Good morning. Happy Friday.

The Asian/Pacific markets are up across the board; China, Indonesia and New Zealand gained more than 1%. Europe is currently down across the board, but there are no big losers. Futures here in the States suggest a moderate gap down open for the cash market.

The Dollar is up. Oil and copper are own. Gold and silver are down.

For the most part, the song remains the same, but warnings persist so we have to manage positions wisely. The trend is rock solid and should not be fought. One of these days a top will be put in place but not until the bears stop trying to figure out where it is. That’s how the market works. When the bears throw in the towel, the indexes will correct.

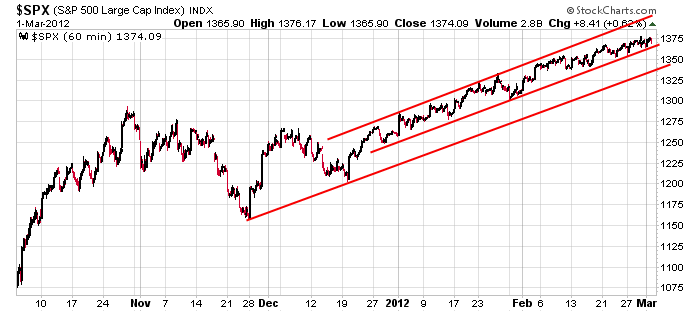

As of now the S&P is up 8 points on the week. Barring a moderate sell-off, it’ll be the 9th up week of the last 11 and the 16th of the last 22. Being negative doesn’t work. Being cynical doesn’t work. Thinking the world is coming to an end has either caused you a lot of pain or kept you on the sidelines. The trend is up so that’s the direction we need to play it. This doesn’t mean you throw all caution to the wind and blindly go full margin long. It just means it’s wise not to make trading any harder than it alread is. Here’s the 60-min S&P chart. Why fight this?

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 2)”

Leave a Reply

You must be logged in to post a comment.

The weekend lull? Anything is feasible since EU is long ways from solved. Spain up, Portugal down. The CDS hold-up by the banks damaged the insurance concept in debt. This will shrink

credits available since it is now clear CDS are merely a fraud – another larceny by bank trick. Sin on wheels.

Investing stratey is to hold until we get the correction – maybe 10% – then become deversified

for the rest of the year. Appears that the economy will stall out soon until the election.

Not too exciting.

Focus on leaders, look under the hood.

If you want to spin your wheels, lose money, focus on being average. Keep looking at that mess of some winners, some losers, lots of has beens put together by the same smug idiots and cons that almost always moves the wrong way.

Our job is to recognize when we are moving the wrong way and stop doing it, recognize the right way and move quickly in time with it.

As Ken Fisher has stated asked what do we believe to be true is wrong?

Good luck.

May be my treat ration will go up to 5X / week 😉

F breaking up from a flag

BIDU breaking up through a mini cup & handle

FIO

ZNGA

YNDX

YOKU

etc

etc

some pullbacks due, some just starting the run.

Best of luck

Best to reduce margin if you have better than 10% gain, starting working more with the house money.

How about some trade input?

No its all manipulated, Fed are bad or similar nonsense please. Input on trades and trading.

lol they’re not even bothering trying to hide it anymore. they should just close the market and quit wasting everyones time. be funny to see when you realize it

Trade input:

ESH2 5d5m: Looks like accumulation, but needs to make any high then a higher-low for me to go long the close.

YNDX confirming yesterdays add in / entry. Good fundamentals, something new. potential mjr brk out of a base. Makes more sense on daily & wkly.

Would not get too distracted by the Putin or other Russia is risky nonsense. Look and analyze the facts.

Well looks like you have it figured out. Big question is does it make you money? Should you consider the alternative(s).

dollar up copper down market wants to come down, but the fed has a stick up shorts ass. I don’t want in this hand. feds not playing by the rules and I don’t trust em

How would you define ‘Mark-up and Mark-down’ and what would be the price/volume patterns to look for.

BTW: ESH2 5d5m looks bullish, but I’m still waiting on a higher-low.

YNDX price vol action is very bullish thus far

BIDU is at interim resistance, may be prudent to take some profit but look of a fade back and break out imho

ZNGA closing the gap, need to watch for failure or bounce / rip

YELP still looks good but out +3 should keep on watch list for future

FIO should get a little pullback but fundy and institutional pressure is for more upside imho

etc

etc

YOKU shld pullback but ditto

There are others in the ldr grps.

