing required

FIO etc running today

YNDX etc at add in / buy pts

look for a rebuy / add in at 525ish on AAPL if it fails dump it

wait for 505ish and if that fails its truly done for now

maybe 540 is the bounce 🙁

They moved the good (GM) auto sales number release up from 2 to 10 o clock to offset the disappoiting ISM and construction numbers. Classic manipulation. It appears IF they let it come down it will be very gradual. draw it out to smooth volitility.

Who is they?

The evil nemesis of the counter traders?

Sometimes best to sit things out and watch carefully

…but you don’t understand what you’re watching… the blinking lights?

why do you think the fed is putting money in the stock market? so traders can take it out?

yup

More Bernanke roasting, congress validating itself nonsenes.

Not only do we sit on our ass we ask dumb questions and indulge in useless activity while we sit on our ass. Sure beats thinking and doing something.

What would be a smart question for Uncle Ben? Sometimes me thinks these dumb questions are an attempt at redirection a.k.a. smoke screen.

Smart things to do and smart questions would include

Stop the grill the Fed head nonsense unless there is a strong inconsistency in their reporting and prgm.

Learn what the Fed is really trying to do – there is a mess, no ones stepping to clean it up, someones got to did. Or maybe do the trailer trash logic, let it all fail, great mrkt logic.

Pass clean up and pass the Volckr rule

Clean up the SEC and give it teeth

Hunt down the culprits of fncl engg mess and make them acctble – kick em to the grnd and stomp on their throats (figuratively & fnclly of course – per Buffet – they shld be fncl destroyed)

now that would be progress

I bet Neil could tell us what the Fed does and give Glen Beck some really good questions to ask.

BVSN trying for a brk out

A counter pt to all the glen beck type charlatans and uneducated just btch, dont think, keep spinning wheels, lose money trailer trash idiots.

http://www.investmentu.com/2011/March/ken-fisher-investing.html

Although Fisher is one of the fat cat investment industry types, he is one of the good guys and mostly right than wrong. So was his dad.

LOL! He said he’s not suited to short term trading, and the only other thing he said is the fed will tighten rates! Jesus H Christ, thats the only place they can go! there at ZERO! What a genius!

Jason right here gives you a mile more info than fishface said in that article. not only the what but more importantly the why

you must like glen beck 😉

look at FIO there are others

don’t tell me you don’t get emotional when he cries

i dont but for some reason my dog wants to take a pee on the tv screen when hes on 😉

how about BVSN CALL etc

yup keep monitoring the indices thats the professional smart thing to do…

Remember Fisher is a big fund / investment guy. He has to push 1000s of block trades for his funds. We dumb money can push several block trades on say AAPL within minutes to a acquire 1-3k share posn.

The pt is not about trading. The point is the useless energy spent on the budget and Fed intervention without studying the facts without prequalifying the actual competence of the messenger.

I have met dozens of retail traders and even CMTs that say they are traders but are really armchair economist and political pundits. Thats why they keep spinning their wheels, keep losing money, wont admit they are wrong and get out or change to the winning trades while alpha stocks old and new keep ticking higher.

YOKU maybe starting to put in its handle on hrly / daily charts

ditto for BIDU, but messy dont trade it if you dont have the capital and cant handle volatility

Raymond – would you share your trading approach using BIDU as an example? Would you be looking to buy if support developed at, say, the 10, 20 day or 50 day EMAs, on a breakout above 139.59 – or whichever occurred first?

BIDU is once alpha stock, great fundys, was basically a monopoly a CANSLIM type alpha stock

It may have washed out all the shorts and the 10 for 1 stock split float

Look at wkly charts

– last bounce was in late dec at 115ish, came up to the down trend at 132ish in early jan, fell back.

– then came back to break the mjr down trend

– building and bouncing within a bull channel that started in late dec

but its volatile,

A similar thing is happening in the auto sector ie F TTM etc

MGA which i noted a few weeks back is up +30% unfortunately I was spooked out of 1/3 of my position

As posted before I am an aggressive CANSLIM type trader. I dont wait for the cup & handle brk out. I swing trade the position to build a core holding up to the first primary base then through the subsequent base and brk out. Even the great man himself William Oneil has stated that 40-60% of all brk outs out of c&h and other bases fail then may re-establish itself – not good odds for me. My money better work most of the time or its fired.

Now your turn share one of your trades

One caution is that BIDU may eventually make a POD (punch bowl of death) a Gil Morales (ex top fund mgr for ONeil) term for a big rounding formation near all time highs followed by a slow then fast rollover.

Yo Brian – If for no other reason than to change the subject today, let’s consider SPX from an EW perspective. IMO, we may very well be looking at an ending diagonal pattern close to termination. Whether it would end wave 3 of C or wave 5 of C, I care not. If the pattern interpretation is correct, we are approaching a turning point that would imply the first meaningful downturn since the DEC pullback from 1267 to 1202 (wave 2 of C).

Assuming my EW pattern interpretation is correct, I would expect yesterday’s 1378 high to be at least tested & more likely exceeded before turning down. Many technical indicators are overbought etc., etc. But, until price confirms by moving down in impulsive fashion though the 10 day EMA (1363) and more importantly 1352ish (20day EMA corresponding to a trendline support drawn from 1250 on the daily chart) there is nothing to act upon, IMO. Nevertheless, we may have a low risk shorting opportunity and/or a profit taking signal on long positions close at hand as we enter the Ides of March.

