Good morning. Happy Tuesday. Happy Fed Day.

The Asian/Pacific markets closed mostly up. Australia, Hong Kong, India, New Zealand, South Korea and Taiwan rallied more than 1%. Europe is currently up across the board. Austria, Belgium, France, Germany, Amsterdam and Stockholm are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are down.

Today is FOMC day, the day the Fed targets overnight rates and the discount rate. The Fed has already said rates will remain low until 2014, so no change is expected, but their statement will be closely studied. Personally I wish they’d raise rates. If the economy is slowly getting better, they can back off the accomodation. But with commodity prices much closer to their 1-year low than 1-year high, they’re not worried about inflation.

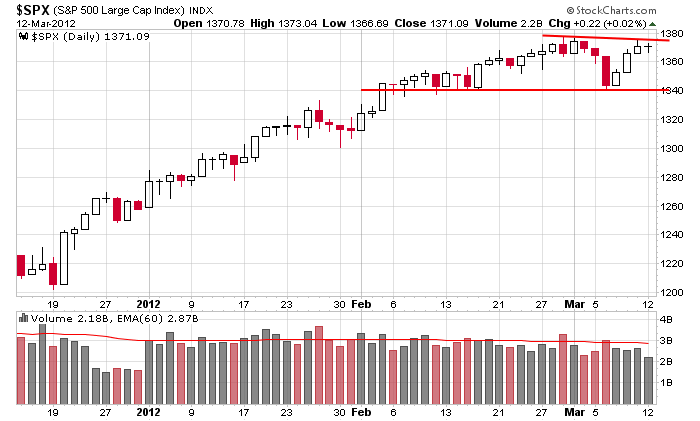

Here’s my very simple S&P chart. There is nothing wrong here. A steady uptrend has turned into five weeks of sideways movement. Yes there’s lots of stuff going on in the world, but this chart tells us all is good…at least for now. Don’t think too much.

But as I’ve pointed out several times the last month the market is not very correlated. That means while the overall market is very healthy, there will be many stocks that out-perform and many stocks that under-perform. You can’t use the movement of the entire market to justify staying in a lagging position. Judge each position in-and-of-itself. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 13)”

Leave a Reply

You must be logged in to post a comment.

All indicators are essentially based on the reversion to the mean concept. This means they tend to work in range bound / channel conditions.

For following trends almost all are useless.

The same indicators provide different information, primarily on a historical tracking, often not a predictive basis, in different time frames. ie – an oscillator will show different information in hrly daily wkly monthly qtrly basis.

I also believe that prop trading computers are effectively used to high volume characteristics to throw us dumb money off the alphas stocks.

You should consider time tested insights as noted by validated successful trader / investors like Ken Fisher William O’Neil Dr Chris Kacher and Gil Morales in addition to the popular web junk food TA.

And definitely forget most of the bleeping media bleep heads. The more articulate, sincere and earnest sounding the more likely they are full of bleeping bleep.

I would also avoid the nonsense, the sometimes absolutely misguided and wrong TA at the following web sites. Definitely do not pay for garbage, one of my younger relatives was, imho, conned by the last one.

daytradingbootcamp

daytradingradio

tidetraders

Learn from validated successful traders like those noted above, think, work hard and collaborate. dont try to game each other or be a smug idiot, trading is hard enough as it is.

All the best

Investors Intelligence reports that insider selling is 8 to 1 (normally, insiders sell about 2 shares on the open market for every outright purchase). Trim Tabs reports that, in dollar terms, recent activity has $13 of insider sales for every $1 of purchases.

define insiders and on what portion of the mrkt?

MCP should run now, with some chop but run

YOKU confirmed an add in level today

FIO still stewing trying to put in a base on base

makes more sense via multi time frame price-vol analysis

hrly daily wkly

although its often foolish to limit oneself with profit targets, next stop for MCP shld be 35ish, some profit taking and higher

similar for YOKU (longer term play) & TODU (shorter term play)

similar for FIO (longer term play), expect choppy action

ditto for ZNGA, waiting for FB ipo

YOKU may brk out / fail today

but the bias is up

I may be wrong, YOKU struggling with 33ish resistance.

but the bias is still up

sorry MCP I mean

time and sales indicate big money is definitely coming into YOKU

INVN may be at profit taking consolidation lvls

Out F taking some profit TTM TSLA UCO

ABC completing dbbl bttm, looks to pullback but bias is higher, use caution, FOMC expectancy betting nonsense day volatility

bond auction neutral / positive, ditto for eqtys

To clarify my earlier comment, it is my understanding that insiders are defined as officers, directors and 10% plus shareholders of a company.