Rvw at both daily & wkly time frames as well as the intraday will make more sense.

AAPL sitting on a shelf for the last 2-1/2 days could be dtrbtn could be shake out move ready to happen. Place your bets.

F back testing – look for a bounce or failure

UNG is backtesting failure level

Fundys are for upside pressure

Technicals show more downside

Biased to upside, waiting.

GDX ready to brk down more could still bounce,

1/2 out DUST a bit thin but perky mover for day to short multiday

TVIX may be setting up

Think its prudent to keep looking for opportunities in China, Russia, Latin America. Prgm tdng may push the heat there for awhile, perhaps the jumpy start for long term.

Input please, need a bit of collaboration.

KMI may back test but XL pipeline will likely go through.

In which case SU and CNQ will be taking a spike.

Took profit QIHU +50% on margin.

Holding some for a pullback addin for a longer term swing.

DANG also worth watching, tried a brk out today, pulling back. May turn out to be dead money until brk out above 9ish.

time and sales show more big money interest in YNDX FIO

could be a fake out.

ESH2 5d5m:Oh tay! Next s/b HL.

Taking some more profit on BVSN

Still think it has more upside, maybe a little pullback first

Looks like the herd is seeing the potential in FIO

Having Steve Woz and other Tech hvy wts on board helps.

Dumped the rest of VVUS

Holding other fatty stocks WTW HLF

Yo! Brian – Been out on appointments and checking in on SPX EW pattern (Raymond – please close your eyes and ignore this post).

IMO, we may be looing at the 4th wave of an ending diagonal attempting to complete above the 10day EMA (SPX 1365ish). If it holds, it would imply a rally to test and break 1378 in what would be the final wave up of this ending diagonal. As I mentioned yesterday, it matters not whether it’s wave 3 or wave 5 of C, as the best downside action since mid/late DEC should follow if this pattern completes as per interpretation.

I’ve been out of town since yesterday. Consequently, I don’t have access to good charts and can’t respond intelligently. As best as I can deduce, the mar contract pulled back, rallied to test but not breech yesterday’s high and has retreated since. But, I’ve not looked for a couple of hours. Last view lead me to believe the market was going for a flat close. General assessment of risk/reward is look for the opportunity to short. I impressed by the wedge formation. Regardless of end of 3 or 5, I agree with you – look to go short.

each to their own trading style/trading plan

personally im cheif crazy horse,son of cheif sitting bull–im a scalping snipper

each day the market goes up/ down so i only care about 15 min /to half day trades and have the freedom to do what i like when not in a trade

sometimes i will just trade from piviot point to piviot

looking at the bigger trend than intraday can be a hinderance and give me a bias

my enemey is a flat market and no volitity

peronal notes on market

ecb bank bailouts will put liquidity in markets and weaken the euro

this market is traders trading with traders

hedge funds against long only mutuals -buy hold hope mentality

selling will come one day and most will be caught in disbeleif

i only use live indicators not backward looking inds on the 1 and 5 min world indexes

not being a yank i dont know usa stocks or follow them and aussie stocks and index to illiquid to realy follow and has little volitility

bring back the 500 point intraday up and down on the dow

my job is to pick tops/bottoms–trend changes intraday —EVERYDAY

its easy

Which symboles do you trade?

Do you trade only intraday (DayTrade)

How do you pick a bottom and top?

Personally I find picking tops and bottoms hard.

Yes, the 500+point daily moves were nice!

Very few traders can pick tops and bottoms consistently.

If you can good for you and keep going. But as a general observation its a consistent way to spin your wheels or slowly bleed out.

Yesterday afternoon there was strong evidence of broad selling into rising prices albeit on not big volume. Could be a bear trap but it would be prudent to do more rigorous analysis this weekend and look to lock in any long side profit if you entered recently.

If you entered early and have a health profit margin, look to limit give back, build cash and perhaps add back in on the next support level bounce.

Next week may finally be the long awaited pullback.

Good luck.

easy thing to do would be to let this pullback play out, then tell everyone what happened. thats what crackhead cramer does/will do tonight LMAO

gotta give it to the bastards. slow commodity inflation, blame it on china and stii keep the market propped up.

wonder if they’ve thought of anything to get oil down without raising the dollar

if neckline breaks on AA, target is 9. …if the market were real