Pete,

Do you ever do an EWT analysis on the sectors such as XLK XLI XRT etc?

Yes – IMO, from a long term perspective, XLK is in a corrective upward 3 wave pattern (correcting the calendar yr 2000 to 2002 decline). It appears to have an upside target of 32.00 to 32.50 and is still in wave 3 of C. XLI seems to have completed wave 3 of C. XRT is in wave 5 of C and close to its 60ish target.

hmm interesting

XLK has broke 2008 highs with conviction

I do expect it to pullback sometime to retest brk out lvls. perhaps at the end of the QE, optn twist or other punch bowl removal and the start of congressional / election grand standing silliness. until then staying with the trend.

Same for XRT

XLV and others not far behind.

Would like your analysis, after mrkt hrs is ok.

Pete – I have no disagreement with your assessment. I’d anticipate yesterday’s high to be tested as well. Because the pull back from that high in the front month contract was a clear 3 wave affair, I’d expect the high to be exceeded. I’ve got a resistance at 1380 – 1383 in that contract. The S&P is running about a point higher than the contract now. So, I’m not expecting much more before we see that low risk opportunity to go short. I’d like to see a gap up tomorrow with a close at the low for the day tomorrow. But, it will be what it will be and usually not exactly what I want.

I agree. I have 1381ish as the SPX target. A gap and reversal that creates and outside day to the downside on the daily chart would be an early warning that an important turn may be occurring.

look at last to march’s. rest sounds good to me

the bernak just said what he/they are doing is stabilization. market…economy…banks…even Raymond, who he says blood pressure is too high. wants to send him to a two week resort w/GB

…and dog

I am moving my old plasma tv set out side so my dog can pee at will at every bleep head idiot he sees. Hes a very good judge of character and intelligence. 😉

PeteM

What are your thots on the Shanghai index (or use FXI)?

It recently broke the mjr down trend going back to 2007.

It has done this approx 5x before and pulled back.

My thry – I think china is transitioning from a dominantly slave economy to a slave / consumer economy.

I still stand by my thry that ex-prop computers are being used to basket / prgm trade the leaders. And (a bit of paranoia here) that the computers are masking volume. Therefore need to focus on price action per covell & seykota.

The has been stocks that make up indices are masking the real action.

Looks like I’ll be shorting b4 the close.

Nsdq100 Rssls challenging new highs / cracking interim down trend

Be selective on what you short imho

Feathering out of FAST before end of day, Too parabolic. May keep going like AAPL.

Raymond – Thanks for your in depth comments on BIDU and your trading approach. From my end, I’m a registered rep with an independent broker dealer. My clients are mostly at, near, or in retirement and my focus with their accounts is income producing investments. I screen for stocks that have dividends of 5% or higher, solid balance sheets with low debt, the cash flow to sustain dividends and appear to be undervalued. I use technical analyis to position entry & exit points for longer term positions with long term capital gain potential.

I particularly like the energy sector, both for dividend plays and capital gains. Within the energy sector, I’m tracking natural gas. GSFVF is a natural gas play that may have long term potential. The weekly chart suggests that a 1 year corrective pattern may have ended with an impulsive move to the upside that broke a long term downtrend line this week on high volume. This is a speculative position for my portfolio and not necessarily for clients.

With respect your comment on EMAs how to you enter and exit on your trades and in what time frame?

careful on nat gas it broke support today. inventories still need to be worked off.

and most producers have started to cut back on production so well frac-ing services may suffer.

Raymond – I’ll try to address several of your posts in this post. Regarding EMAs,I use the daily EMAs in conjunciton with trendlines and EW analysis. For example, assume SPX breaks down on daily chart through 10day EMA. 10day EMA happens to coincide with trendline support (using closing basis)back to late DEC. I conclude that wave 3 of C is complete (or even more bearish – wave 5 of C complete). I look for internal wave count of first decline through 10 day EMA. If impulsive (5 waves down on hourly, or maybe on 15 min chart), I look for a bounce with corrective look, ie. 3 wave bounce to a Fibo resistance level. I short the bounce once it turns back down and would cover on a move back up past the high of what I thought was wave 3 of C high.

SSEC – Just hit trendline support last month going back to calendar yr 2005, but in a downtrend since 2007. May be in an ABC advnace from 2008 low with wave B just completed and beginning wave C from FEB low. Near term, 2350-2375 could be place to get long with close stop loss.

Natgas & GSFVF – I hear you. I’d wait for pullback to see if 7.30-8.00 holds as support on GSFVF. Could that be a “handle” to your “cup & handle” potential formation?

I suggest you consider KMI ENB TRP for future energy plays

Yep – I’ve had clients in energy pipeline MLPs (e.g. EEP and KMP) for quite awhile at higher yields.

znga yoku socl

yndx fio

etc

moving

Jason

The NASDAQ keeps rising and the small caps keep falling. I think you nailed it Jason. Last time I saw this was October of 2007. We can all read the chart to see what followed. I don’t think it will be as bad this time but a pullback should be coming.