Thxs, I understand that, as well as optns excercise vs open mrkt.

I meant with respect to the overall market.

It seems you are concerned with this, what is your reasoning?

With respect to the overall market, I also see a pickup in institutional selling since mid FEB as institutional buying has turned down at the same time. In the past, this combination of insider selling and institutional selling has been sign of distribution as supposedly smart money comes out of the market. To me, it suggests that present overall market averages will be broken on the downside and, more likely, the decline will be swift in terms of time and downside volatility.

In the meantime, the trend is up until it’s not. You’ve been correct in advising to focus on the alpha stocks with good setups. My comments are cautionary and not meant to be a timimg or price forecast in regards to the stock market averages.

This guy has noticed the same thing.

http://www.stocktiming.com/Tuesday-DailyMarketUpdate.htm

Unfortunately he has been about 75% wrong over the years. I have challenged him to provide an audited trade record to see if he eats his own cooking, he refused. Told my cousin to dump the subscription.

took more profit on CALL (of magic jack fame)

great fundys and ta action

80% of leaders and leader groups rallying

even FAS DRN

look for bullish chart patterns,

some alphas are breaking out, some others are basing / consolidating after an up move

play the perky ones, make money dont buy, wait and bet. without a profit margin that is gambling, not trading

NBG IRE may not put in a technical bounce

the so called good banks are

cdn like TD BNS etc

on us side

JPM WFC

others in thry are technical bounces.

just use FAS DRN imho

correction

NBG IRE shld now put in a technical bounce

The VIX hit a low today of 13.99, lower than last year’s APR low of 14.27. It appears to be a new level of complacency not seen since 2007 when the VIX got below 10.00. This is occurring as the averages hit the highest levels since 2007.

Bulls are forcasting SPX 1425, but not necessarily by tomorrow. Financials are running as JPM announces dividend increase and stock buyback. C rallies same percent as JPM as all banks rise in unison. The FED seems to implore individual investors to jump in now as the bull move has a long way to go and equities are the palce to be.

NYC bus driver, Ralph Kramden (a small investor), when asked by his wife, Alice, just how high the stock market can go, was heard to say, “To da moon, Alice, to da moon!”

As we enter the close, the FED has announced that they’ll be releasing info on bank “stress tests” at 4:30 today. There’s no truth that there was giggling in the background when they made the notification. There’s overall giddiness on the Street as we enter the close. It just doesn’t get any better than this!

so called good banks steady, bad ones being beaten after stress test

After mrkt action indicates neutral / bullish

What do you see?

JPM WFC even BAC steady moving up

Next step is to break up the investment, S&L and brokerage operations of the banks and implement worldwide regulations to stop the banky hanky panky.

I would not be surprised if such a move adds more upside catalyst, more trust for more participants to bring in new money.

90% of leaders on my list rallying

Days and weeks like these are why Ken Fisher calls the mrkt TGH, The Great Humiliator.

Do not be discouraged, to paraphrase Fisher, consider what you believe to be true that may be false / incorrect and preventing you from making money. Focus on the momentum not when it may or will stop.

I ran into the same thing from pro money mgrs during the 90s bubble. My fund mgr was very articulate, she told me it was all a fad this internet nonsense. A year later she put me into that nonsense space as they fell back then became ‘good value’. Of course you know the rest of the story. Yup, its all a fad.

Unfortunately I was single then and she was beauty who always distracted her clients with her wonderful legs and well presented breasts, made my blood drain from my head to some where else. Destroyed most of my start up retirement savings. After that I resolved to think and only consider the facts be they fundamental or technical.

Best of luck.

A Seductive beauty in a Seductive market………

is it time to sell yet

I have monitored the after mkrt and it still looks strong, but in all honesty I do have reservations of staying long.

I did get off margin and booked more profits, limited pullbacks. However, I am still long, I even went long on BOIL today as the Nat Gas may now be finally putting a double bottom (expect more volatility, reserves may still need to be worked off).

I am expecting some profit taking but anticipating more asset rotation as the money seems to dance from one play to another. But that is just an opinion based on my observations of the leading stocks and groups that seem to be perking up.

I would appreciate the input of other traders of what they see, and have a rigorous discussion based on technicals and some global economic drivers (QE etc). And no the fed is bad, the debt is bad nonsense please.